3 Sample Nonprofit Business Plans For Inspiration

Download our Ultimate Nonprofit Business Plan Template here

Below are sample plans to help guide you in writing a nonprofit business plan.

- Example #1 – Kids Are Our First Priority (KAOFP) – a Nonprofit Youth Organization based in Chicago, IL

- Example #2 – Church of the Sacred Heart – a Nonprofit Church based in St. Louis, MO

- Example #3 – Finally Home – a Nonprofit Homeless Shelter in Los Angeles, CA

Sample Nonprofit Business Plan #1 – Kids Are Our First Priority (KAOFP) – a Nonprofit Youth Organization based in Chicago, IL

Executive summary.

Kids Are Our First Priority (KAOFP) is a 501(c)3 nonprofit youth organization that seeks to provide opportunities for students who might otherwise not have access to the arts and humanities. We believe all students should have the opportunity to discover and develop their interests and talents, regardless of socioeconomic status or geographic location. We offer completely free after-school programming in music production, digital photography, creative writing, and leadership development to 12-18-year-olds at risk of dropping out of high school.

Our organization has been active for over five years and has run highly successful programs at two schools in the city of Chicago. We have been awarded an active grant from a local foundation for this coming year, but we will need to cover all costs on our own after that point. Nonprofit administrators have seen a lot of turnovers, leaving the organization without a sustainable plan for reaching its goals.

Organization Overview

The Kids Are Our First Priority (KAOFP) is a 501(c)3 nonprofit youth organization with a mission to provide opportunities for development and self-expression to students who might otherwise not have access. Audiences include at-risk, low-income students from elementary through high school in the Chicago area.

Our programs are built around creative learning with two goals: firstly, creating a space for learning and growth; secondly, encouraging students to share their work with the world.

KAOFP runs three different programs in partnership with closely related nonprofit organizations, providing after-school programming for elementary, middle, and high school-aged children. Programs take place twice a week at different schools around Chicago. While each program is unique in its goals and activities, all programs focus on creative development in the arts and humanities.

Products, Programs, and Services

The three programs offered by KAOFP are Leadership Development (LD), Creative Writing (CW), and Music Production (MP). Students learn in small groups led by skilled instructors. All activities are designed to encourage student engagement, creativity, expression, and community building. Instructors encourage students to share their work with the world through presentations on- and off-site.

Leadership Development (LD)

The Leadership Development program is designed to provide leadership opportunities for high school students who might not otherwise have access to these experiences. Students learn about facilitation, collaboration, communication, and organizational skills as they plan and run projects of their own design. The program’s goal is to provide a structured environment that encourages students to become more confident and comfortable being leaders in their schools, communities, and future careers.

Creative Writing (CW)

Students learn how to use writing creatively as a tool for expression, discovery, and communication. In small groups led by skilled instructors, students write poetry, short stories, and essays of their own design. They also learn about the publishing industry, read each others’ work, and share their writing with the community.

Music Production (MP)

Students learn how to use digital media as a tool for expression, discovery, and communication. In weekly sessions led by skilled instructors, students explore music production through computer software and recording equipment. Students produce their own music and write about their experiences in weekly journals. Industry professionals in the community often volunteer to lead special workshops and seminars.

Industry Analysis

The youth arts and humanities field is extremely competitive. There are many different types of nonprofit organizations doing similar work, but few credible providers with long-term commitments to their communities. KAOFP’s greatest strengths and competitive advantages are our stable and qualified staff, a strong foundation of funding and community support, and a diverse set of programs.

Our biggest competitors include national non-profits with large budgets for advertising and marketing as well as commercial programs that offer music lessons and creative writing courses which may be more cost-effective than our programs. We feel that by focusing on specific areas of creative expression, KAOFP can better serve its communities and differentiate itself from other nonprofit organizations effectively.

Customer Analysis

KAOFP serves elementary, middle, and high school-aged students with programs that include both after-school and summer programming.

Our focus is on low-income neighborhoods with a high population of at-risk youth. In these areas, KAOFP fills a void in the education system by providing opportunities for creative expression and leadership development to students who would not otherwise have access to these resources.

The demographics of our current students are as follows:

- 91% African-American/Black

- 6% Hispanic/Latino

- 5% Multiracial

- 3.9% Low Income

- 4.9% Not Identified

Our main target is low-income African American and Latino youth in Chicago Public Schools. We would like to expand our outreach to include other communities in need of creative enrichment opportunities.

Marketing Plan

KAOFP’s marketing program is designed to support student, parent, and staff recruitment by promoting the organization’s goals and programs. Our main target audience consists of parents seeking after-school enrichment opportunities for their children that emphasize creativity and the arts.

To reach this audience, we advertise in public schools as well as on social networking sites such as Facebook and Twitter. We intend to begin marketing online through a company-sponsored blog, which will feature regular updates about KAOFP events and activities. We also intend to use word of mouth as a form of marketing.

Strategic partnerships with local schools and community centers will provide us with additional exposure as well as additional resources to secure funding.

Operations Plan

KAOFP’s day-to-day operation is structured around its programs on Tuesdays from 4 pm to 8 pm.

Administrative offices are located in the same space as each program, allowing instructors to closely monitor their students and provide support as needed. The administrative offices serve the essential function of fundraising, communications, record-keeping, and volunteer coordination. KAOFP’s Board of Directors meets bi-monthly to provide further leadership, guidance, and oversight to our board members and volunteers.

Customer service is conducted by phone and email during our regular business hours of Monday – Friday 9 am to 12 pm. We are not open on weekends or holidays.

Management Team

KAOFP’s organizational structure includes a Board of Directors, an Executive Director, and Program Directors. The Board of Directors provides guidance and oversight to the organization, while the Executive Director manages day-to-day operations. The Program Directors oversee each of KAOFP’s programs.

KAOFP has a small but dedicated staff that is committed to our students and our mission. Our team has a wide range of experience in the arts, education, and nonprofit sector.

Executive Director

The Executive Director is responsible for the overall management of KAOFP. This includes supervising staff, developing and implementing programs, overseeing finances, and representing the organization to the public.

Our Executive Director, Susie Brown, has been with KAOFP since its inception in 2010. She has a B.A. in Fine Arts from the University of Illinois at Urbana-Champaign and an M.F.A. in Creative Writing from Columbia College Chicago. Susie is responsible for the overall management of KAOFP, including supervising staff, developing and implementing programs, overseeing finances, and representing the organization to the public.

Program Directors

Each of KAOFP’s programs is overseen by a Program Director. The Program Directors are responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Art Program Director

The Art Program Director, Rachel Smith, has a B.A. in Fine Arts from the University of Illinois at Urbana-Champaign. She is responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Music Program Director

The Music Program Director, John Jones, has a B.A. in Music Education from the University of Illinois at Urbana-Champaign. He is responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Theatre Program Director

The Theatre Program Director, Jane Doe, has a B.A. in Theatre Arts from the University of Illinois at Urbana-Champaign. She is responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Board of Directors

KAOFP’s Board of Directors provides guidance and oversight to the organization. The Board consists of community leaders, educators, artists, and parents. Board members serve three-year terms and can be renewed for one additional term.

Financial Plan

KAOFP’s annual operating budget is approximately $60,000 per year, with an additional one-time cost of about $10,000 for the purchase of equipment and materials. The agency makes very efficient use of its resources by maintaining low overhead costs. Our biggest expense is instructor salaries, which are approximately 75% of total expenses.

Pro Forma Income Statement

Pro forma balance sheet, pro forma cash flow statement, nonprofit business plan example #2 – church of the sacred heart – a nonprofit church based in st. louis, mo.

The Church of Sacred Heart is a nonprofit organization located in St. Louis, Missouri that provides educational opportunities for low-income families. We provide the best quality of education for young children with tuition rates significantly lower than public schools. It has been voted Best Catholic Elementary School by the St Louis Post Dispatch for four years running, and it has maintained consistently high ratings of 4.5 out of 5 stars on Google Reviews since its opening in 1914.

The Church of Sacred Heart strives to build strong relationships with our community by making an impact locally but not forgetting that we operate on global principles. As such, our school commits 10% of its profits to charitable organizations throughout the world every year, while also conducting fundraisers throughout the year to keep tuition rates affordable.

We are currently transitioning from a safe, high-quality learning environment to an even more attractive facility with state-of-the-art technology and modern materials that will appeal to young students and their families. New facilities, such as additional classrooms and teachers’ lounges would allow us not only to accommodate new students but also attract current families by having more places within the school where they can spend time between classes.

By taking full advantage of available opportunities to invest in our teachers, students, and facilities, we will be able to achieve steady revenue growth at 4% per year until 20XX.

The Church of Sacred Heart provides a safe learning environment with an emphasis on strong academics and a nurturing environment that meets the needs of its young students and their families. Investing in new facilities will allow us to provide even better care for our children as we continue to grow as a school.

Mission Statement: “We will strive diligently to create a safe, respectful environment where students are encouraged and inspired to learn through faith.”

Vision Statement: “Sacred Heart believes education gives every child the opportunity to achieve their full potential.”

