Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success.

We collaborate with business-to-business vendors, connecting them with potential buyers. In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. We are committed to providing trustworthy advice for businesses. Learn more about our full process and see who our partners are here .

How to Create a Desirable Compensation Plan

A competitive compensation plan is necessary to attract and retain top talent.

Table of Contents

A robust compensation plan is crucial for attracting and keeping a quality team. A successful compensation strategy incorporates multiple elements beyond salary, including flexibility, employee benefits, paid time off (PTO) and much more.

We’ll detail compensation plan elements and explain how to develop and implement a competitive compensation plan that can boost recruitment and retention efforts while ensuring equity and fairness.

What is a compensation plan?

A compensation plan, also called a “total compensation plan,” encompasses all of the compensatory components of a company’s strategy: employees’ wages, salaries, benefits and total payment terms. Employee compensation plans also include raise schedules, fringe benefits, union perks and employer-provided vendor discounts.

A strategically designed compensation philosophy that is kept current, relevant and compliant supports critical components of your business, including the following:

- Strategic plans

- Budgeting and business goals

- Industry-competitive challenges

- Operating needs

- Total reward strategies that support retention of the company’s top talent

When your business maintains a robust compensation program, you’ll enjoy the following benefits:

- A compensation plan can support your business strategy. A desirable compensation plan describes how your organization’s pay and compensation philosophies support your business strategy, industry competitiveness, operating objectives and staff needs.

- A compensation plan can help with recruitment. A desirable compensation plan helps your business attract and retain top talent with the in-demand career skills that can take your business to the next level.

- A compensation plan can boost employee motivation. A desirable compensation plan motivates employees to perform at high levels and exceed goals.

- A compensation plan can keep your business competitive. A desirable compensation plan helps keep your business competitive in the marketplace in terms of base pay, incentives, total compensation and benefits opportunities.

Why do companies need a compensation plan?

Companies need a thoughtful compensation program to stay competitive in their industry and attract and retain top talent. Employers that determine salaries and benefits without regard for industry data will slowly lose the talent game to competitors. Additionally, managing a workforce without a predetermined business budget is risky. Compensation programs allow for consistent and predictable budgeting and planning.

According to Payscale’s 2023 Compensation Best Practices Report, job seekers have the upper hand in today’s job market. To attract and retain the best workers, more organizations are focusing on building compensation packages that will help recruit employees in a tough labor market and keep them engaged and motivated.

What is direct and indirect compensation?

There are two types of foundational compensation:

- Direct compensation: Direct compensation includes salary, hourly pay, commissions and bonus pay.

- Indirect compensation: Indirect compensation includes various benefits.

We’ll take a closer look at direct and indirect compensation.

4 types of direct compensation

Most employers choose one type of direct compensation and stick to it. However, you can use various methods to compensate employees for their work. The exception is bonus pay, which is meant to be an addition to regular pay based on employee or company performance.

- Salary: The most traditional form of salary is a monetary amount scheduled over one year. How often salaried employees are paid is another part of the compensation strategy. However, businesses typically pay their employees every two weeks. Salary is the most common method of direct compensation for exempt employees . An exempt employee is not eligible for overtime pay . They receive a base salary for their work instead of being paid an hourly rate; employers pay exempt employees for their job instead of the number of hours they work.

- Hourly pay: Nonexempt employees are typically paid an hourly rate and are eligible for overtime pay; they’re guaranteed at least minimum wage . When an employee works over 40 hours in a workweek, their employer must pay them overtime. The hourly pay rate is typically a predetermined dollar amount per work hour. Hourly employees generally keep a timecard or clock in and out to begin and end their work shifts. During times of slow or reduced work or budget changes, nonexempt employees might not work as many hours as they did in previous weeks. Thus, a routine number of hours worked per pay period is not guaranteed.

