Pledging Accounts Receivable

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on January 30, 2024

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Definition and explanation.

Pledging accounts receivable is essentially the same as using any asset as collateral for a loan. Cash is obtained from a lender by promising to repay.

If the loan is not repaid, the collateral will be converted to cash, and the cash will be used to retire the debt.

The receivables can be either an identified set of notes and accounts or a general group in which new ones can be added and old ones retired.

The collection of a pledged receivable has no impact on the loan balance.

The pledging agreement usually calls for the substitution of another receivable for the one collected.

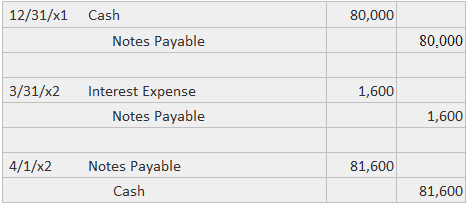

As an example, suppose that Sample Company borrows $80,000 on 31 December 2023, and agrees to pay back $81,600 on 1 April 2024.

Further, it pledges $100,000 of trade receivables for the loan. The company would make three journal entries as follows:

The last two entries can be combined, but they are shown separately here to facilitate a comparison of pledging with the other approaches.

The only financial statement disclosures provided for pledged receivables are notes or parenthetical comments.

A similar notation is provided for the notes payable .

Assignor Collects

As an alternative to pledging, the company may decide to assign its receivables to a lending institution.

Under this arrangement, the original holder essentially transfers title to the third party but agrees to collect the receivables and pay the cash to the factor .

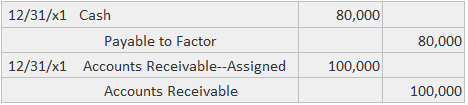

Suppose that Sample Company obtains $80,000 cash on 31 December 2023 by assigning $100,000 of its trade receivables.

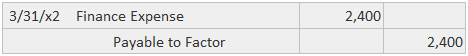

The company agrees to place the collections in a special restricted checking account from which it will repay the original $80 000 plus a $2,400 finance charge on April 1, 2024.

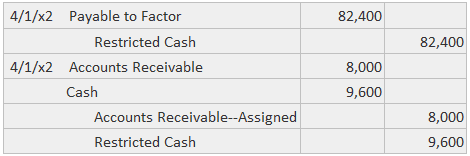

These journal entries would be made as follows:

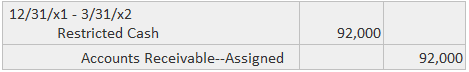

To record partial collection of the assigned accounts :

To accrue the finance charge:

To reclassify the uncollected accounts and unrestricted cash:

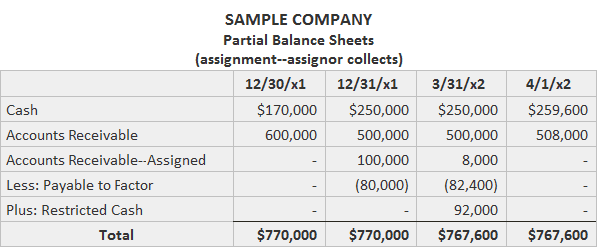

The disclosures that would be provided on various balance sheet dates are shown in the following example, under the simplifying assumption that no other activity took place.

Notice that the payable to the factor is contra to the assigned accounts. Any restricted cash balance is, in turn, contra to the payable account.

Most arrangements of this type call for more frequent payments than the example shows.

The net result of the assignment is that Sample Company obtained $80,000 by giving up $82,400 of receivables.

Pledging Accounts Receivable FAQs

What is pledging accounts receivable.

Pledging Accounts Receivable means that a business gives up some of its rights to an asset in order to borrow money. For example, you could pledge your car title as collateral for a loan. If the loan isn't repaid, the lender can take possession of your car.

What are the journal entries for pledging accounts receivable?

There are no Special Journal entries required when you pledge your Accounts Receivable as collateral for a loan. The lender still has to approve giving up your Accounts Receivable before making the loan.

How are accounts receivable journal entries prepared?

Accounts Receivable are money owed to a company by their customers for products they've already received. Accounts are recorded in the balance sheet as assets.

What are the journal entries for assigning Accounts Receivable as collateral for a loan?

The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables. The assign Accounts Receivable account is credited because they still owe this money to their customers.

What are the main financial statements in an assignment of accounts receivable?

