How to Write a Good Life Insurance Cover Letter

Updated: September 5, 2023, at 4:11 PM

I’m sure underwriters ask you for cover letters…and cover letters…and more cover letters.

I was once at an underwriting conference with 20 or so carriers, and the individual carrier underwriters kept talking about cover letters. But all that talk doesn’t necessarily tell you how to write a life insurance cover letter.

When I was a home office underwriter, I learned that well-written cover letters are essential. How else could I understand the context of the application? Where else was I going to get necessary information that didn’t fit on the forms? At the same time, I didn’t appreciate cover letters that were poorly written or full of extraneous information.

Now that I’m in a position to write cover letters myself, here are the three main underwriting factors I think about to make sure I give the underwriter what he or she needs.

1. Is it Needed?

As important as cover letters are, not all cases need them. Say a young individual making $50,000 a year at an office job, with no medical history, comes in for a $100,000 term for the purpose of income replacement. In that scenario, no extra information is necessary.

Underwriters already read a lot so they don’t appreciate being given unnecessary material. Look at the information you’re sending. If it tells a complete story by itself, you don’t need a cover letter. If it doesn’t, or if there’s some facet of the applicant’s situation you want to stress, then it’s best to write a letter.

2. Purpose of Coverage

Your life insurance cover letter should focus on explaining the need and justifying the face amount, especially in cases where the need may be outside normal underwriting guidelines.

For example, say the case involves business key person insurance at 15 to 20 times the applicant’s compensation. Since key person insurance is generally only five to ten times compensation, you have to make a strong case of why your client’s employer would suffer a loss of the applied-for amount.

If your client has a difficult medical situation, you could have a hard time securing the rate you want. You’ll have to use your cover letter to address all potential roadblocks and pull out every favorable factor about the client’s medical history to lobby for the best rates.

That’s a lot easier if you have the complete medical records in front of you. If you don’t, do the best you can based on the application itself. And use the information obtained during your fact-finding.

3. Writing the Cover Letter

Now that you know whether to write a cover letter and what to put in it, be sure to write it well; meaning keep it short, clear, and to the point—with no unnecessary information.

No cover letter should ever be over one page in length, and most should be shorter. Also, be realistic. If your client had three heart attacks before the age of 40, don’t recommend him or her for Super Preferred. You’re not going to get it, and pretending you are is a good way to quickly lose credibility with an underwriter.

Again: write a clear, succinct, and realistic letter that makes both the need and amount clear to the underwriter and highlights the favorable factors of your client’s medical history. That letter is your best bet to secure the best possible rates for your client.

Keep Reading: How Life Insurance Loans Work

You May Also Like

Maximizing your conference experience: a guide for financial..., closing the divide: insight from 3 female leaders..., 7 tips to help you master the art..., lead generation strategies for financial advisors: 9 appointment-setting..., 2024 new year’s resolutions for financial planners [7..., a gratuitous recipe: tips for financial decision-making and..., ai and cybersecurity: what financial professionals need to..., mastering the monster hunt for top talent: stay..., do you need a business coach or business..., 5 facts & 5 thoughts on market volatility....

Redbird Agents

How to Write a Life Insurance Cover Letter Like a Million Dollar Producer

August 13, 2015 By Drew Gurley

A commonly overlooked element of insurance sales training is learning how to write a life insurance cover letter to an underwriter.

This is something I learned from a mentor of mine who was a top 1% advisor in the country.

Using a life insurance cover letter when submitting life insurance applications is one of the easiest and quickest ways to increase your placement. And, earn more commissions.

Yes, this is something top insurance agents have learned to do because they know it increases their productivity!

You have a strategy for your life insurance sale pitch right? Why not have one for your underwriters?

Why Write a Life Insurance Cover Letter

The purpose of the life insurance cover letter is simple: provide case-specific details that help get your client the most competitive offer from the life insurance company and likely expedite the approval process.

Here’s the scenario.

You just submitted a life insurance application and after a few days the emails begin pouring in about outstanding requirements holding the case from moving forward. A life insurance cover letter submitted with the original application will help avoid these interruptions.

The more information you provide an underwriter on the front end, the better off you’ll be. Plus, you’ll begin to build great relationships with the underwriting team. Tip…life insurance underwriters love cover letters because it makes their job easier!