The Church of the Sacred Heart was built in 1914 and is located in the Old North St. Louis neighborhood, an area with a high concentration of poverty, crime, unemployment, and abandoned buildings.

The church houses the only Catholic school for low-income families in the north city; together they formed Sacred Heart’s educational center (SCE). SCE has strived to provide academic excellence to children from low-income families by providing a small, nurturing environment as well as high academic standards.

The facility is in need of renovations and new equipment to continue its mission.

The Church of the Sacred Heart is a small nonprofit organization that provides a variety of educational and community services.

The services provided by Sacred Heart represent a $5 billion industry, with nonprofit organizations accounting for $258.8 billion of that total.

The health care and social assistance sector is the largest among nonprofits, representing 32 percent of revenues, followed by educational services (18 percent), and human and other social service providers (16 percent).

The key customers for the Church of the Sacred Heart are families in need of affordable education. The number of students in the school has increased from 500 when it opened in 1914 to 1,100 at its peak during 20XX-20XX but has since declined due to various reasons.

The children at Sacred Heart are from low-income families and 91 percent qualify for free or reduced lunches. Most parents work or have a family member who works full-time, while others don’t work due to child care restraints. The number of children enrolled in Sacred Heart is stable at 1,075 students because there is a lack of affordable alternatives to Catholic education in the area.

SCE offers K-5th grade students a unique learning experience in small groups with individualized instruction.

Sacred Heart has an established brand and is well known for its high standards of academic excellence, which include a 100 percent graduation rate.

Sacred Heart attracts prospective students through promotional materials such as weekly bulletins, mailers to homes that are located in the area served, and local churches.

Parents and guardians of children enrolled in Sacred Heart are mainly referrals from current families, word-of-mouth, and parishioners who learn about the school by attending Mass at Sacred Heart.

The Church of Sacred Heart does not currently advertise; however, it is one of the few Catholic schools that serve low-income families in St. Louis, MO, and therefore uses word of mouth to attract new students to its school.

The Church of Sacred Heart has an established brand awareness within the target audience despite not having direct marketing plans or materials.

The operations section for the Church of the Sacred Heart consists of expanding its after-school program as well as revamping its facility to meet the growing demand for affordable educational services.

Sacred Heart is located in an area where more than one-third of children live below the poverty line, which helps Sacred Heart stand out among other schools that are more upscale. Expansion into after-school programs will allow it to capture a larger market share by providing additional services to its target audience.

In order to expand, Sacred Heart will have to hire additional personnel as well as invest in new equipment and supplies for both the school and the after-school program.

The Church of Sacred Heart’s financial plan includes a fundraising plan that would help renovate the building as well as acquire new equipment and supplies for the school.

According to the National Center for Education Statistics, Catholic elementary schools across all grade levels spend an average of $6,910 per pupil on operating expenses. A fundraising initiative would help Sacred Heart acquire additional revenue while expanding its services to low-income families in St Louis, MO.

Financial Overview

The Church of the Sacred Heart expects to generate revenues of about $1.2 million in fiscal year 20XX, representing a growth rate of 2 percent from its 20XX revenue level. For 20XX, the church expects revenues to decrease by 4 percent due to a decline in enrollment and the lack of new students. The Church of Sacred Heart has experienced steady revenue growth since its opening in 1914.

- Revenue stream 1: Tuition – 22%

- Revenue stream 2: Investment income – 1%

Despite being located in a poverty-stricken area, the Church of Sacred Heart has a stable revenue growth at 4 percent per year. Therefore, Sacred Heart should be able to attain its 20XX revenue goal of $1.2 million by investing in new facilities and increasing tuition fees for students enrolled in its after-school program.

Income Statement f or the fiscal year ending December 31, 20XX

Revenue: $1.2 million

Total Expenses: $910,000

Net Income Before Taxes: $302,000

Statement of Financial Position as of December 31, 20XX

Cash and Cash Equivalents: $25,000

Receivables: $335,000

Property and Equipment: $1.2 million

Intangible Assets: $0

Total Assets: $1.5 million

Balance Statement

The board of directors has approved the 20XX fiscal year budget for Sacred Heart Catholic Church, which is estimated at $1.3 million in revenues and $920,000 in expenditures.

Cash Flow Statement f or the Fiscal Year Ending December 31, 20XX

Operating Activities: Income Before Taxes -$302,000

Investing Activities: New equipment and supplies -$100,000

Financing Activities: Fundraising campaign $200,000

Net Change in Cash: $25,000

According to the 20XX fiscal year financial statements for Sacred Heart Catholic Church, it expects its investments to decrease by 4 percent and expects to generate $1.3 million in revenues. Its total assets are valued at $1.5 million, which consists of equipment and property worth approximately 1.2 million dollars.

The Church of Sacred Heart’s financial statements demonstrate its long-term potential for strong revenue growth due to its steady market share held with low-income families in St. Louis, MO.

Nonprofit Business Plan Example #3 – Finally Home – a Nonprofit Homeless Shelter in Los Angeles, CA

Finally Home is a nonprofit organization that aims to provide low-income single-parent families with affordable housing. The management team has a strong background in the social service industry and deep ties in the communities they plan to serve. In addition, Finally Home’s CEO has a background in real estate development, which will help the organization as they begin developing its operations.

Finally Home’s mission is to reinvent affordable housing for low-income single-parent families and make it more sustainable and accessible. They will accomplish this by buying homes from families and renting them out at an affordable price. Finally Home expects its model of affordable housing to become more sustainable and accessible than any other model currently available on the market today. Finally Home’s competitive advantage over similar organizations is that it will purchase land and buildings from which to build affordable housing. This gives them a greater amount of ownership over their communities and the properties in which the homes are located, as well as freedom when financing these projects.

Finally Home plans on accomplishing this by buying real estate in areas with high concentrations of low-income families who are ready to become homeowners. These homes will be used as affordable housing units until they are purchased by Finally Home’s target demographic, at which point the organizations will begin renting them out at a base rate of 30% of the family’s monthly household income.

Finally Home plans on financing its operations through both private donations and contributions from foundations, corporations, and government organizations.

Finally Home’s management team has strong backgrounds in the social service industry, with deep ties to families that will be prepared to take advantage of Finally Home’s affordable housing opportunities. The CEO of Finally Home also brings extensive real estate development experience to the organization, an asset that will be especially helpful as Finally Home begins its operations.

Finally Home is a nonprofit organization, incorporated in the State of California, whose mission is to help homeless families by providing them with housing and support services. The centerpiece of our program, which will be replicated nationwide if successful, is an apartment complex that offers supportive living for single parents and their children.

The apartments are fully furnished, and all utilities are paid.

All the single parents have jobs, but they don’t earn enough to pay market-rate rent while still paying for other necessities such as food and transportation.

The organization was founded in 20XX by Henry Cisneros, a former U.S. Secretary of Housing and Urban Development who served under President Bill Clinton. Cisneros is the chairman of Finally Home’s board of directors, which includes leaders with experience in banking, nonprofit management, and housing professions.

The core values are family unity, compassion for the poor, and respect for our clients. They are the values that guide our employees and volunteers at Finally Home from start to finish.

According to the United States Conference of Mayors’ Task Force on Hunger and Homelessness 20XX Report, “Hunger & Homelessness Survey: A Status Report on Hunger & Homelessness in America’s Cities,” almost half (48%) of all homeless people are members of families with children. Of this number, over one quarter (26%) are under the age of 18.

In 20XX, there were 9.5 million poor adults living in poverty in a family with children and no spouse present. The majority of these families (63%) have only one earner, while 44% have zero earners because the person is not old enough or does not work for other reasons.

The total number of people in poverty in 20XX was 46.5 million, the largest number since Census began publishing these statistics 52 years ago.

Finally Home’s goal is to help single parents escape this cycle of poverty through providing affordable housing and case management services to support them long term.

Unique Market Position

Finally Home creates unique value for its potential customers by creating housing where it does not yet exist.

By helping single parents escape poverty and become self-sufficient, Finally Home will drive demand among low-income families nationwide who are experiencing homelessness. The high level of need among this demographic is significant nationwide. However, there are no other organizations with the same market position as Finally Home.

Finally Home’s target customers are low-income families who are experiencing homelessness in the Los Angeles area. The organization will actively seek out these families through national networks of other social service providers to whom they refer their clients regularly.

Finally Home expects to have a waiting list of families that are interested in the program before they even open their doors.

This customer analysis is based on the assumption that these particular demographic groups are already active users of other social service programs, so referrals will be natural and easy for Finally Home.

Industry Capacity

This information is based on the assumption that these particular demographic groups are already active users of other social service programs, so referrals will be natural and easy for Finally Home.

There is a growing demand for low-income single-parent housing nationwide, yet there is no one organization currently providing these services on a national level like Finally Home.

Thus, Finally Home has a competitive advantage and market niche here because it will be the only nonprofit organization of its kind in the country.

Finally Home’s marketing strategies will focus on attracting potential customers through national networks of other social service providers. They will advertise to their referral sources using materials developed by the organization. Finally Home will also advertise its services online, targeting low-income families using Google AdWords.

