- About Summit

- Diversity, Equity & Inclusion

- Teaming Partners

- AWS Partnership

- DC DataFest

- GSA Schedules

- Greenhouse Gas Emissions

- All Services

- Federal Infrastructure Finance, Loans & Grants

- Evidence-Based Program Evaluation

- Program and Business Modernization

- Enforcement & Litigation Analytics, Program Integrity

- Data Science

- Qualitative Research

- Risk Analytics, Modeling & Statistics

- Case Studies

Debt Collection Analytics

Challenge: Debt Management Service (DMS), within the Fiscal Service at the Department of the Treasury, seeks to identify, collect, and resolve debts owed to government agencies, including those associated with state child support and delinquent student loans. DMS utilizes a number of passive and active collection activities to collect on delinquent debt. DMS aimed to apply optimal collection techniques to maximize collections given their limited resources.

Summit’s Approach: Summit integrated relational databases containing information on debts and collection activities. We then classified different clusters of debts based on debt and debtor characteristics. Implementing machine learning and regression techniques, we determined which debts would likely result in the highest collections using DMS' active collection tools and campaigns. The models also identified the optimal collection timing and holding period for conducting collection activities to maximize overall collections. The operational and financial impact of these changes in collection strategies were then estimated through the use of randomized control trials.

Result: The revised collection strategies led to an 7% increase in collections, increasing DMS’s revenue as well as reducing the costs of the DMS program to taxpayers.

Case Study: Improving Cash Collections with Analytics

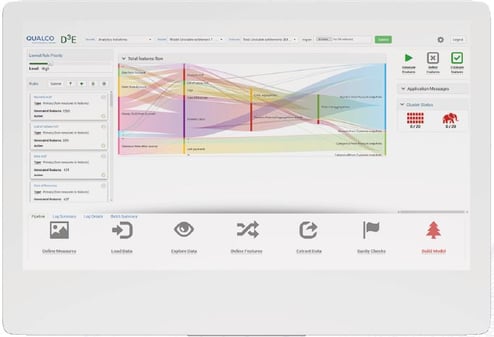

QUALCO | June 9, 2021

During the recent Consumer Credit Risk Conference, Terry Franklin , QUALCO’s Global Business Development Director, presented a case study showcasing the benefits of adopting predictive analytics models in collections workflows to significantly increase cash collections.

You can watch now the full presentation below:

By following our tested approach and employing the powerful data intelligence of QUALCO’s Data-Driven Decisions Engine (D3E) , we managed to deliver:

- 7% improvement in cash collections during the first month of deployment, a percentage that is continuously increasing

- Better roll rates powered by insight driven customer treatment

- Measurable improvement in treatment outcomes, especially in terms of “unofficial” payment promises

Identify, monitor and verify your performance optimisation initiatives more effectively and efficiently.

Learn more on how to bring predictive insights to your operations, here

TOP STORIES, LATEST PRESS AND ANNOUNCEMENTS

- Analyst Rankings

- Board of Directors

- Client Stories

- Corporate Social Responsibility

- WNS Women Returnship

- Protecting Our Planet

- Enabling People to Outperform

- Caring for Our Communities

- Ethics, Integrity and Compliance

- Delivering Value to Our Clients

- From the CEO

- South Africa

- United States

- The Philippines

- United Arab Emirates

- United Kingdom

- Management Team

- Press Releases

- WNS in the News

- Vision and Mission

Generative AI

- ESG Analytics

- Augmented Data Management and Data Governance

- BI & Visualization

- Big Data Engineering

- Data Governance Intelligent Cloud

- Data Sciences

- Embedded Analytics

- Fraud And Risk Analytics

- HR Data Analytics

- Customer Loyalty Analytics

- Marketing Analytics Services

- Insurance Analytics

- Retail Media

- Centers of Excellence

- Customer Experience Consulting

- HIFFI – Home Insurance in a Jiffy

- Digitally Simulated Training Environment

- WNS Open Talent

- CFO Advisory Services

- TRAC ONE-F Autonomous Accounting

- WNS Duplicate Invoice Detector

- WNS Forecaster and Predictor

- WNS Journal Entry Analytics

- WNS Risk and Audit Analytics

- WNS Working Capital Analytics

- Sustainability and Technical Accounting & Reporting Consulting

- Finance Controls & Compliance

- WNS TRAC eClose

- Quote-to-Sustain (QtS)