- Commission: Commission is when compensation is based on volume, production or a predefined performance level. This compensation type is also known as “piecework” or “piecemeal.” Paid commissions are usually based on the volume of services performed or products made, or are structured around sales volume. For example, a real estate agent who sells a house will receive compensation from that sale. It doesn’t matter how long or what work activities were necessary to sell the house, only that it was sold.

- Bonus pay: Bonuses are used to motivate employees or increase their overall performance. Bonuses are a variable compensation method that’s commonly associated with sales professionals, who tend to be salaried or exempt personnel. For example, if a sales professional exceeds their quarterly target by a specific dollar amount based on a predetermined matrix, they will receive a commensurate bonus. Bonuses can also be paid for company performance or when hard-to-fill positions are filled with employees with unique or highly sought-after skills or experience. Holiday bonuses are another popular type of bonus.

Types of indirect compensation

Indirect compensation can be any fringe benefit employers offer. Most commonly, it refers to the various insurance types employers offer in their employee benefits plans . For example, the employer may offer health insurance , dental insurance, life insurance, short- and long-term disability insurance and vision insurance. Employee retirement plans , like 401(k) plans , are another common form of indirect compensation.

Equity-based programs are another compensation offering. However, these aren’t typically offered within the small business realm. Equity-based compensation is generally some sort of share or stock in the company.

Other examples of indirect compensation include the following:

- Disability income protection

- Vacation days

- Paid holidays

- Flexible work policies

- Other forms of retirement benefits

- Opportunities for advancement and career growth

- Student loan assistance

- Educational benefits

- Assistance with child care expenses

- Employee relocation packages

- Company car

- Company equipment (e.g., laptops, mobile phones)

How to develop and implement a compensation plan

There’s no one-size-fits-all strategy for developing a compensation plan. Rather, it’s best to approach it in terms of what’s right for your team. Here are some suggestions to guide you along the way.

- Create a compensation plan outline. Set an objective for your program and specific targets. Begin with job descriptions for each position on the team, and set a generalized budget for your personnel.

- Appoint a compensation manager. This position, usually filled by someone in human resources, aligns the program and researches what each position pays within the industry, how job classifications will be determined and how direct compensation will be selected.

- Craft a compensation philosophy. Determine how competitive you’ll be in your industry’s job market. Will you lead the market in direct compensation or offer modest pay with great benefits?

- Rank jobs and place them within a matrix. Outline what, if any, pay tiers should exist in pay structures for executives and sales employees, for example. You also should determine potential tiers within each job classification.

- Develop seniority grades within each job classification. It’s essential to develop opportunities for career advancement. For example, create levels or senior- and entry-level roles that may affect the compensation matrix but offer advancement for employees.

- Settle on salaries and hourly pay rates. After you outline your compensation platform, assign pay rates and salary ranges for each position and job classification. This is when you’ll fine-tune your organizational budget.

- Complete necessary policies. A compensation plan may affect policies related to payroll, fringe benefits and other pay-related matters. For example, companies often have policies for paid holidays, healthcare benefits, payroll administration and company-issued pay advances that must factor into — or at least align with — the company’s compensation policy. Ensure that all policies are updated and included in your employee handbook .

- Get approval or buy-in from your company’s other leaders. Once everything is in place, ensure that your company’s leadership team fully supports your compensation packages.

- Develop a communication plan. All of your employees should learn about the compensation program at the same time. Use several communication methods to share the plan (e.g., email, group gatherings, social media, flyers in common areas). Issue this messaging in multiple languages if not all of your employees speak English as a first language. You should also expect many questions. The complexities of total compensation are not easy to understand, and it’s essential for every employee to understand their compensation package.

- Monitor your compensation plan. Be prepared to keep tabs on and change employee compensation. Over time, adjustments will be necessary for you to remain legally compliant and competitive.

How can you ensure equity, fairness, legality and competitiveness?

Part of developing a compensation plan is ensuring it’s fair for all employees. This pertains to gender, culture, race and ethnicity, as well as to the skill sets and experience new team members bring to your company.