Finally Home will be reinventing affordable housing to make it more accessible and sustainable for low-income single parents. In this new model, Finally Home will own the land and buildings on which its housing units are built, as well as the properties in which they are located.

When a family is ready to move into an affordable housing unit, Finally Home will buy the home they currently live in. This way, families can take advantage of homeownership services like property tax assistance and financial literacy courses that help them manage their newfound wealth.

Finally Home has already partnered with local real estate agents to identify properties for purchase. The organization expects this to result in homes that are at least 30% cheaper than market value.

Finally Home will finance its operational plan through the use of private contributions and donations from public and private foundations, as well as corporate sponsorships.

Finally Home’s management team consists of:

- Veronica Jones, CEO, and Founder

- Mark MacDonald, COO

- Scott Bader, CFO

Management Summary

The management team has a strong history of social service advocacy and deep ties in the communities they plan to serve. In addition, the organization’s CEO has a background in real estate development that will be helpful as Finally Home begins operations.

- Year 1: Operation startup costs to launch first five houses ($621,865)

- Year 2: Deliver on market offer and complete first capital raise ($4,753,000)

- Year 3: Deliver on market offer and complete $5 million capital raise ($7,950,000)

- Year 4+: Continue to grow market share with a national network of social services providers ($15,350,000).

This nonprofit business plan will serve as an effective road map for Finally Home in its efforts to create a new model for affordable housing.

Nonprofit Business Plan Example PDF

Download our non-profit business plan PDF here. This is a free nonprofit business plan example to help you get started on your own nonprofit plan.

How to Finish Your Nonprofit Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your nonprofit business plan?

With Growthink’s Ultimate Nonprofit Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Nonprofit Business Planning Articles

- Non-Profit Business Plan

- How to Write a Nonprofit Business Plan

- How to Write a Mission Statement for Your Nonprofit Organization

- Strategic Planning for a Nonprofit Organization

- How to Write a Marketing Plan for Your Nonprofit Business

- 4 Top Funding Sources for a Nonprofit Organization

- What is a Nonprofit Organization?

- 20 Nonprofit Organization Ideas For Your Community

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

11 Best Non Profit Business Plan Examples + Template (2024)

Table of Contents

What Is Non Profit Organization?

Things to consider when starting a non-profit business, here are 11 best non profit business plan examples for your inspiration, executive summary, organizational description, mission statement, vision statement, market analysis, programs and services, marketing and outreach strategy, operational plan, financial plan, evaluation and measurement, risk management, want to prepare a business plan, non profit business plan faq's.

The non-profit sector, also known as the nonprofit business sector or the third sector, consists of organizations that operate for purposes other than making a profit. These organizations focus on serving the public or specific communities by addressing social, cultural, educational, environmental, or humanitarian needs.

Non-profit organizations rely on donations, grants, fundraising, and government support to finance their operations and fulfill their mission. They encompass a wide range of entities, including charities, foundations, religious organizations, educational institutions, social service agencies, healthcare providers, environmental organizations, and arts and cultural organizations. Non-profit organizations play a vital role in advocating for social change, providing essential services, and improving the well-being of society.

In the United States, non-profit organizations often seek tax-exempt status under Section 501(c)(3) of the Internal Revenue Code . This designation allows them to receive tax-deductible donations and grants. Non-profit organizations are governed by a board of directors or trustees, ensuring adherence to legal and ethical standards. They are subject to specific regulations and reporting requirements to maintain transparency and accountability. Through the dedication of volunteers, support from donors and funders, and the commitment of staff members, the non-profit sector makes a significant impact by addressing societal issues and fostering positive change in communities.

- Clearly define your non-profit’s mission and vision for guidance.

- Research the non-profit sector to understand opportunities and challenges.

- Identify your target audience to tailor programs and services.

- Develop a strategic plan with clear goals and objectives.

- Choose a suitable legal structure for your non-profit organization.

- Establish a dedicated board of directors for guidance and governance.

- Create a strong fundraising strategy to secure funds.

- Build partnerships for collaboration and extra support.

- Implement effective marketing and outreach plans to raise awareness.

- Manage finances wisely for transparency and sustainability.

- Recruit passionate individuals who share your mission.

- Track and evaluate impact using measurable indicators.

- Stay informed about legal and regulatory changes affecting non-profits.

- Continuously learn and improve to meet evolving needs.

- Nurture relationships with stakeholders for engagement and support.

Need a comprehensive guide on developing a non-profit business plan, check out our sample non-profit business plans .

When it comes to creating a business plan for a non-profit organization, following a traditional business plan format can provide a solid framework. Here are 11 examples of non-profit business plans that adhere to the traditional structure:

For instance, a non-profit focused on providing education to underprivileged children may have an executive summary that highlights the organization’s mission, the target population, and the key strategies for achieving educational goals.

Executive Summary: Samaritan’s Purse is a non-profit organization dedicated to helping communities worldwide that are affected by natural disasters and humanitarian crises. Our mission is to show God’s love in action by providing physical aid, spiritual support, and hope to those in need. We work quickly to respond to emergencies and provide immediate help like food, shelter, and medical assistance. Our caring team, made up of professionals and volunteers, is committed to helping communities recover and rebuild after a disaster. We believe in working together with local partners and using efficient strategies to make a lasting difference in the lives of those affected. Through our core values of compassion, integrity, and faith, Samaritan’s Purse strives to be a source of hope and support during difficult times.

An example of an organizational description could be a non-profit that supports environmental conservation, providing details about its establishment, the board of directors, and the legal status as a registered non-profit organization.

Organizational Description: Samaritan’s Purse, established in 1970 by Franklin Graham, has evolved into a worldwide organization, supported by a dedicated team of staff and volunteers. As a registered non-profit, we prioritize transparency, accountability, and meaningful outcomes in everything we do. Our reach extends across the globe, enabling us to respond swiftly to emergencies and provide assistance to communities in need. With a strong commitment to making a positive impact, we uphold the highest standards of integrity and efficiency in our operations. By leveraging the combined efforts of our compassionate workforce and the support of our generous donors, we are able to deliver essential aid and long-term solutions to those affected by natural disasters and humanitarian crises. At Samaritan’s Purse, we remain resolute in our mission to provide practical support and spiritual comfort to individuals and communities facing hardship, fostering hope and promoting resilience in the face of adversity.

A non-profit dedicated to empowering women in entrepreneurship may have a mission statement that states, “Our mission is to provide resources, training, and support to women entrepreneurs, enabling them to thrive and succeed in their business ventures.

Ready to get started on your custom business plan? Take just two easy steps to receive personalized pricing tailored to your specific needs. Click here to begin your journey toward a professionally crafted business plan that sets you up for success!

Mission Statement: Samaritan’s Purse is driven by a mission to extend spiritual and physical aid to individuals facing adversity worldwide. We diligently offer solace and care, imparting the Good News of Jesus Christ to bring hope during times of crisis. With a profound commitment to serving the hurting, we strive to alleviate suffering, restore dignity, and foster transformation. Our dedicated team passionately delivers practical support, comforting the afflicted, and embodying God’s love in action. Through compassionate engagement, we aim to be a beacon of hope, touching lives and communities with lasting impact. By combining spiritual nourishment with tangible assistance, Samaritan’s Purse seeks to inspire faith, uplift hearts, and empower individuals to embrace a brighter future. Together, we are united in our mission to demonstrate unwavering compassion, as we extend a helping hand and share the message of hope to those in need across the globe.

Looking for a company that writes business plans ?

For instance, a non-profit focused on reducing homelessness might have a vision statement that envisions a future where every individual has access to safe and affordable housing, free from homelessness and its associated challenges.

Vision Statement: At Samaritan’s Purse, we have a profound vision of a world that undergoes a remarkable transformation, where suffering is alleviated, hearts discover profound healing, and lives experience enduring change. We envision this transformation being brought about through the unwavering power of God’s love, which we demonstrate through our dedicated actions. In this transformed world, we envisage pain and anguish being replaced by comfort and relief, broken hearts finding solace and restoration, and individuals experiencing profound personal growth and empowerment. Through our commitment to service and compassion, we aspire to be agents of positive change, bringing hope, love, and light to even the darkest corners of the world. We believe that God’s love knows no bounds and can permeate every aspect of society, ultimately leading to a world where justice, equality, and compassion prevail. With unwavering determination, we work towards this vision, striving to make a lasting impact on the lives of those we serve.

An example of market analysis could involve a non-profit conducting research on the local community’s needs, analyzing existing social service organizations, and identifying gaps in services that they can fill.

Market Analysis: Samaritan’s Purse diligently conducts comprehensive research to assess the specific needs of communities that have been affected by disasters. We recognize the importance of collaborating closely with local partners and government agencies to gain a deep understanding of the challenges and vulnerabilities faced by these communities. Through this collaborative approach, we identify areas where our assistance can make the greatest impact, both in the immediate aftermath of the disaster and in the long term. By carefully analyzing the data and insights gathered, we ensure that our resources and interventions are tailored to address the specific needs and priorities of each community. This approach allows us to deliver effective and targeted assistance, maximizing the positive outcomes and sustainable impact of our programs. Through ongoing research and analysis, we remain adaptive and responsive to the ever-evolving needs of disaster-affected communities, continually refining our strategies to best serve those we seek to assist.