- Procure-to-Pay (P2P)

- Outperforming CFO Framework (OCF)

- Anti-Money Laundering and Know Your Customer

- Financial Crime

- Fraud and Risk Analytics

- Fraud Management Services

- Regulatory Compliance and Risk Reporting

- Third-Party Risk Management

- Compensation

- HR Analytics

- Learning and Performance Management

- Payroll Administration

- Recruitment Services

- Workforce Management

- Legal Services

- Category Management

- Contracting Services

- Digital Solutions

- Procure-To-Pay Services

- Sourcing Services

- Supplier Management

- Supply Chain Management

- Robotics & Digital Automation TRAC

- Supplier Portal

- Technology Services

- WNS IP Labs

- Insurance TRAC

- RPA & Intelligent Automation TRAC

- Security TRAC

- Travel TRAC

- Analytics Incubation Center

- Big Data Analytics

- Data Sciences Group

- Process Maturity Model

- Value Innovation Program

- WNS Transition

- Workforce And Productivity Management

- Industry Segments

- Capital Markets Operations

- Research and Analysis Services

- Trade Finance

- Financial Crime and Compliance (FCC)

- FinTech Services

- Mortgage Operations

- Retail Banking

- Banking Analytics

- Banking and Financial Services Consulting

- Credit Risk Management and Underwriting Services

- Customer Experience in BFS

- Finance & Accounting for Banks & Financial Institutions

- Governance, Risk and Compliance

- Model Risk Management

- Customer Acquisition and Customer Experience Management Services

- Driving Insight-led Decisions

- Realizing Your Energy and Utility Digital Transformation Goals

- Carbon Accounting

- Digital Customer Experience Services

- Digital Meter-to-Cash

- Collections Dashboard

- Elevating Business Operations with Shared Services

- Customer Management Services

- Digital Simulated Training Environment

- Energy & Utilities Analytics

- Shared Services

- Customer Analytics

- Data Management

- Revenue Assurance

- Risk Analytics

- Video and Voice AI Solution

- Benefits Administration

- Care Management

- Clinical Operations

- Healthcare Claims

- Medical Bill Review

- Member Engagement Services

- Provider Lifecycle Management

- Revenue Cycle Management

- Information Processing Services

- Content and Information Publishers

- Consumer Tech and Platforms

- Enterprise Tech and Platforms

- Internet and Social Media

- Conveyancing

- Executive Search Services

- ID and Background Verification Firms

- Legal Service Firms

- Real Estate Services

- Risk and Compliance Service Providers

- Talent Advisory

- Design Services

- Hi-Tech & Professional Services Analytics

- InfoTurf.ai

- Product Data Operations

- Revenue Operations

- Pension Risk Transfer

- Lloyd’s of London Market

- Claims Prevention

- Straight-through Processing (STP)

- Subrogation Services

- WNS Insurance Broker Services

- Insurance Finance & Accounting

- WNS Claims 360

- Voice AI Solution

- Finance and Accounting

- Procurement

- Research and Analytics

- Biostatistics

- Clinical Data Management

- Medical Affairs

- Pharmacovigilance

- Competitive Intelligence

- Forecasting

- Business Intelligence

- Marketing & Pricing Analytics

- Sales Analytics

- Commercial Assessment

- Customer Experience

- Finance & Accounting

- Supply Chain Management (SCM)

- CPG & Retail Analytics

- Integrated Sales Order Management

- Forwarders and Brokers

- Safety and Compliance

- WNS Air Cargo Optimized Solutions Suite (ACOSS)

- WNS Document Verification Solution

- WNS Volume Surge Solution

- Hospitality Companies

- Online Travel Agencies

- Travel Management Companies

- Travel and Leisure Analytics

- WNS Ancillary Revenue Optimizer Suite

- Verifare Plus

- WNS Agent Decision Support Platform

- WNS Corporate Travel Management Solution

- WNS Post-booking Servicing Solution

- WNS and HFS Research Travel and Hospitality Market Impact Report

- Private Equity

- WNS DESAiGN HUB

Perspectives

A Leading Utility Increases its Debt Collection by 50 Percent with Predictive Analytics

23 june 2015.