Before you unveil your compensation plan, address the following questions:

- Are the programs in your compensation policy legally compliant? Be mindful of labor laws , including state laws (which may include PTO or vacation regulations) and federal laws (such as the Affordable Care Act).

- Is the overall program fair to all employees?

- Do employees perceive the overall program as fair? In this case, perception is reality.

- Is the overall program fiscally sound? Can you maintain the benefit offerings even if profits dip for a quarter or two?

- Can your organization effectively communicate the overall program to employees?

- Are the programs fair, competitive and in line with your overall compensation policies?

- Is the compensation policy competitive? Will it help your organization attract and retain top talent in your industry?

It’s crucial to keep your compensation plan active and relevant by adjusting it as necessary to stay compliant and continue attracting and retaining excellent employees.

Resources for creating compensation plans

Consider the following compensation planning and design companies that can guide you toward a fair, desirable compensation plan:

- Culpepper and Associates: Culpepper and Associates offers compensation surveys and other services.

- PeopleFluent: PeopleFluent provides talent management services.

- Unit4: Unit4 offers comprehensive HR and financial software, including employee compensation management software.

- Flex HR: Flex HR provides full-service consulting.

- emPerform: emPerform offers all-inclusive employee performance management.

Good compensation plans make good teams

A solid compensation plan should be a key component of any company’s strategy for attracting and retaining the best team members possible. There are many ways to offer a good compensation program to your employees based on your business needs and budget. Take the time necessary to develop a comprehensive program that works for your organization, and then communicate the plan effectively to everyone on your team. Do it right, and your employee morale and retention will increase substantially.

Natalie Hamingson contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

How to Create a Salary Proposal

Once you're in the final stages of the hiring process for your dream job, one of the most challenging steps in this process could be justifying your worth, or convincing the hiring committee that you deserve the salary that you want. Research is fundamental to creating a salary proposal, but confidence in your skills, abilities, experience and capabilities is the factor that will benefit you throughout the process.

Define the Purpose of a Salary Proposal

When you receive a job offer, your future employer will likely have a salary range they have already decided is appropriate for your new position. The salary range may be based on previous employees' earnings or it might be a generic range that the company and its HR leadership feel is sufficient compensation for the position they offer to you. In this case, creating your own salary proposal could be instrumental in helping the company restructure its compensation practices, or at the very least, revisiting the compensation level for your position.

More For You

How should salary requirements be emailed, how should i answer about flexibility for salary requirements, how to respond to an e-mail for desired salary, how to list salary in a job posting, how to negotiate a salary based on the salary range.

Alternatively, creating a salary proposal might be your counterproposal to a salary offer that's on the table. If it's a job you've set your sights on for quite some time, or an organization you have wanted to join but never had the opportunity, and you're willing to put in the extra work, creating a salary proposal letter to the employer might further illustrate why you're the right person for the job.

Advertisement

Article continues below this ad

Set Up a Salary Proposal Template

Unless you're creating a salary proposal letter or email for several different jobs and companies, you probably don't need to create a compensation proposal template. Although if you embark on a job search that entails numerous interviews and you intend to compare the salary expectations or offers for all the positions you're considering, a salary proposal template is a useful tool for organizing the last stages of your job search. Ideally, a pay proposal template would include the employer's name, location, and contact information for HR as well as the hiring manager.

The position or job title, a brief job description, including the number of direct reports or team members, also is helpful information for a well-thought-out salary proposal template. Insert columns for the employer's proposed salary level, your salary expectation and researched salary information and sources.

Compare Similar Job Titles

Conducting a broad search for positions with the same or similar job titles is the first step in creating a salary proposal. Job titles can vary, particularly if you're comparing private sector to public sector roles. For example, a junior accountant for a mid-size accounting firm might be considered Accountant I within state government, and a Management Analyst for the federal government might be the equivalent of an executive assistant with a law firm. Your research will need to include a cursory view of the job titles, duties and responsibilities to find equivalent salaries.