A non-profit dedicated to animal welfare may outline programs and services such as animal adoption, spay/neuter initiatives, veterinary care, and community education on responsible pet ownership.

Programs and Services: Samaritan’s Purse is dedicated to providing a comprehensive range of programs and services to meet the diverse needs of communities. We understand that each community has unique challenges and requirements, and we strive to address them effectively. Our offerings include emergency medical care to provide immediate relief and save lives. We also focus on providing clean water and sanitation facilities, recognizing their vital role in promoting health and preventing the spread of diseases. Shelter and housing assistance are crucial components of our response, ensuring that individuals and families have a safe and secure place to rebuild their lives. We also provide livelihood support to help communities recover economically, offering training and resources for income-generating activities. Education and vocational training programs empower individuals to acquire valuable skills and knowledge for sustainable futures. Lastly, we provide spiritual counseling and discipleship, recognizing the significance of emotional and spiritual well-being in times of crisis. Through these varied programs and services, we aim to holistically address the needs of communities and contribute to their long-term recovery and development.

Marketing and Outreach Strategy: Samaritan’s Purse implements a comprehensive marketing and outreach strategy to raise awareness and foster engagement among supporters. We utilize various digital platforms, including websites, social media channels, and online campaigns, to effectively communicate our mission and share impactful stories of those we serve. Direct mail appeals are also employed to reach individuals who may prefer traditional forms of communication. Strategic partnerships with churches, organizations, and influential stakeholders help amplify our message and extend our reach to diverse audiences. Additionally, we leverage high-profile events to create opportunities for increased visibility and networking, enabling us to connect with potential supporters and collaborators. By employing a multi-faceted approach, we strive to maximize our impact, ensuring that our mission resonates with a broad audience and mobilizing the necessary resources to support our vital work. Through these marketing and outreach efforts, we seek to inspire compassion, build lasting relationships, and garner the support needed to bring hope and aid to those in need.

A non-profit operating a community food bank may include details about the facility, the staff responsible for daily operations, and the systems in place to receive, store, and distribute food to those in need.

Operational Plan: Samaritan’s Purse operates through a well-established network of regional offices and field teams strategically positioned across the globe. Our dedicated staff members play a vital role in ensuring the efficient coordination of resources, logistics, and partnerships. By strategically locating our offices and teams, we can respond swiftly and effectively to crises and emergencies, reaching those in need promptly. Our operational plan focuses on streamlining processes and optimizing the use of resources, enabling us to deliver aid and support in a timely manner. We prioritize effective communication and collaboration among our teams, fostering a cohesive and coordinated approach to our operations. Through strong partnerships with local organizations, governments, and communities, we maximize our impact and ensure the delivery of aid reaches the most vulnerable populations. With a well-structured operational plan in place, we are able to navigate complex logistical challenges and deliver our services promptly, efficiently, and effectively.

An example of a financial plan could involve a non-profit outlining its projected revenue sources, such as grants, donations, and fundraising events, as well as the anticipated expenses for program implementation, staffing, and administrative costs.

53 Best Non-Profit Business Ideas

Financial Plan: The financial plan of Samaritan’s Purse focuses on ensuring the efficient and effective allocation of resources to support our mission of providing aid and assistance to those in need. Here are some key aspects of our financial plan:

Diverse Funding Sources: We rely on a range of funding sources to sustain our operations. In the previous fiscal year, our total funding amounted to $10 million. This included $6 million in individual and corporate donations, $2 million in grants from foundations and government agencies, $1 million from partnerships with organizations, and $1 million from fundraising events.

Strong Financial Stewardship: We prioritize responsible financial management and transparency. Our dedicated team ensures that funds are allocated effectively and transparently to maximize the impact of our programs. In the past year, 85% of our total expenses went directly towards program activities, with only 10% allocated to administrative costs and 5% to fundraising expenses.

Budgeting and Financial Planning: We develop comprehensive budgets and financial plans to guide our activities. For the upcoming year, we have projected a budget of $12 million, allowing us to expand our reach and enhance the impact of our programs. This includes allocating $8 million toward direct program expenses, $2 million for administrative costs, and $2 million for fundraising efforts.

Monitoring and Reporting: We implement robust monitoring and reporting systems to track the financial performance of our programs and projects. Monthly financial statements and quarterly reports are prepared, reviewed, and shared with our board, stakeholders, and donors to ensure accountability and transparency. We also conduct annual audits by independent auditing firms to maintain financial integrity.

Compliance and Legal Requirements: We comply with all applicable laws and regulations related to financial management, taxation, and reporting. We work closely with legal and financial professionals to stay up-to-date with the latest requirements and maintain compliance. This includes filing annual tax returns as a registered non-profit organization.

Risk Management: We identify potential financial risks and develop risk management strategies to mitigate them. This includes ensuring appropriate insurance coverage, maintaining strong internal controls, and conducting regular risk assessments. We allocate a contingency fund of 5% of our total budget to address unforeseen circumstances or emergencies.

Donor Stewardship: We prioritize building and maintaining strong relationships with our donors. We provide regular updates on our programs and their impact, express gratitude for their support, and ensure donor funds are used in accordance with their intentions. Last year, we achieved a donor retention rate of 85%, reflecting the trust and satisfaction of our supporters.

Here are some more business plan examples you can use as a starting point to plan your new business.

A non-profit focused on youth development may establish key performance indicators (KPIs) to measure the effectiveness of their programs, such as tracking the percentage of participants who graduate high school and pursue higher education.

Evaluation and Measurement:

Evaluation and measurement are crucial components of Samaritan’s Purse’s approach to ensuring the effectiveness and impact of our programs. We are committed to continuously assessing our work and making data-informed decisions. Here’s an overview of our evaluation and measurement practices:

Key Performance Indicators (KPIs): We establish specific KPIs for each program to track progress and measure outcomes. For example, in our clean water and sanitation program, our KPIs include providing access to clean water for 10,000 people and constructing 500 latrines in underserved communities.

Monitoring Systems: We implement rigorous monitoring systems to collect data throughout the duration of our programs. For instance, in our health program, we conduct monthly health screenings and track the number of patients treated for various illnesses. Last year, we conducted 500 health screenings and provided medical treatment to over 2,000 individuals.

Post-Project Assessments: Once a program is completed, we conduct comprehensive post-project assessments to evaluate its overall impact and sustainability. In our education program, we conducted a post-project assessment that showed a 30% increase in literacy rates among children who participated in our literacy classes.

Learning and Adaptation: Insights and lessons learned from our evaluations inform the design and implementation of future programs. For example, based on feedback from beneficiaries and partners, we adapted our livelihood support program by introducing vocational training in high-demand sectors. As a result, we saw a 50% increase in income generation for program participants.

Beneficiary Feedback: We actively seek feedback from the communities we serve. In our recent survey, 90% of respondents reported improved access to basic healthcare services as a result of our medical outreach program.

Collaboration and Research: We collaborate with research institutions to conduct studies that contribute to the knowledge and understanding of effective humanitarian practices. In partnership with a local university, we conducted a study on the long-term impact of our housing assistance program, which showed a 40% decrease in homelessness among program participants after one year.

Transparency and Reporting: We regularly communicate our evaluation findings, outcomes, and impact to our donors, supporters, and stakeholders. Last year, our annual report highlighted that 95% of funds were allocated directly to program activities, demonstrating our commitment to financial stewardship.

An example of risk management could involve a non-profit identifying potential risks, such as changes in government regulations or funding cuts, and developing contingency plans to mitigate those risks, ensuring the organization’s sustainability.

Hire our professional business plan preparers now!

Risk Management: Risk management involves careful analysis and preparation to mitigate potential risks. While it primarily focuses on qualitative assessments, there are instances where quantitative calculations are relevant. Here are some examples:

Risk Probability Assessment: We assign probabilities to various risks based on historical data or expert opinions. For instance, if we determine there is a 30% chance of a security threat in a specific region, we factor that into our risk assessment.

Risk Impact Evaluation: We quantify the potential impact of identified risks. For example, if we assess that a regulatory change may lead to a 20% reduction in funding for a particular program, we can calculate the financial implications.

Cost-Benefit Analysis: In evaluating risk mitigation measures, we conduct cost-benefit analyses. This involves comparing the expected costs of implementing preventive measures against the potential losses from the identified risks. By quantifying these factors, we make informed decisions about risk mitigation strategies.

Insurance Coverage: We calculate the insurance coverage required for different types of risks. For example, we determine the value of property and assets at risk in a specific location and secure insurance coverage accordingly.

Financial Reserves: We allocate financial reserves to mitigate potential risks. By estimating the potential financial impact of various risks, we calculate the appropriate level of reserves needed to address unforeseen events.

A non-profit organization, also known as a nonprofit or not-for-profit organization, is an entity that operates for a specific purpose or mission other than making a profit. Its primary goal is to serve the public or a particular cause.