The three main Financial Statements in an assignment of Accounts Receivable are the income statement, balance sheet, and Cash Flow statement. The income statement and Cash Flow statements would report the repayments on the receivables.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

- Receivables

- Notes Receivable

- Credit Terms

- Cash Discount on Sales

- Accounting for Bad Debts

- Bad Debts Direct Write-off Method

- Bad Debts Allowance Method

- Bad Debts as % of Sales

- Bad Debts as % of Receivables

- Recovery of Bad Debts

- Accounts Receivable Aging

- Assignment of Accounts Receivable

- Factoring of Accounts Receivable

Assignment of accounts receivable is an agreement in which a business assigns its accounts receivable to a financing company in return for a loan. It is a way to finance cash flows for a business that otherwise finds it difficult to secure a loan, because the assigned receivables serve as collateral for the loan received.

By assignment of accounts receivable, the lender i.e. the financing company has the right to collect the receivables if the borrowing company i.e. actual owner of the receivables, fails to repay the loan in time. The financing company also receives finance charges / interest and service charges.

It is important to note that the receivables are not actually sold under an assignment agreement. If the ownership of the receivables is actually transferred, the agreement would be for sale / factoring of accounts receivable . Usually, the borrowing company would itself collect the assigned receivables and remit the loan amount as per agreement. It is only when the borrower fails to pay as per agreement, that the lender gets a right to collect the assigned receivables on its own.

The assignment of accounts receivable may be general or specific. A general assignment of accounts receivable entitles the lender to proceed to collect any accounts receivable of the borrowing company whereas in case of specific assignment of accounts receivable, the lender is only entitled to collect the accounts receivable specifically assigned to the lender.

The following example shows how to record transactions related to assignment of accounts receivable via journal entries:

On March 1, 20X6, Company A borrowed $50,000 from a bank and signed a 12% one month note payable. The bank charged 1% initial fee. Company A assigned $73,000 of its accounts receivable to the bank as a security. During March 20X6, the company collected $70,000 of the assigned accounts receivable and paid the principle and interest on note payable to the bank on April 1. $3,000 of the sales were returned by the customers.

Record the necessary journal entries by Company A.

Journal Entries on March 1

Initial fee = 0.01 × 50,000 = 500

Cash received = 50,000 – 500 = 49,500

The accounts receivable don't actually change ownership. But they may be to transferred to another account as shown the following journal entry. The impact on the balance sheet is only related to presentation, so this journal entry may not actually be passed. Usually, the fact that accounts receivable have been assigned, is stated in the notes to the financial statements.

Journal Entries on April 1

Interest expense = 50,000 × 12%/12 = 500

by Irfanullah Jan, ACCA and last modified on Oct 29, 2020

Related Topics

- Sales Returns

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Accounting Systems

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

The Difference Between Assignment of Receivables & Factoring of Receivables

You can raise cash fast by assigning your business accounts receivables or factoring your receivables. Assigning and factoring accounts receivables are popular because they provide off-balance sheet financing. The transaction normally does not appear in your financial statements and your customers may never know their accounts were assigned or factored. However, the differences between assigning and factoring receivables can impact your future cash flows and profits.

How Receivables Assignment Works

Assigning your accounts receivables means that you use them as collateral for a secured loan. The financial institution, such as a bank or loan company, analyzes the accounts receivable aging report. For each invoice that qualifies, you will likely receive 70 to 90 percent of the outstanding balance in cash, according to All Business. Depending on the lender, you may have to assign all your receivables or specific receivables to secure the loan. Once you have repaid the loan, you can use the accounts as collateral for a new loan.

More For You

How to decrease bad debt expenses to increase income, what does "paid on account" in accounting mean, what is a financing receivable, what do liquidity ratios measure, what are some examples of installment & revolving accounts, assignment strengths and weaknesses.

Using your receivables as collateral lets you retain ownership of the accounts as long as you make your payments on time, says Accounting Coach. Since the lender deals directly with you, your customers never know that you have borrowed against their outstanding accounts. However, lenders charge high fees and interest on an assignment of accounts receivable loan. A loan made with recourse means that you still are responsible for repaying the loan if your customer defaults on their payments. You will lose ownership of your accounts if you do not repay the loan per the agreement terms.