Research Salary Tables

The U.S. Office of Personnel Management (OPM) publishes its General Schedule (GS) Local Pay Tables, which contains salaries for every level – except senior executive level and political appointees – in the federal system. The OPM salary tables also include differentials for various localities in the U.S. Another federal resource is the U.S. Bureau of Labor Statistics Occupational Outlook Handbook; it contains average wages and median wages for thousands of occupations.

Industry-specific professional associations often publish salary information, although you might need to be a member to access complete salary data and information on comparable benefits and total compensation plans for people in your field. For example, the Society for Human Resource Management offers to members the SHRM Compensation Data Center, which contains information about salaries and compensation packages for numerous occupations – not just HR-related jobs. In addition, there are online calculators that enable comparisons of jobs in different locales. If you are moving from, say, Kansas City to Atlanta, and are staying in the same field, you can obtain salary and cost-of-living information that you can present to a prospective employer.

Present Your Proposal

The foundation of a salary proposal letter to an employer is the combination of your research, qualifications and experience, and if applicable, your education and professional certifications. A salary proposal letter – or, even a salary proposal email – is, ideally, a formal proposal that sets out your position and the reasons for your salary expectations.

Avoid presenting your salary expectation as a precise number, such as $101,450 per year. Instead, create a proposal that indicates the salary range that you deem acceptable. For example, if you earn $90,000 a year and you are seeking an increase, determine the lowest percentage increase that you will accept, along with the increase you would like to have. If you can live with a five percent increase, but would love to make 15 percent more, indicate the salary you would accept is between $94,500 and $103,500. Or, simply between $95,000 and $104,000.

- U.S. Office of Personnel Management: Pay & Leave, Salaries & Wages

- U.S. Bureau of Labor Statistics: Occupational Outlook Handbook

- Society for Human Resource Management: SHRM Membership

Ruth Mayhew has been writing since the mid-1980s, and she has been an HR subject matter expert since 1995. Her work appears in "The Multi-Generational Workforce in the Health Care Industry," and she has been cited in numerous publications, including journals and textbooks that focus on human resources management practices. She holds a Master of Arts in sociology from the University of Missouri-Kansas City. Ruth resides in the nation's capital, Washington, D.C.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how much should you pay yourself here's how to calculate a business owner’s salary.

Every business owner needs to pay themselves, but how much should your salary be and when should you be paid? Use these calculations to determine your pay.

As a business owner, it may be second nature to remember to pay your employees or adequately invest in your business. However, it’s just as important to compensate yourself for your contributions to the business.

“It’s essential to strike a balance between paying yourself fairly and ensuring that your business has enough capital to cover operational costs, growth initiatives, and unforeseen expenses,” said Paul Miller, CPA and Managing Partner at Miller & Company LLP .

Here’s how to determine when and how to pay yourself.

Ways to pay yourself as a business owner

There are two common ways small business owners can pay themselves in their business:

With the salary option, you can pay yourself just as you would your employees — including withholding taxes. The salary method is more stable, as you can set up weekly, biweekly, or monthly payments through payroll. However, there isn’t much flexibility if you need to cut your pay when the business isn’t as profitable.

Bonuses can be a great way to supplement a business owner’s salary when the business is performing well. You can give yourself bonuses at the end of every quarter or wait until the end of the year.

Owner’s draw

Through an owner’s draw, you can withdraw money from the company’s checking account as needed without withholding employment taxes. Although you won’t need to pay taxes for each draw up front, you will have to pay self-employment taxes either quarterly or annually when you file your tax return.

This is the most flexible option, as it allows you to withdraw varying amounts of cash as needed. It is also the most unpredictable option. You cannot count on a regular paycheck, and you won’t even know how much money you can withdraw until profits are fully reported for the month.