The main difference is the purpose and distribution of funds. Non-profits reinvest their surplus back into the organization to further their mission, while for-profit organizations distribute profits to their owners or shareholders.

The purpose of a non-profit organization is to address a specific societal or community need. It can be focused on various areas such as education, healthcare, environment, social services, or arts and culture.

Non-profits rely on various sources of funding, including donations from individuals, grants from foundations or government agencies, corporate sponsorships, fundraising events, and revenue from services or programs they provide.

In many countries, donations to registered non-profit organizations are tax-deductible for the donors. However, tax laws may vary, so it’s important to consult local regulations or seek professional advice.

Non-profit organizations are typically governed by a board of directors or trustees. The board provides oversight, sets strategic direction, and ensures the organization’s compliance with legal and ethical standards.

Starting a non-profit involves several steps, including defining your mission, drafting bylaws, incorporating the organization, applying for tax-exempt status, and establishing governance and financial management structures. Consulting with legal and accounting professionals is recommended.

Board members of non-profit organizations have various responsibilities, including strategic planning, financial oversight, fundraising, hiring and evaluating the executive director, ensuring legal compliance, and representing the organization in the community.

Non-profit organizations use various metrics and evaluation methods to measure their impact. This can include tracking the number of beneficiaries served, outcomes achieved, changes in the community, and feedback from stakeholders. Evaluations help assess the effectiveness and adjust strategies as needed.

Related Posts

Why Experienced Legal Consultation is Crucial for New Businesses

Creating a ‘Second Brain’ to Manage Information Overload and Enhance Focus

What Are Mobile App Development Services? Guide for Businesses and Startups

Quick links.

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- Business Credit Cards

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- A Comprehensive Guide to Venture Capitalists

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

How to Write a Business Plan For a Nonprofit Organization + Template

Creating a business plan is essential for any business, but it can be especially helpful for nonprofits. A nonprofit business plan allows you to set goals and track progress over time. It can also help you secure funding from investors or grant-making organizations.

A well-crafted business plan not only outlines your vision for the organization but also provides a step-by-step process of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article will provide an overview of the key elements that every nonprofit founder should include in their business plan.

Download the Ultimate Nonprofit Business Plan Template

What is a Nonprofit Business Plan?

A nonprofit business plan is a formal written document that describes your organization’s purpose, structure, and operations. It is used to communicate your vision to potential investors or donors and convince them to support your cause.

The business plan should include information about your target market, financial projections, and marketing strategy. It should also outline the organization’s mission statement and goals.

Why Write a Nonprofit Business Plan?

A nonprofit business plan is required if you want to secure funding from grant-making organizations or investors.

A well-crafted business plan will help you:

- Define your organization’s purpose and goals

- Articulate your vision for the future

- Develop a step-by-step plan to achieve your goals

- Secure funding from investors or donors

- Convince potential supporters to invest in your cause

Entrepreneurs can also use this as a roadmap when starting your new nonprofit organization, especially if you are inexperienced in starting a nonprofit.

Writing an Effective Nonprofit Business Plan

The key is to tailor your business plan to the specific needs of your nonprofit. Here’s a quick overview of what to include:

Executive Summary

Organization overview, products, programs, and services, industry analysis, customer analysis, marketing plan, operations plan, management team.

- Financial Plan

The executive summary of a nonprofit business plan is a one-to-two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your nonprofit organization

- Provide a short summary of the key points of each section of your business plan.

- Organize your thoughts in a logical sequence that is easy for the reader to follow.

- Include information about your organization’s management team, industry analysis, competitive analysis, and financial forecast.

This section should include a brief history of your nonprofit organization. Include a short description of how and why you started it and provide a timeline of milestones the organization has achieved.

If you are just starting your nonprofit, you may not have a long history. Instead, you can include information about your professional experience in the industry and how and why you conceived your new nonprofit idea. If you have worked for a similar organization before or have been involved in a nonprofit before starting your own, mention this.

You will also include information about your chosen n onprofit business model and how it is different from other nonprofits in your target market.

This section is all about what your nonprofit organization offers. Include information about your programs, services, and any products you may sell.

Describe the products or services you offer and how they benefit your target market. Examples might include:

- A food bank that provides healthy meals to low-income families

- A job training program that helps unemployed adults find jobs

- An after-school program that helps kids stay out of gangs

- An adult literacy program that helps adults learn to read and write

Include information about your pricing strategy and any discounts or promotions you offer. Examples might include membership benefits, free shipping, or volume discounts.

If you offer more than one product or service, describe each one in detail. Include information about who uses each product or service and how it helps them achieve their goals.

If you offer any programs, describe them in detail. Include information about how often they are offered and the eligibility requirements for participants. For example, if you offer a job training program, you might include information about how often the program is offered, how long it lasts, and what kinds of jobs participants can expect to find after completing the program.

The industry or market analysis is an important component of a nonprofit business plan. Conduct thorough market research to determine industry trends, identify your potential customers, and the potential size of this market.

Questions to answer include:

- What part of the nonprofit industry are you targeting?

- Who are your competitors?

- How big is the market?

- What trends are happening in the industry right now?

You should also include information about your research methodology and sources of information, including company reports and expert opinions.

As an example, if you are starting a food bank, your industry analysis might include information about the number of people in your community who are considered “food insecure” (they don’t have regular access to enough nutritious food). You would also include information about other food banks in your area, how they are funded, and the services they offer.

For each of your competitors, you should include a brief description of their organization, their target market, and their competitive advantage. To do this, you should complete a SWOT analysis.

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a helpful tool to assess your nonprofit’s current position and identify areas where you can improve.

Some questions to consider when conducting a SWOT analysis include:

- Strengths : What does your nonprofit do well?

- Weaknesses : What areas could your nonprofit improve?

- Opportunities : What trends or changes in the industry could you take advantage of?

- Threats : What trends or changes in the industry could hurt your nonprofit’s chances of success?

After you have identified your nonprofit’s strengths, weaknesses, opportunities, and threats, you can develop strategies to improve your organization.

For example, if you are starting a food bank, your SWOT analysis might reveal that there is a need for more food banks in your community. You could use this information to develop a marketing strategy to reach potential donors who might be interested in supporting your organization.

If you are starting a job training program, your SWOT analysis might reveal that there is a need for more programs like yours in the community. You could use this information to develop a business plan and marketing strategy to reach potential participants who might be interested in enrolling in your program.

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, if you are starting a job training program for unemployed adults, your target audience might be low-income adults between the ages of 18 and 35. Your customer analysis would include information about their needs (e.g., transportation, childcare, job readiness skills) and wants (e.g., good pay, flexible hours, benefits).

If you have more than one target audience, you will need to provide a separate customer analysis for each one.

You can include information about how your customers make the decision to buy your product or use your service. For example, if you are starting an after-school program, you might include information about how parents research and compare programs before making a decision.

You should also include information about your marketing strategy and how you plan to reach your target market. For example, if you are starting a food bank, you might include information about how you will promote the food bank to the community and how you will get the word out about your services.

Develop a strategy for targeting those customers who are most likely to use your program, as well as those that might be influenced to buy your products or nonprofit services with the right marketing.

This part of the business plan is where you determine how you are going to reach your target market. This section of your nonprofit business plan should include information about your marketing goals, strategies, and tactics.

- What are your marketing goals? Include information about what you hope to achieve with your marketing efforts, as well as when and how you will achieve it.

- What marketing strategies will you use? Include information about public relations, advertising, social media, and other marketing tactics you will use to reach your target market.

- What tactics will you use? Include information about specific actions you will take to execute your marketing strategy. For example, if you are using social media to reach your target market, include information about which platforms you will use and how often you will post.

Your marketing strategy should be clearly laid out, including the following 4 Ps.

- Product/Service : Make sure your product, service, and/or program offering is clearly defined and differentiated from your competitors, including the benefits of using your service.

- Price : How do you determine the price for your product, services, and/or programs? You should also include a pricing strategy that takes into account what your target market will be willing to pay and how much the competition within your market charges.

- Place : Where will your target market find you? What channels of distribution will you use to reach them?

- Promotion : How will you reach your target market? You can use social media or write a blog, create an email marketing campaign, post flyers, pay for advertising, launch a direct mail campaign, etc.

For example, if you are starting a job training program for unemployed adults, your marketing strategy might include partnering with local job centers and adult education programs to reach potential participants. You might also promote the program through local media outlets and community organizations.

Your marketing plan should also include a sales strategy, which includes information about how you will generate leads and convert them into customers.

You should also include information about your paid advertising budget, including an estimate of expenses and sales projections.

This part of your nonprofit business plan should include the following information:

- How will you deliver your products, services and/or programs to your target market? For example, if you are starting a food bank, you will need to develop a system for collecting and storing food donations, as well as distributing them to the community.

- How will your nonprofit be structured? For example, will you have paid staff or volunteers? How many employees will you need? What skills and experience will they need to have?

- What kind of facilities and equipment will you need to operate your nonprofit? For example, if you are starting a job training program, you will need space to hold classes, as well as computers and other office equipment.