A WNS Perspective

Challenge The client wanted to optimize collection processes to improve recovery and create strategies to manage customer write-offs more effectively

Solution WNS transformed the client's collections process by leveraging predictive analytics and enhancing the customer interaction strategy

Benefits The client achieved a 50 per cent improvement in debt collection in three months

One of the leading energy and utilities companies

The Challenge

The client had a dire business need to re-balance its energy final debt portfolio. On one hand, its debt recovery rate was 4 percent, compared to 14 percent achieved by its competitors. On the other hand, the commissions charged by the client's debt collection agencies were as high as 50 percent of the collected amount, which resulted in high operational costs. Consequently, profit margins were dented. The client intended to optimize its final debt collection processes to improve recovery of receivables. The client also wanted to formulate focused debt management strategies for different customer segments to manage customer writeoffs more effectively and decrease operational costs.

The WNS Solution

WNS concentrated on transforming the client's collections process by embedding predictive analytics and making changes to the customer interaction strategy. Key aspects of the WNS Solution:

A Propensity-to-Pay Predictive Data Model exclusively for residential customers. This model predicted the likelihood of customers being able to pay their dues after their accounts were finalized. The model assigned a propensity-to-pay score to every customer.

Customer classification into high, medium and low propensity-to-pay segments based on their scores.

Focused delinquency management strategies for every segment.

Customer segment prioritization. Customer segments were prioritized on the basis of the propensity-to-pay scores and the amount of outstanding debt.

Rigorous cost-benefit analysis to streamline operational, financial and human resource activities. This exercise was instrumental in optimizing the debt management process.

Engaging with customers. The customer service executives used customized call scripts and pre-determined verbiage to conduct settlement negotiations and provide debt management advice to customers.

Performance monitoring of pilot strategies against critical tactical and quality indicators and also against the parameters set by the standard process.

Benefits Delivered

By deploying predictive analytics, WNS was able to fulfill the client's business objectives and helped achieve the following outcomes:

Debt collection increased by 50 percent within 3 months

The modified process recorded an 8 percent rise in conversion rates compared to the standard process

Operational expenses decreased by 20 percent

Join the conversation

Related To:

Similar perspectives, the transformative impact of ai on business: insights from our….

27 June 2024

Utilities and Energy

Navigating the Utility Debt Management Crisis with Data…

06 October 2023

Finding the Pulse of the New Digital Healthcare Paradigm

16 March 2023

Leveraging Data for Faster and Improved Collections

A fintech bnpl case study this website, how a fintech lender leveraged data analytics to achieve 27% higher recoveries, download our case study to know how a leading fintech in the bnpl and personal loan segment leveraged credgenics collections analytics to adopt a data-driven strategic framework for higher, faster and lower cost recoveries., fill all the details to get case study.

- I hereby give my consent to Credgenics to use my details for the purposes of sharing industry updates and insights through a newsletter

Recovery amount within the first week

Reduction in time to collect

Saving in human calling agent cost

A customer-centric approach to accelerate your debt recoveries.

Omnichannel communications

Create templates and automate emails, SMS, WhatsApp, and voice messages for different segments of your borrowers.

Digital-first and Digital-fast Collections

Our 3C framework – Connect, Contact and Collect offers risk and language-based segmentation, and automated workflows for borrower reach-out and engagement.

Efficient field debt collections

Get your field agents to use the Credgenics app and find locations easily using your Google Maps integrations.

Improve team performance

See which agent is delivering results, know the gaps in your collections process and track every metric that matters.

Log in with your credentials

Forgot your details.

IMAGES

VIDEO