[Read more: What Is Variable Pay and How Can It Help Small Businesses? ]

Tax implications of different salary structures

Salaries and owner’s draws have different tax responsibilities. Salaries are treated by the IRS like any other employee wages, meaning they are subject to federal income tax, Social Security, and Medicare taxes.

An owner’s draw is not subject to payroll taxes, but you will pay self-employment taxes on your share of the business profits through your personal tax return.

“A salary can provide a steady income and predictable tax deductions for the business, but it means higher payroll taxes,” wrote Cunningham & Associates, LLC . “An owner's draw may offer more flexibility and lower immediate tax liability, but it requires careful tax planning to ensure self-employment taxes are accurately paid.”

It’s not just the pay structure that will influence your taxes, either. The type of entity you form can have implications for your owner's salary and tax obligations.

How does business structure influence owner pay?

Depending on your business structure, certain payment options may make more sense than others:

- Corporations : Owners of C corporations are considered employees of their own businesses and can pay themselves a regular salary, which is taxed separately from their business profits. They might also receive shareholder dividends. With an S corporation, you can receive a salary as well as take out distributions, but the salary must be “reasonable” according to IRS guidelines and in comparison to similar positions in your industry.

- Pass-through entitie s: Owners of pass-through entities like sole proprietorships, partnerships, and LLCs (if taxed as a sole proprietorship or partnership) typically pay themselves through owner’s draws. Owners can make regular withdrawals from the business's profits, but they are not considered employees. In partnerships, these withdrawals might include guaranteed payments, which are akin to a salary but are not subject to payroll taxes.

“Consider the tax implications of different pay structures, such as whether you take a salary, dividends, or a combination of both,” Miller told CO—. “This decision can significantly impact your personal tax liabilities and the business’s tax obligations.”

Regularly review your compensation strategy with a financial advisor or CPA to ensure it remains aligned with both your business and personal financial goals.

Paul Miller, CPA and Managing Partner at Miller & Company LLP

How much should you pay yourself?

Small business owners in the United States make between $83,000 to $126,000 on average, depending on their industry and location. Keep in mind that many business owners do not take a salary in the first couple of years. Others may pay themselves too much and limit the growth of their business.

To ensure the financial health of both you and your business at any stage of growth, Brittney Suttle, CPA and Owner of Knies & Co. Accounting , recommended the “Modified Profit First Method.” In this method, you’ll allocate a certain percentage of revenue toward tax savings and your take-home pay.

“The percentage you allocate can greatly fluctuate business-to-business based on expenses … but it's a great method that can grow with you as your business grows,” she said.

For cyclical or seasonal businesses, Suttle advised allocating your pay percentage to a separate Owner’s Pay Savings account and then taking a consistent paycheck from that account throughout the year.

“The amount in those high-dollar months should cover those low-dollar months while allowing you to consistently get paid on a personal level,” she added.

[Read more: How to Do A Competitive Salary Analysis ]

Tips for setting your compensation

As a business owner, you should pay yourself enough to live on but be realistic about what you need. Follow these tips to compensate yourself fairly without putting your business in financial jeopardy.

Calculate your net income

Calculating your net income ensures your business can cover expenses before calculating your own pay. This step is crucial to avoid debt or even bankruptcy. First, subtract the cost of your business’s expenses (such as employees’ salaries, rent for your office space, etc.) from your gross revenue to find your net income. Once you subtract the amount of taxes to set aside, you will pull your pay from this figure.

Consider tax savings

Planning (and saving) throughout the year is necessary to keep tax payments from adding up. According to the IRS , most corporations and self-employed business owners that will incur over $1,000 in annual tax payments must submit and pay estimated quarterly taxes.

Whether you are a new or existing business owner, confer with an accountant to find the tax specifications required for your business and to avoid incurring penalties.

Tax calculations should always occur before taking expenses out. A good rule of thumb is to save 30% of your income for taxes. This percentage may be higher if you or your joint filing partner are in a higher tax bracket.