- What are the day-to-day operations of your nonprofit? For example, if you are starting a food bank, you will need to develop a system for accepting and sorting food donations, as well as distributing them to the community.

- Who will be responsible for each task? For example, if you are starting a job training program, you will need to identify who will be responsible for recruiting participants, teaching classes, and placing graduates in jobs.

- What are your policies and procedures? You will want to establish policies related to everything from employee conduct to how you will handle donations.

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is the section of the business plan where you elaborate on the day-to-day execution of your nonprofit. This is where you really get into the nitty-gritty of how your organization will function on a day-to-day basis.

This section of your nonprofit business plan should include information about the individuals who will be running your organization.

- Who is on your team? Include biographies of your executive director, board of directors, and key staff members.

- What are their qualifications? Include information about their education, work experience, and skills.

- What are their roles and responsibilities? Include information about what each team member will be responsible for, as well as their decision-making authority.

- What is their experience in the nonprofit sector? Include information about their work with other nonprofits, as well as their volunteer experiences.

This section of your plan is important because it shows that you have a team of qualified individuals who are committed to the success of your nonprofit.

Nonprofit Financial Plan

This section of your nonprofit business plan should include the following information:

- Your budget. Include information about your income and expenses, as well as your fundraising goals.

- Your sources of funding. Include information about your grants, donations, and other sources of income.

- Use of funds. Include information about how you will use your income to support your programs and operations.

This section of your business plan is important because it shows that you have a clear understanding of your organization’s finances. It also shows that you have a plan for raising and managing your funds.

Now, include a complete and detailed financial plan. This is where you will need to break down your expenses and revenue projections for the first 5 years of operation. This includes the following financial statements:

Income Statement

Your income statement should include:

- Revenue : how will you generate revenue?

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, what is the net income or loss?

Sample Income Statement for a Startup Nonprofit Organization

Balance sheet.

Include a balance sheet that shows what you have in terms of assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Nonprofit Organization

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Income : All of the revenue coming in from clients.

- Expenses : All of your monthly bills and expenses. Include operating, marketing and capital expenditures.

- Net Cash Flow : The difference between income and expenses for each month after they are totaled and deducted from each other. This number is the net cash flow for each month.

Using your total income and expenses, you can project an annual cash flow statement. Below is a sample of a projected cash flow statement for a startup nonprofit.

Sample Cash Flow Statement for a Startup Nonprofit Organization

Fundraising plan.

This section of your nonprofit business plan should include information about your fundraising goals, strategies, and tactics.

- What are your fundraising goals? Include information about how much money you hope to raise, as well as when and how you will raise it.

- What fundraising strategies will you use? Include information about special events, direct mail campaigns, online giving, and grant writing.

- What fundraising tactics will you use? Include information about volunteer recruitment, donor cultivation, and stewardship.

Now include specific fundraising goals, strategies, and tactics. These could be annual or multi-year goals. Below are some examples:

Goal : To raise $50,000 in the next 12 months.

Strategy : Direct mail campaign

- Create a mailing list of potential donors

- Develop a direct mail piece

- Mail the direct mail piece to potential donors

Goal : To raise $100,000 in the next 24 months.

Strategy : Special event

- Identify potential special event sponsors

- Recruit volunteers to help with the event

- Plan and execute the special event

Goal : To raise $250,000 in the next 36 months.

Strategy : Grant writing

- Research potential grant opportunities

- Write and submit grant proposals

- Follow up on submitted grants

This section of your business plan is important because it shows that you have a clear understanding of your fundraising goals and how you will achieve them.

You will also want to include an appendix section which may include:

- Your complete financial projections

- A complete list of your nonprofit’s policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- A list of your hard assets and equipment with purchase dates, prices paid and any other relevant information

- A list of your soft assets with purchase dates, prices paid and any other relevant information

- Biographies and/or resumes of the key members of your organization

- Your nonprofit’s bylaws

- Your nonprofit’s articles of incorporation

- Your nonprofit’s most recent IRS Form 990

- Any other relevant information that may be helpful in understanding your organization

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your nonprofit organization. It not only outlines your vision but also provides a step-by-step process of how you are going to accomplish it. Sometimes it may be difficult to get started, but once you get the hang of it, writing a business plan becomes easier and will give you a sense of direction and clarity about your nonprofit organization.

Finish Your Nonprofit Business Plan in 1 Day!

Other helpful articles.

How to Write a Grant Proposal for Your Nonprofit Organization + Template & Examples

How To Create the Articles of Incorporation for Your Nonprofit Organization + Template

How to Develop a Nonprofit Communications Plan + Template

How to Write a Stand-Out Purpose Statement + Examples

Nonprofit Business Plans

Written by Dave Lavinsky

Explore our collection of nonprofit industry business plan examples, crafted to guide leaders and founders through the unique challenges of the nonprofit sector. These comprehensive plans provide a blueprint for establishing clear objectives, developing fundraising strategies, implementing effective programs, and managing financial stewardship with transparency.

Nonprofit Business Plan Templates

Nonprofit Business Plan Template

Social Enterprise Business Plan Template

Free Nonprofit Business Plan Templates

By Joe Weller | September 18, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up the most useful list of nonprofit business plan templates, all free to download in Word, PDF, and Excel formats.

Included on this page, you’ll find a one-page nonprofit business plan template , a fill-in-the-blank nonprofit business plan template , a startup nonprofit business planning timeline template , and more. Plus, we provide helpful tips for creating your nonprofit business plan .

Nonprofit Business Plan Template

Use this customizable nonprofit business plan template to organize your nonprofit organization’s mission and goals and convey them to stakeholders. This template includes space for information about your nonprofit’s background, objectives, management team, program offerings, market analysis, promotional activities, funding sources, fundraising methods, and much more.

Download Nonprofit Business Plan Template

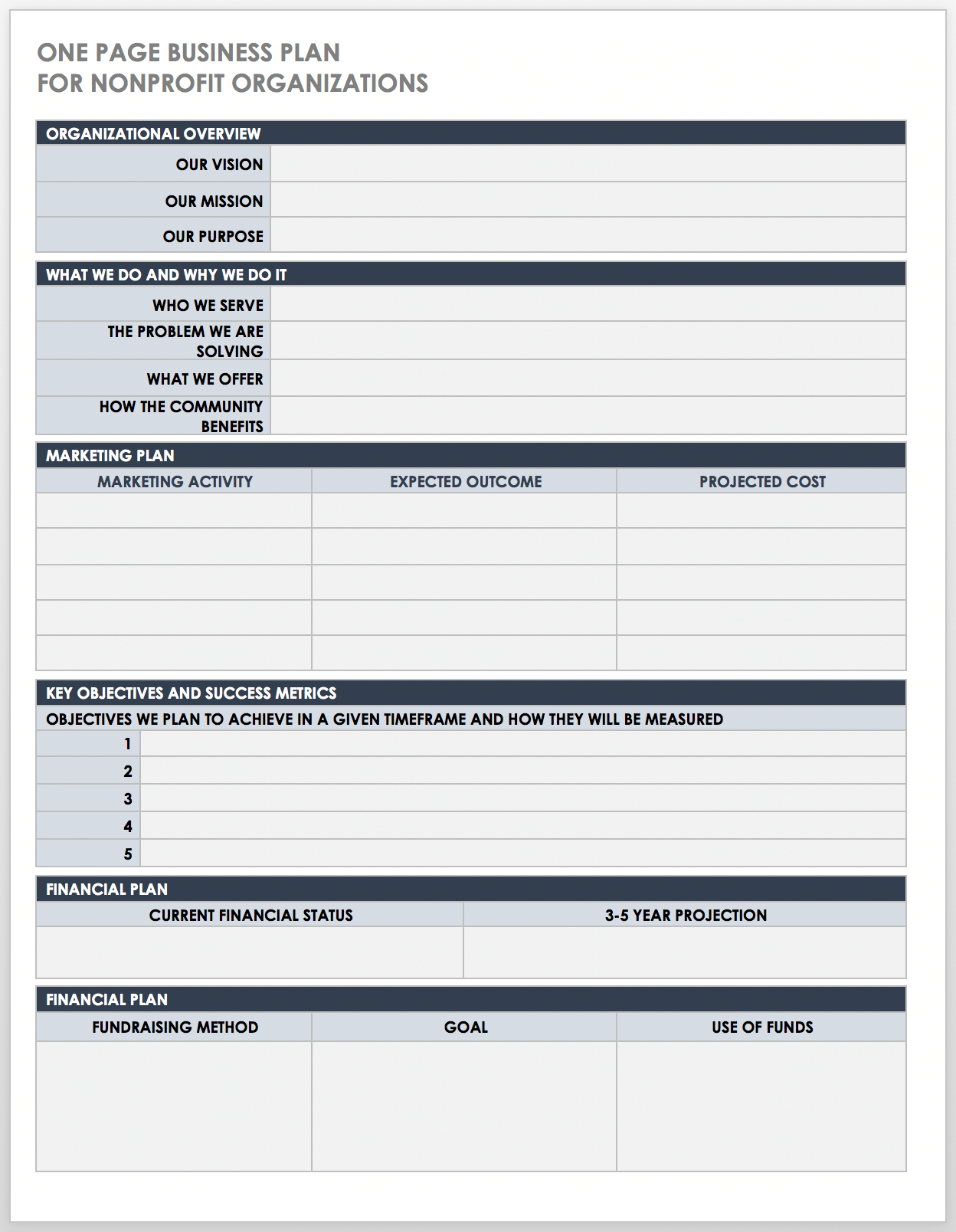

One-Page Business Plan for Nonprofit Template

This one-page nonprofit business plan template has a simple and scannable design to outline the key details of your organization’s strategy. This template includes space to detail your mission, vision, and purpose statements, as well as the problems you aim to solve in your community, the people who benefit from your program offerings, your key marketing activities, your financial goals, and more.