Advertisement

Article continues below this ad

How Factoring Receivables Works

When you factor your accounts receivable, you sell them to a financial institution or a company that specializes in purchasing accounts receivables. The factor analyzes your accounts receivable aging report to see which accounts meet their purchase criteria. Some factors will not purchase receivables that are delinquent 45 days or longer. Factors pay anywhere from 65 percent to 90 percent of an invoice's value. Once you factor an account, the factor takes ownership of the invoices.

Factoring Strengths and Weaknesses

Factoring your accounts receivables gives you instant cash and puts the burden of collecting payment from slow or non-paying customers on the factor. If you sell the accounts without recourse, the factor cannot look to you for payment should your former customers default on the payments. On the other hand, factoring your receivables could result in your losing customers if they assume you sold their accounts because of financial problems. In addition, factoring receivables is expensive. Factors charge high fees and may retain recourse rights while paying you a fraction of your receivables' full value.

- All Business: The Difference Between Factoring and Accounts Receivable Financing

- Search Search Please fill out this field.

What Is Accounts Receivable (AR)?

- Understanding AR

- Receivable vs. Payable

- What AR Can Tell You

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Accounts Receivable (AR): Definition, Uses, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Accounts receivable (AR) is an accounting term for money owed to a business for goods or services that it has delivered but not been paid for yet. Accounts receivable is listed on the company's balance sheet as a current asset .

Key Takeaways

- Accounts receivable (AR) is an item on a company's balance sheet that represents money due the company for products or services it has already delivered.

- Accounts receivable is considered an asset to the company.

- The opposite of accounts receivable is accounts payable, which reflects money that a company owes but has not yet paid.

Joules Garcia / Investopedia

Understanding Accounts Receivable (AR)

Accounts receivable represents money that a business is owed by its clients, often in the form of unpaid invoices. "Receivable" refers to fact that the business has earned the money because it has delivered a product or service but is, at that point in time, still waiting to receive the client's payment.

Accounts receivable, or receivables, can be considered a line of credit extended by a company and normally have terms that require payments be made within a certain period of time. If effect, the company has accepted an IOU from the client. Depending on the agreement between company and client, the payment might be due in anywhere from a few days to 30 days, 60 days, 90 days, or, in some cases, up to a year. At some point along the way, interest on the debt might also begin to accrue.

Companies record accounts receivable as assets on their balance sheets because the customer has a legal obligation to pay the debt and the company has a reasonable expectation of collecting it. They are considered liquid assets because they can be used as collateral to secure a loan to help the company meet its short-term obligations. Receivables are part of a company's working capital .

Furthermore, accounts receivable are classified as current assets, because the account balance is expected from the debtor in one year or less. Other current assets on a company's books might include cash and cash equivalents , inventory , and readily marketable securities.

Assets that could not easily be converted into cash within a year are recorded as noncurrent assets . That category often includes things like physical property, long-term investments, and intellectual property, such as trademarks.

Accounts Receivable vs. Accounts Payable

When a company owes debts to its suppliers or other parties, those are accounts payable . Accounts payable are the opposite of accounts receivable. To illustrate, Company A cleans Company B's carpets and sends a bill for the services.

Company B now owes Company A money, so it lists the invoice in its accounts payable column. While Company A waits to receive the money, it records the amount in its accounts receivable column.

What Accounts Receivable Can Tell You

Accounts receivable are an important element in fundamental analysis , a common method investors use to determine the value of a company and its securities. Because accounts receivable is a current asset, it contributes to a company's liquidity or ability to cover short-term obligations without additional cash flows.

Fundamental analysts often evaluate accounts receivable in the context of turnover, also known as the accounts receivable turnover ratio . It measures the number of times a company has collected its accounts receivable balances during an accounting period and is considered an indicator of both how efficient the company is in collecting its debts and the credit quality of its customers.

Further analysis would include assessing days sales outstanding (DSO) , which measures the average number of days that it takes a company to collect payments after a sale has been made.

Example of Accounts Receivable

An everyday example of accounts receivable would be an electric company that bills its clients after the clients receive and consume the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills.

Most companies operate by allowing a portion of their sales to be on credit. Sometimes, businesses offer such credit to frequent or special customers, who receive periodic invoices rather than having to make payments as each transaction occurs. In other cases, businesses routinely offer all of their clients the ability to pay within some reasonable period after receiving the products or services.

When Does a Debt Become a Receivable?