Save yourself the time and headache and include a life insurance cover letter with every application you submit. One of the easiest ways to get a request for letter of explanation is by not including the information ahead of time in your cover letter.

The most recent example of a cover letter working to our advantage was an impaired risk case we ended up placing for a target premium of $43,000. The underwriter loved our detail and it avoided a bunch of wasted time communicating back and forth.

General Life Insurance Cover Letter Information:

Each life insurance cover letter should include the basic information that an underwriter will want to review. Below are the items you should include in your life insurance cover letter at a minimum.

- Employment and community involvement

- Your relationship with the client (Example, new, longstanding, center of influence, etc.)

- The offer you are looking for and the timeline you are trying to work within

- Any other pending applications or life insurance offers

- Explanation why any requirement is not available or attainable

Purpose of Insurance, Sales Strategy, and Financial Information:

- Is the applicant married, divorced, widowed?

- Do they have children or other dependents?

- Is there a formal buy-sell agreement or business appraisal in place ?

- How was the value of the business determined?

- Are all partners applying?

- What are the proposed insured’s job duties?

- How experienced is this person in the industry?

- How was the loss to the company determined?

- How long has this business been in operation?

- How many employees?

- Is this the only key person?

- What is the purpose of the loan?

- Is this an SBA loan?

- What is the duration and value of the loan?

- Estate planning

- Was an estate planning attorney or CPA involved?

- How was the face amount determined?

- Will the policy be owned by a trust?

- What is the exit strategy to repay the loan?

- What is the client’s net worth?

- What is the client’s current income?

- Has a lender already been identified?

Health and life style summary:

- Health factors in the client’s history that might make placing the case tough

- Any extensive travel plans

- Citizenship details

- Details not provided in application regarding avocations or driving history

- Reasons for any substandard ratings or declinations in the past

Underwriters are information junkies… the more you provide, the easier it is on the underwriter to approve the life application or consider a more competitive offer.

Conclusion:

Consistently implementing the use of an underwriting cover letter will result in three things.

- You will quickly become a better fact finder with your clients and instantly raise consumer confidence during your sales cycle.

- You will build stronger relationships with the insurance companies and underwriting departments which means your quality of business will improve.

- You will increase your referrals because your clients will recognize you actually care about the process. People do business with those they like and trust, and they will see you as a reliable, knowledgeable problem solver.

So, go make underwriters a priority in your sales cycle and start reaping the rewards! 🙂

Other Trending Articles

- Understanding how business owners use life insurance.

- Building a six-figure income in the Medicare space.

- Guide to understanding how ancillary insurance products work.

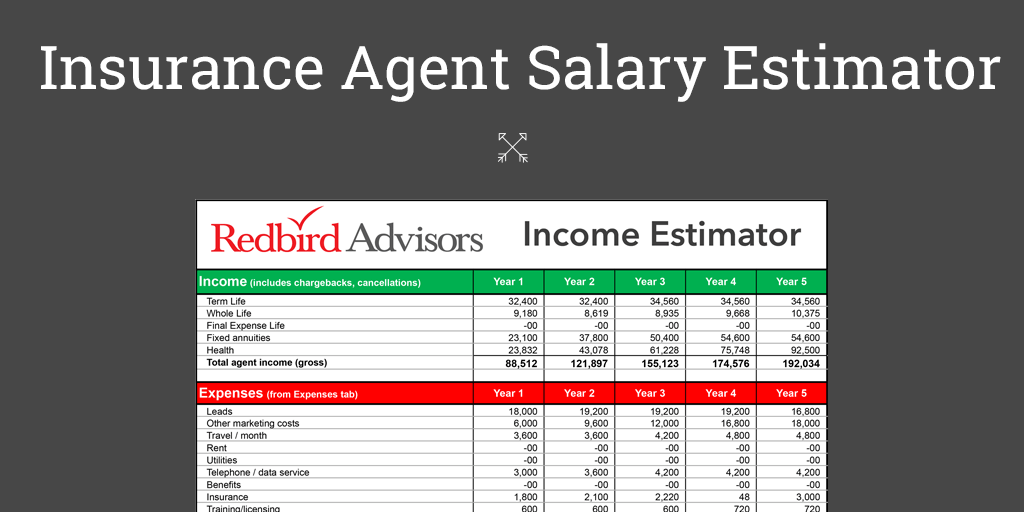

FREE DOWNLOAD: Redbird Insurance Income Estimator

Ever wonder what your true income potential is in the insurance business?