Download One-Page Business Plan for Nonprofit Template

Excel | Word | PDF

For additional resources, including an example of a one-page business plan , visit “ One-Page Business Plan Templates with a Quick How-To Guide .”

Fill-In-the-Blank Nonprofit Business Plan Template

Use this fill-in-the-blank template as the basis for building a thorough business plan for a nonprofit organization. This template includes space to describe your organization’s background, purpose, and main objectives, as well as key personnel, program and service offerings, market analysis, promotional activities, fundraising methods, and more.

Download Fill-In-the-Blank Nonprofit Business Plan Template

For additional resources that cater to a wide variety of organizations, visit “ Free Fill-In-the-Blank Business Plan Templates .”

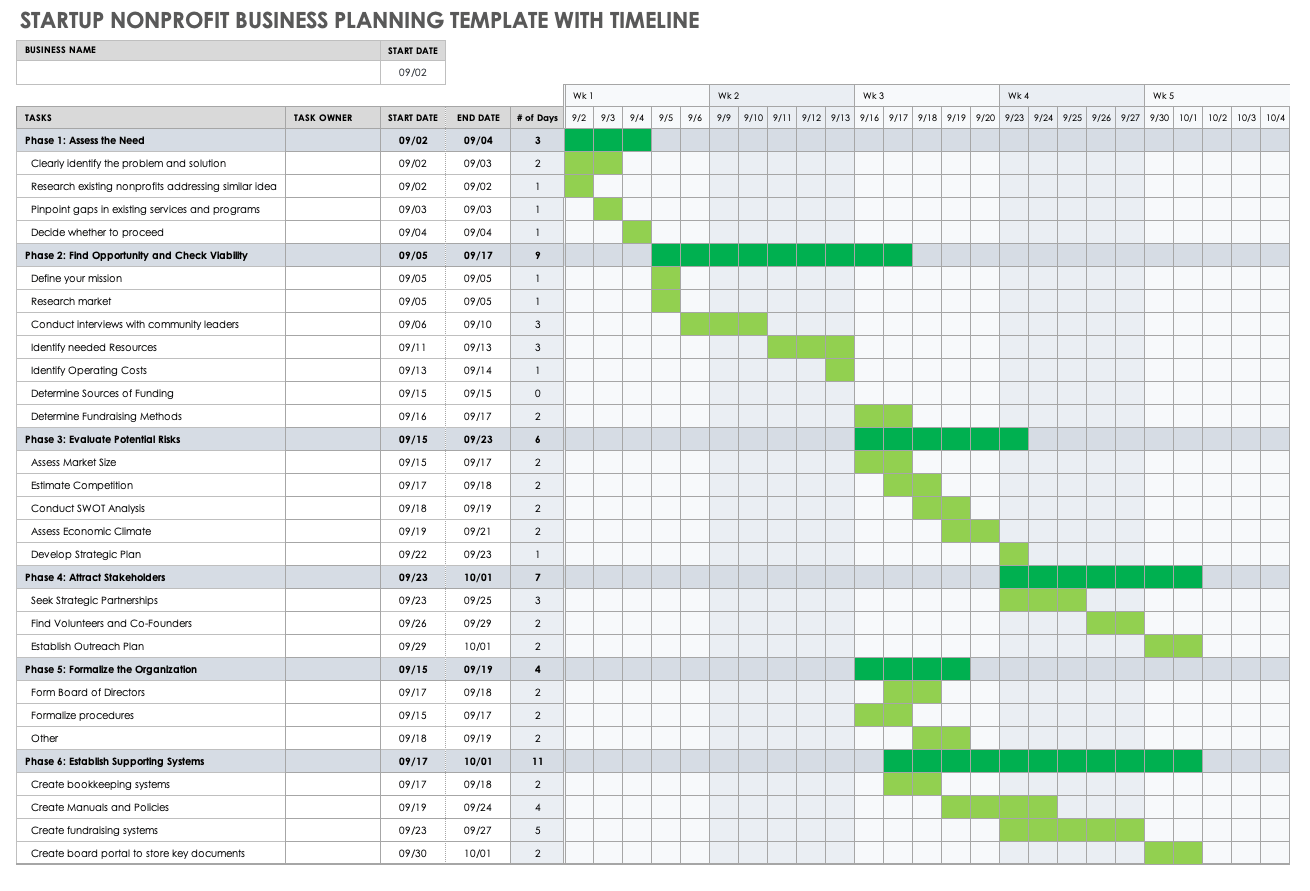

Startup Nonprofit Business Planning Template with Timeline

Use this business planning template to organize and schedule key activities for your business. Fill in the cells according to the due dates, and color-code the cells by phase, owner, or category to provide a visual timeline of progress.

Download Startup Nonprofit Business Planning Template with Timeline

Excel | Smartsheet

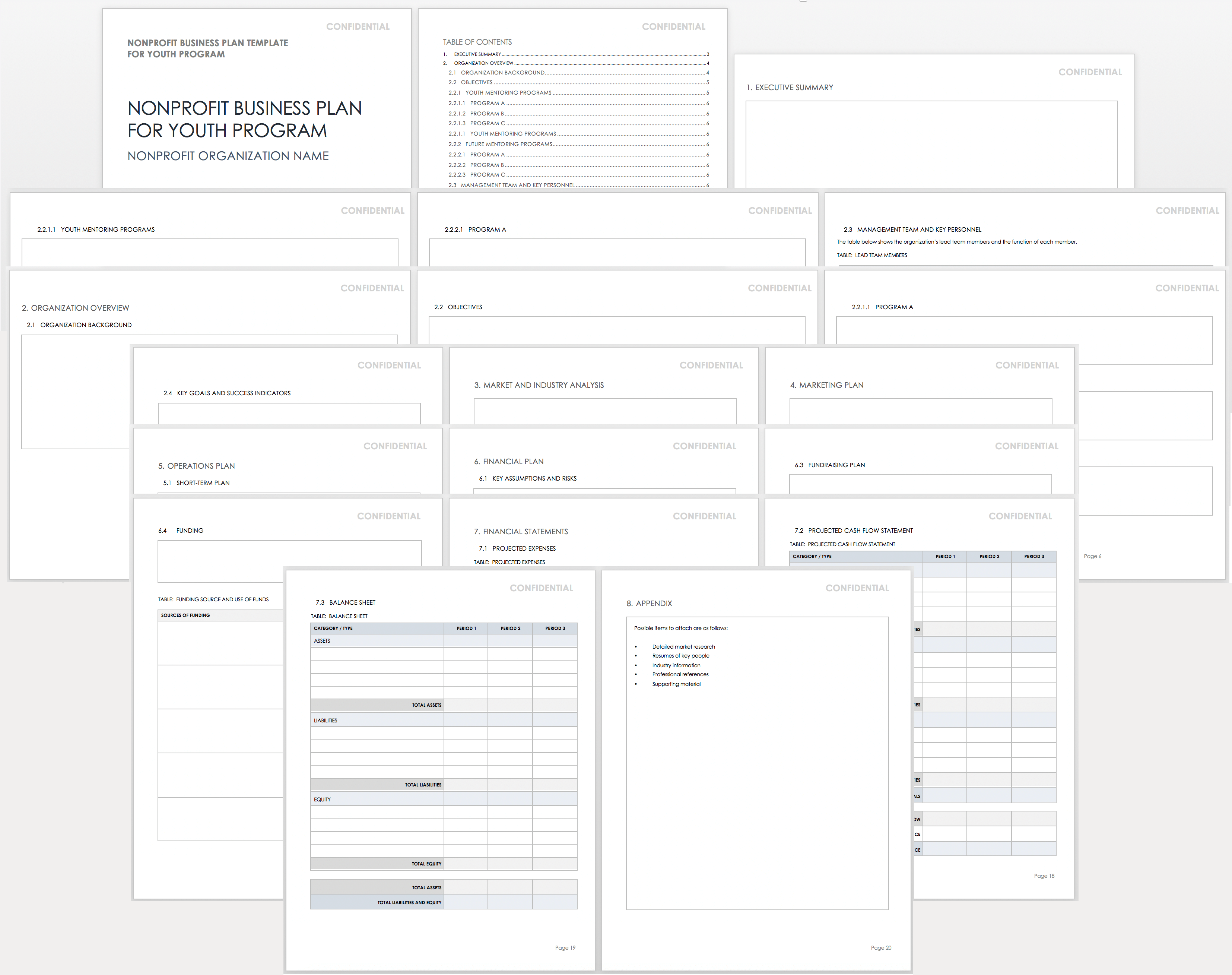

Nonprofit Business Plan Template for Youth Program

Use this template as a foundation for building a powerful and attractive nonprofit business plan for youth programs and services. This template has all the core components of a nonprofit business plan. It includes room to detail the organization’s background, management team key personnel, current and future youth program offerings, promotional activities, operations plan, financial statements, and much more.