A receivable is created any time money is owed to a business for services rendered or products provided that have not yet been paid for. For example, when a business buys office supplies, and doesn't pay in advance or on delivery, the money it owes becomes a receivable until it's been received by the seller.

Where Do I Find a Company's Accounts Receivable?

Accounts receivable are recorded on a company's balance sheet. Because they represent funds owed to the company (and that are likely to be received), they are booked as an asset.

How Are Accounts Receivable Different From Accounts Payable?

Accounts receivable represent funds owed to a company and are booked as an asset. Accounts payable, on the other hand, represent funds that a company owes to others and are booked as liabilities.

What Happens If Customers Never Pay What's Due?

When it becomes clear that a receivable won't be paid by the customer, it has to be written off as a bad debt expense or a one-time charge. Companies might also sell this outstanding debt to a third party debt collector for a fraction of the original amount—creating what accountants refer to to as accounts receivable discounted .

What Are Net Receivables?

Net receivables is an accounting term for a company's accounts receivable minus any receivables it has reason to believe it will never collect. It is typically expressed as a percentage of uncollectible debts relative to collectible ones, and the lower the percentage, the better.

Accounts receivable is one of the most important line items on a company's balance sheet. It reflects the money owed to a company from the sale of its goods or services that remains to be paid by the buyer. Even though it is not yet in hand, it is considered an asset because the company expects to receive it in due course. The shorter the period of time a company has accounts receivable balances, the better, as it means the company can use that money for other business purposes.

Cornell Law School Legal Information Institute. " Accounts Receivable ."

Office of the Comptroller of the Currency. "Accounts Receivable and Inventory Financing"

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1555356662-1aa43f27babd41eab9336eaa20f2975a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Double Entry Bookkeeping

learn bookkeeping online for free

Home > Accounts Receivable > Assignment of Accounts Receivable Journal Entries

Assignment of Accounts Receivable Journal Entries

The assignment of accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable assignment.

The assignment of accounts receivable journal entries are based on the following information:

- Accounts receivable 50,000 on 45 days terms

- Assignment fee of 1% (500)

- Initial advance of 80% (40,000)

- Cash received from customers 6,000

- Interest on advances at 9%, outstanding on average for 40 days (40,000 x 9% x 40 / 365 = 395)

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

COMMENTS

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the ...

Under an assignment of arrangement, a pays a in exchange for the borrower assigning certain of its receivable accounts to the lender. If the borrower does not repay the , the lender has the right to collect the assigned receivables. The receivables are not actually sold to the lender, which means that the borrower retains the of not collecting ...

The pledging agreement usually calls for the substitution of another receivable for the one collected. As an example, suppose that Sample Company borrows $80,000 on 31 December 2023, and agrees to pay back $81,600 on 1 April 2024. Further, it pledges $100,000 of trade receivables for the loan. The company would make three journal entries as ...

Summary: Assignment of accounts receivable is a lending arrangement where a borrower assigns their accounts receivable to a lending institution in exchange for a loan. This article delves into the intricacies of this financing method, its advantages and disadvantages, special considerations, and emerging trends in the fintech sector.

Assigning accounts receivable is a fairly straightforward business financing option where a company receives a loan using its outstanding invoices as collateral. It is a form of asset-based financing. In general assignment, the company uses all accounts receivable as collateral. In specific assignment, the borrower only puts up select invoices ...

Assignment of accounts receivable is an agreement in which a business assigns its accounts receivable to a financing company in return for a loan. It is a way to finance cash flows for a business that otherwise finds it difficult to secure a loan, because the assigned receivables serve as collateral for the loan received.

Assigning your accounts receivables means that you use them as collateral for a secured loan. The financial institution, such as a bank or loan company, analyzes the accounts receivable aging report.

The purpose of assigning accounts receivable is to provide collateral in order to obtain a loan. To illustrate, let’s assume that a corporation receives a special order from a new customer whose credit rating is superb. However, the customer pays for its purchases 90 days after it receives the goods. The corporation does not have sufficient ...

Accounts receivable is one of the most important line items on a company's balance sheet. It reflects the money owed to a company from the sale of its goods or services that remains to be paid by ...

The assignment of accounts receivable journal entries are based on the following information: Accounts receivable 50,000 on 45 days terms. Assignment fee of 1% (500) Initial advance of 80% (40,000) Cash received from customers 6,000. Interest on advances at 9%, outstanding on average for 40 days (40,000 x 9% x 40 / 365 = 395)