Use our Redbird Insurance Income Estimator and accurately forecast your income.

Sign up to get instant access to our FREE Estimator.

" * " indicates required fields

About Drew Gurley

As a co-founder of Redbird Advisors, one of my primary missions in growing our business is connecting bright minds that together can accomplish great things. Leading our team down a path with clearly defined goals and objectives while adapting to change along the way.

Popular Articles

Seo for insurance agencies: services, tips and tricks, selling your medicare book of business and maximizing your valuation, agent’s guide to selling medicare [2024 edition], how to become a medicare insurance agent, top medicare fmos for 2024 [contact info included], ultimate guide to selling final expense insurance [2024], why the ebitda multiple is useful…but has seven caveats, 10 rules for creating a kick ass insurance blog, the immense value of “long tail keywords” for insurance seo, top vendors for medicare supplement and medicare advantage leads in 2023, how to sell indexed universal life insurance: agent’s ultimate guide, insurance agent’s guide to how business owners use life insurance.

- Leadership Team

- Open Sales Jobs

- The Opportunity

- Carrier Contracting

- Insurance Copywriting Team

- Best Insurance Sales Books

- Insurance Websites

- Insurance Leads

- Insurance License Prep

- Continuing Education Courses

- E&O Insurance

- The Burial Insurance Manifesto

- Find an Insurance Agent Near You

Stay up to date with REdbird

- Customer Experience Services

- Fractional CMO for Insurance Agencies

- Content & Copywriting

- Keynotes and Sales Workshops

- Mergers & Acquisitions

- Final Expense

- Hospital Indemnity

- Ancillary Plans

- Buy Sell & Keyman

Letter Templates & Example

Sample Cover Letter for Life Insurance Application: Tips and Examples

Are you in the process of applying for life insurance? Then, you know how important a cover letter is for your application. It’s the first impression you make to the person reviewing your application and it can make all the difference. But, how do you know what to include in your cover letter? Don’t worry, we’ve got you covered. Below, you’ll find sample cover letters for life insurance applications that you can use as a starting point and customize to fit your specific needs. So, whether you’re a first-time applicant or just need a refresher, take a look at these samples and edit them as needed. A great cover letter can make your application stand out and increase your chances of getting the life insurance you need.

The Best Structure for a Sample Cover Letter for Life Insurance Application

When it comes to applying for life insurance, it’s important to present yourself in the best light possible. Your cover letter is often the first impression you’ll make with your insurer, so it’s vital that it’s well-written, concise, and easy to read.

To make the best impression, your cover letter should follow a basic structure that includes an introductory paragraph, a second paragraph that emphasizes your qualifications and experience, and a closing paragraph that thanks the insurer, encourages them to contact you, and provides your contact information.

In the introductory paragraph, you should state the purpose of your letter, which is to apply for life insurance, and immediately grab the insurer’s attention. Perhaps you start with a question or a statement that highlights the importance of life insurance. Be sure to introduce yourself by name and provide a brief description of your background.

In the second paragraph, you’ll want to highlight your qualifications and experience. This may include your current job, your industry expertise, and your education. Make sure to focus on how this background will make you a good candidate for life insurance. Keep it concise but informative.

In your closing paragraph, thank the insurer for considering your application, and encourage them to follow up with you if they have any questions or if they need additional information. Provide your contact information so they can reach out to you easily.

Remember to proofread your cover letter carefully, with a focus on grammar and spelling, before submitting it. You want to make the best impression possible with your cover letter, so take the time to do it right.

In conclusion, a solid and well-structured cover letter is a key component to successfully applying for life insurance. Follow the basic structure outlined here and use a casual, friendly tone of voice, and you’ll be off to a great start.

Good luck with your application!

Life Insurance Application Cover Letter Samples

Life insurance application cover letter – family protection.

Dear [Insurance Provider Name],

I am writing to apply for a life insurance policy as part of my family’s protection plan. As a family man/woman, protecting my loved ones has always been a priority for me. While I am in good health and have a stable job, I understand that life is unpredictable and unforeseeable events can happen. Therefore, I want to ensure that my family is financially protected in case anything happens to me.