[Read more: The Most Common Business Entities for Startups ]

Factor in your business debt

After accounting for tax payments, you can use these funds to pay off your business’s debt. If you’ve taken out any loans or used a credit card, your lender most likely requires a minimum payment each month. Subtract that total minimum debt payment from your net monthly income. If you have extra funding left over after paying yourself, you can increase your monthly payments and clear your debt more quickly.

Create a business savings plan

Build up a savings buffer while you have the money for any new hires, training programs, or emergency funds. Figure out which goals are most important to you and which you can put on hold. Your future self will appreciate the effort you take to set aside funds for your business goals and divide them into monthly savings.

How to adjust your salary over time

As your business evolves, the best method and amount to pay yourself may change, too.

“Once you see excess cash building up in your business bank account or your revenue and/or net profit margin percentage improving, you typically can give yourself a pay raise,” said Suttle.

Miller noted that changes in tax laws or your personal financial needs might also prompt you to revisit how you’re paying yourself — for example, shifting from a salary to a dividend or vice versa.

“Regularly review your compensation strategy with a financial advisor or CPA to ensure it remains aligned with both your business and personal financial goals,” Miller advised.

Rachel Barton also contributed to this article.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more financial tips

How much should you pay yourself here's how to calculate a business owner’s salary, 14 commonly overlooked small business tax credits, how to calculate year-end employee bonuses.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Crafting a Competitive Employee Compensation Plan Guide (with Templates)

Table of Contents

If you want to hire and retain top talent, improve employee productivity , and build trusting relationships with your employees, then crafting a competitive compensation plan is what you need.

Still, a compensation package involves far more than just an employee salary or pay rate, and it is equally important to both employees and business owners.

This text will cover everything you need to know about crafting a compensation package and benefits, including:

- The definition of compensation plan,

- Benefits of crafting a compensation package,

- Types of compensation,

- Steps on how to create compensation plans, and

- Compensation plan templates and examples.

Let’s begin!

- A compensation plan is a formal document that outlines the components of an employee’s pay structure.

- Effective compensation plans help attract top talent, boost employee morale and productivity, promote a healthy company culture, and more.

- Direct compensation is financial or monetary compensation given to an employee for the time worked, such as hourly wages, salary, commissions, and bonuses.

- Indirect compensation, on the other hand, is non-monetary compensation that includes a retirement plan, time off, health insurance, and other employee benefits.

- Crafting a competitive compensation package includes several steps, such as deciding on your company’s compensation philosophy, researching the job market, defining the compensation structure, and including employee benefits.

- Time tracking is crucial for your business as it covers keeping track of your employees’ work hours, PTO, and more.

What is a compensation plan?

A compensation plan is a formal document that includes all the components of the employee compensation packages . This involves:

- Hourly wages,

- Salaries,

- Commissions and bonuses, as well as

- Employee benefits and other incentives.

Compensation plans are somewhat flexible, as it’s up to the employers to decide what they want to offer to their employees in order to stay competitive in the labor market.

Nowadays, as more employees work remotely, companies must make sure they offer competitive compensation packages that cater to their remote workers . For some, that may be offering location-based or location-agnostic compensation. While location-based pay will require you to pay your employees based on the cost of living in their place of residence, location-agnostic pay calls for equal pay no matter the location.

The 2 types of compensation

There are 2 major types of employee compensation for an employer to consider when setting up a compensation plan:

- Direct compensation, and

- Indirect compensation.

Apart from these 2 major types of compensation, there is an additional type that doesn’t fall into any of these categories and which we’ll discuss in more detail below.

Let’s break down each in more detail.

Type #1: Direct compensation

Direct compensation is financial compensation given to an employee for time worked. It can be in the form of a salary, overtime pay , bonuses, or commissions (we’ll go over each more thoroughly in The 4 types of direct compensation section below).