Download Nonprofit Business Plan Template for Youth Program

Word | PDF | Google Doc

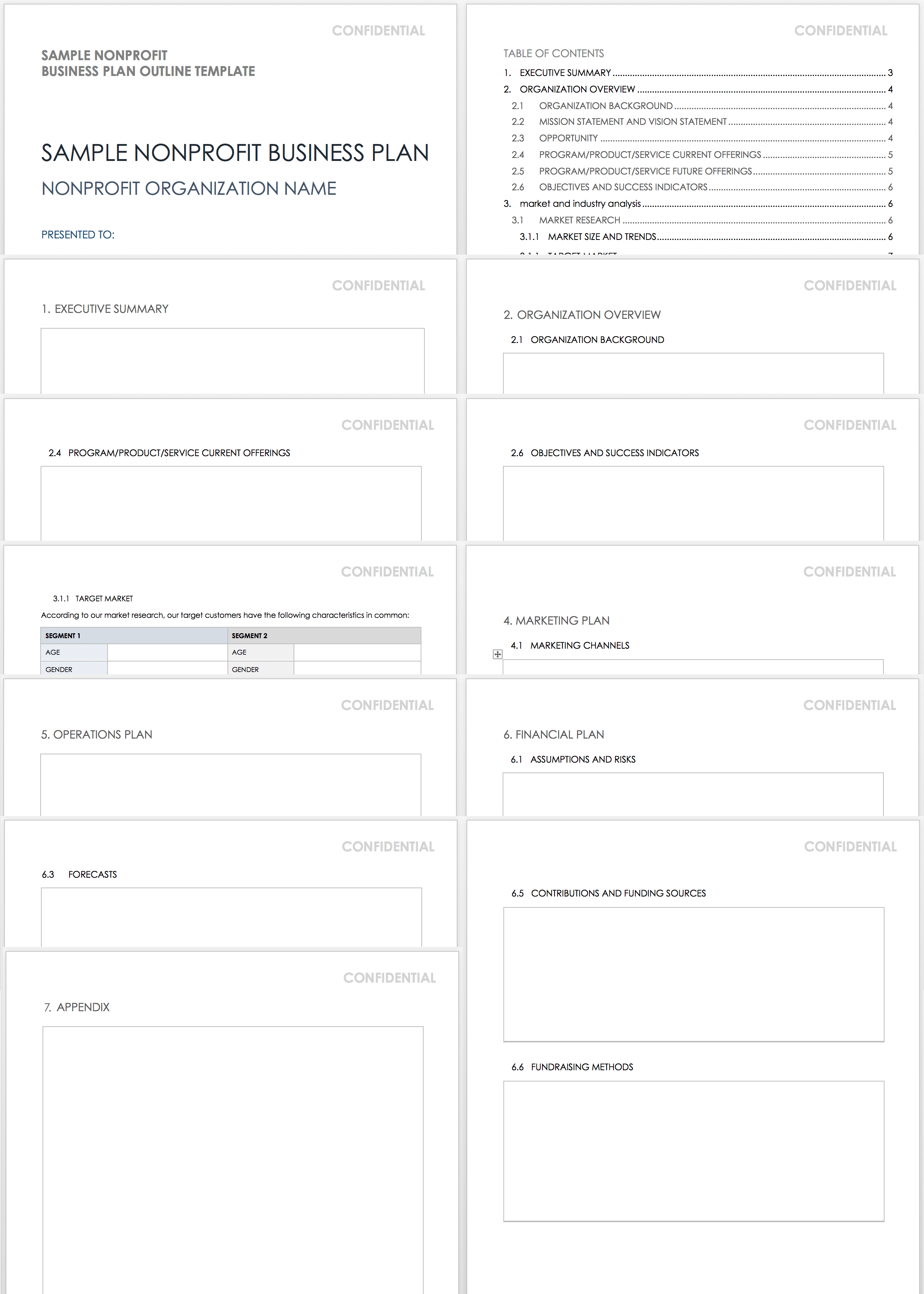

Sample Nonprofit Business Plan Outline Template

You can customize this sample nonprofit business plan outline to fit the specific needs of your organization. To ensure that you don’t miss any essential details, use this outline to help you prepare and organize the elements of your plan before filling in each section.

Download Sample Nonprofit Business Plan Outline Template

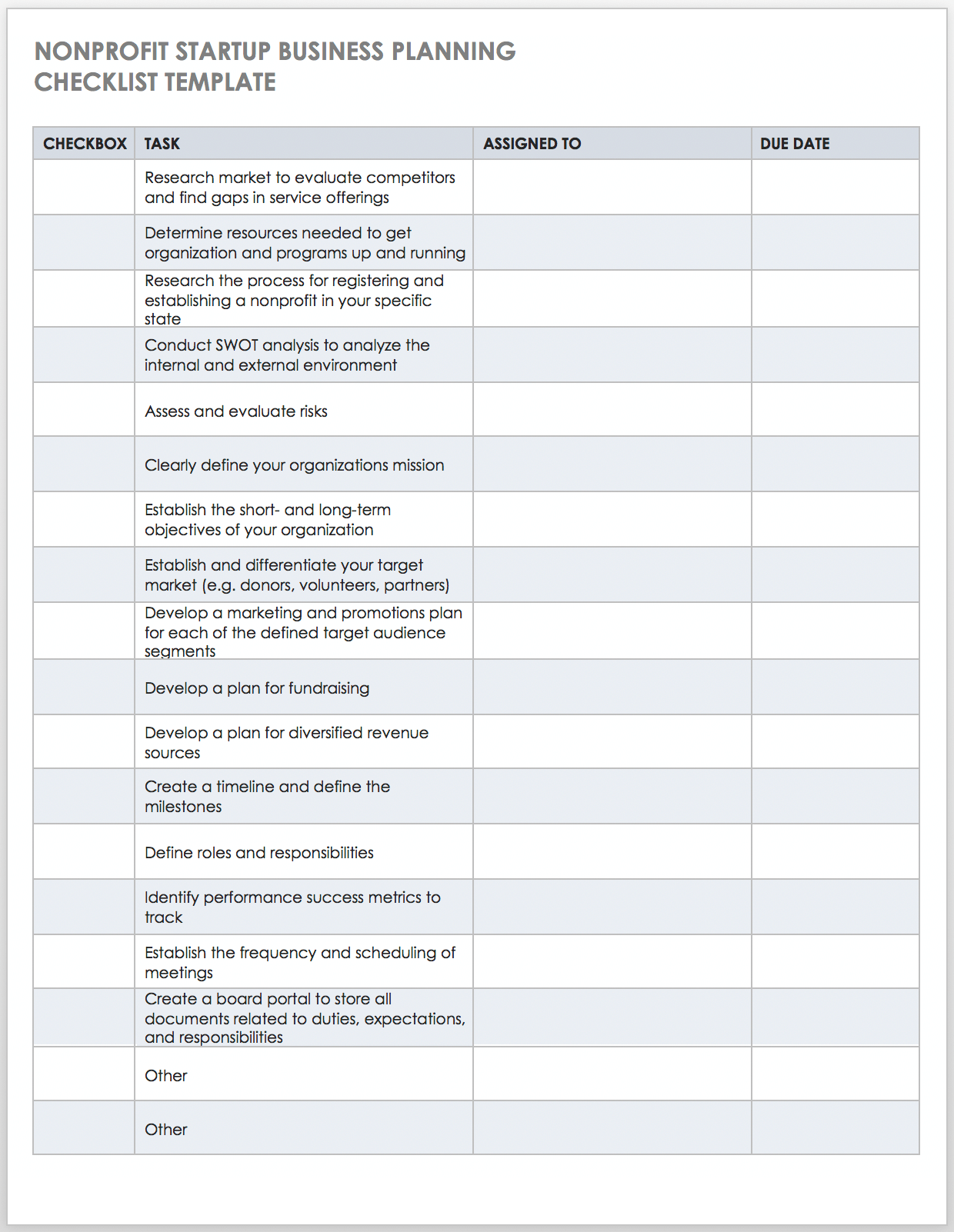

Nonprofit Startup Business Planning Checklist Template

Use this customizable business planning checklist as the basis for outlining the necessary steps to get your nonprofit organization up and running. You can customize this checklist to fit your individual needs. It includes essential steps, such as conducting a SWOT analysis , fulfilling the research requirements specific to your state, conducting a risk assessment , defining roles and responsibilities, creating a portal for board members, and other tasks to keep your plan on track.