I have done my research and believe that your insurance products and services align with my needs and standards. I would like to request your assistance in selecting the best policy for me and my family. I appreciate any guidance and advice you can provide in this matter and look forward to securing my family’s financial future.

Thank you for considering my application.

[Your Name]

Life Insurance Application Cover Letter – Business Continuity

I am interested in applying for a life insurance policy for the purpose of business continuity. As a business owner, I understand the importance of ensuring that my business continues to thrive even in unforeseeable events such as my passing. I want to secure the financial stability of my business partners, employees, and clients in the event of my unfortunate and untimely death.

I believe that your insurance products and services can provide the protection and support that my business needs. As such, I would like to request your assistance in determining the best policy that aligns with my business vision and objectives. Also, I would appreciate any advice and guidance you can provide in this matter.

Life Insurance Application Cover Letter – Mortgage Protection

I am writing to apply for a life insurance policy to protect my mortgage. As a homeowner, it is important for me to ensure that my mortgage payments are covered in case of my unexpected passing. I want my family to have the comfort of staying in our home without worrying about financial difficulties.

I believe that your insurance products and services offer the protection and coverage that I need for my mortgage. Hence, I would like to request your assistance in determining the best policy for me and my family. Any recommendations and advice you can provide would be greatly appreciated.

Life Insurance Application Cover Letter – Retirement Planning

I am interested in applying for a life insurance policy as part of my retirement planning. As I approach my retirement years, financial security and peace of mind become increasingly important to me. I want to ensure that I have enough resources and assets to live comfortably and enjoy retirement.

Based on my research, I believe that your insurance products and services, particularly your retirement planning options, align with my needs and expectations. Thus, I would like your assistance in selecting the best policy for my retirement goals. I would also like to hear any recommendations and insights you can provide in this aspect.

Thank you for your consideration.

Life Insurance Application Cover Letter – Estate Planning

I am writing this letter to apply for a life insurance policy for estate planning purposes. As a responsible individual, I want to ensure that my assets and wealth are distributed in accordance with my wishes and plans. Therefore, I want to secure the financial future of my beneficiaries and ensure that they are not burdened with financial stress and challenges in my passing.

After conducting my research, I strongly believe that your insurance products and services are equipped to provide the protection and coverage that I need to plan my estate. With that said, I would like your help in selecting the best policy that aligns with my estate planning goals. I would appreciate any advice and insights you can share in this matter.

Life Insurance Application Cover Letter – Critical Illness Protection

I am interested in applying for a life insurance policy that also provides critical illness protection. As the primary caregiver of my family, being diagnosed with a critical illness can significantly affect our financial stability and well-being. Thus, I want to ensure that I have the appropriate protection and coverage that can provide financial assistance in such circumstances.

After reviewing your insurance products and services, I believe that your company can offer the appropriate protection and coverage that I need for critical illness protection. Therefore, I want to request your assistance in selecting the best policy that aligns with my critical illness protection needs. Any advice and recommendations you can share would be greatly appreciated.

Life Insurance Application Cover Letter – Legacy Planning

I am writing to apply for a life insurance policy for legacy planning purposes. As a philanthropist and advocate for social causes, it is important to me to leave a lasting legacy. I want to ensure that my contributions to society continue even after my passing.

Based on my research, I believe that your insurance products and services have the features and benefits that can help me achieve my legacy planning goals. I would like to request your assistance in determining the best policy for me in this regard. Any advice and guidance you can offer would be greatly appreciated.

Tips for Writing a Sample Cover Letter for Life Insurance Application

When it comes to applying for life insurance, a cover letter can make all the difference in getting your application accepted. Here are a few tips to make sure that your cover letter is up to par:

Be clear and concise. Your cover letter should be short and to the point. Make sure that you clearly state your intent and provide any necessary details.

Highlight your strengths. Use your cover letter to highlight your strengths as a policyholder. For example, if you have a long history of paying your premiums on time, be sure to mention it.

Address any reservations. If you have any reservations about your health or lifestyle that may impact your ability to secure coverage, address them upfront in your cover letter.

Use clear language. Avoid using technical jargon or complicated terminology. Instead, use clear and simple language to convey your thoughts and ideas.

Highlight your reasons for needing coverage. If you have any specific reasons for needing life insurance coverage, be sure to highlight them in your cover letter. This can help to demonstrate your commitment to making sure that your loved ones are taken care of after you pass away.

Thank the insurer for their consideration. Make sure to thank the insurance company for taking the time to review your application and for considering your request for coverage.

Overall, the goal of your cover letter for your life insurance application should be to convey your commitment to securing coverage and to demonstrate why you are a good candidate for the policy. By following these tips, you can ensure that your cover letter is compelling, concise, and effective.

FAQs for Sample Cover Letter for Life Insurance Application

What is a cover letter for a life insurance application?

A cover letter for a life insurance application is a document that accompanies your application and provides more information about your health history and lifestyle choices. It allows you to explain any details that may affect your policy’s approval or rate.

What information should be included in the cover letter?

The cover letter should include your name, date of birth, policy number (if applicable), and the purpose of the letter. It should also provide a brief summary of your health history, including current medical issues or past surgeries, as well as lifestyle choices such as smoking or alcohol consumption.

Do I have to write a cover letter when applying for life insurance?

No, a cover letter is not mandatory when applying for life insurance, but it can be helpful in providing additional context for your application. It may also help speed up the approval process by addressing any potential concerns upfront.

Can the cover letter affect my insurance premium?

Yes, the information you provide in your cover letter can impact your insurance premium. If your health history or lifestyle choices indicate higher risk, the insurance company may charge a higher premium or deny coverage altogether.

Should I disclose all my health issues in the cover letter?

Yes, it is important to disclose all health issues in your cover letter to ensure transparency with the insurance company. Failure to disclose relevant medical information may result in cancellation of your policy or denial of claims.

Can I use a template for my cover letter?

Yes, you can use a template for your cover letter, but make sure to personalize it to your specific circumstances. Your medical history and lifestyle choices are unique, so it is important to provide accurate and detailed information to help the insurance company determine your risk profile.

How long should my cover letter be?

Your cover letter should not exceed one to two pages. Be concise and clear in your communication, and focus on providing only relevant information to the insurance company.

Cheers to Your Future with Life Insurance Coverage

Thanks for taking the time to read our sample cover letter for a life insurance application. We hope it has provided some inspiration and guidance as you prepare your own cover letter. Remember, your cover letter is your chance to showcase why you are the perfect candidate for the life insurance coverage you need. If you have any questions or need assistance with your application, please don’t hesitate to reach out to us. We wish you the best of luck in your future endeavors and hope to see you again soon.

Crafting the Perfect Cover Letter for Insurance Advisor Positions 5 Examples of Great Insurance Agent Thank You Letters to Clients Thank You Letter from Insurance Agent to Client: Expressing Gratitude and Building Strong Relationships Writing an Effective Letter to Patients Regarding Insurance: Tips and Samples Medical Insurance Renewal Letter Sample: Tips and Examples Effective Thank You Letter Templates after Insurance Sale

IMAGES

VIDEO

COMMENTS

Your life insurance cover letter should focus on explaining the need and justifying the face amount, especially in cases where the need may be outside normal underwriting guidelines. For example, say the case involves business key person insurance at 15 to 20 times the applicant’s compensation.

Learn everything you need to know about writing a compelling cover letter for your life insurance application. Read this article to know more about the purpose of a cover letter and how to draft one that impresses your insurer.

Why Write a Life Insurance Cover Letter. The purpose of the life insurance cover letter is simple: provide case-specific details that help get your client the most competitive offer from the life insurance company and likely expedite the approval process. Here’s the scenario.

The purpose of an underwriting cover letter for life insurance is simple. It’s a way to provide details on a particular case to help clients get the most competitive offer from the carrier and to aid the underwriter during the review. Although it’s not always necessary, a cover letter can preemptively address questions from underwriters.

Learn how to write a compelling cover letter for your life insurance application. This article provides tips and a sample cover letter to make your application stand out to insurers.

In this article, we review what to include in an insurance agent cover letter and provide an example that you can use as a guide during your job search. When you're ready to apply for insurance agent positions, you can upload a resume file or build an Indeed Resume.