Type #2: Indirect compensation

As opposed to direct or financial compensation, indirect compensation is the non-monetary payment provided to an employee. This type of compensation usually involves the benefits an employee receives in addition to the direct compensation, commonly known as employee benefits .

Such benefits may include health insurance, life insurance, vacation or paid time off , retirement funds, fringe benefits, etc. Some companies may also offer company stocks and profit-sharing in their benefits packages.

💡 Clockify Pro Tip

Want to know how to request time off and track it properly? Stick around and read the following blog post on the matter:

- How to request time off and track it successfully

Bonus compensation type: Incentives

Speaking of the additional type of compensation, incentive pay is also a form of employee compensation — one that doesn’t strictly fall under the above-listed categories.

Incentive pay is a form of compensation that is usually either indirect or non-financial and based on performance rather than on time worked. Incentives serve as a form of encouragement and motivation for employees to strive for excellence in their work. They usually imply a specific goal — if an employee reaches the said goal, they get the incentive, which may be in the form of travel, merchandise, or even cash.

If you want to learn more about goals, their types, and most importantly, how to achieve them, pay attention to the following text:

- Different Types of Goals and How to Achieve Them

The 4 types of direct compensation

As we mentioned earlier, direct compensation is monetary or financial employee compensation, and these are main types of direct compensation:

- Hourly compensation,

- Salary compensation,

- Commissions, and

- Bonuses.

Direct compensation type #1: Hourly compensation

Hourly compensation is a type of direct compensation associated with base pay, meaning companies pay their employees a predetermined rate for each hour worked.

Unless additional rules apply (some hourly workers are exempt from minimum wage and overtime ), hourly employees are treated as non-exempt as they are entitled to the federal minimum wage under the Fair Labor Standards Act . In addition to the hourly wage, the same act entitles hourly workers to receive overtime compensation — 1.5 times their standard hourly rates. This rule applies for each hour they spend working beyond 40 hours per week .

The required federal minimum wage in the US is $7.25 per hour worked . Still, if a state law requires a higher minimum wage per hour worked, then the more favorable law for the employee prevails.

To find out if you are eligible for either federal or state minimum wage, read the following text that will give you more insight into the topic:

- Minimum wages by state in USA for 2023

Direct compensation type #2: Salary compensation

Salary compensation is another type of direct compensation associated with base pay, meaning employees receive a fixed amount of money each pay period (weekly, monthly, bi-weekly, etc.).

This fixed salary is always based on a salary range defined for a particular job position.

A salary range is the pay range defined by the employer that describes the minimum and maximum pay rate for a job position. It also includes a series of mid-range pay increases employees may expect to get during their time at a company.

In case salaried employees are exempt from the FLSA , they do not get paid either minimum wage or overtime for the hours they spend working past 40 hours per week. This is the case if they earn more than $684 per week or $27.63 per hour . If they earn less than this amount, they are treated as non-exempt and are entitled to minimum wage and overtime pay.

To learn more about the differences between hourly and salaried employee compensation, as well as their pros and cons, check out our blog post on the subject:

- Salary vs hourly employment: pros and cons

Direct compensation type #3: Commission

Compensation based on commission is a type of direct compensation associated with variable pay . It is common among people in the sales industry who get paid in this manner based on the sales quotas, sales percentages, and goals they reach.

Commission rates may be based on:

- Revenue — for example, if a sales professional gets 5% worth of commission for each sale, and they make a $50,000 sale, they get $1,000 worth of commission for that sale,

- Gross margins or profit — the higher a sales professional sells a product or service, the higher the commission rate, and

- Commission fee — the sales professional makes a fixed commission amount regardless of the monetary value of the sales they made.

Direct compensation type #4: Bonuses

Compensation based on bonuses is another direct type of compensation associated with variable pay. Professionals who have precise goals to reach — such as managers and salespeople — usually receive bonuses.

Bonuses are frequently paired up with other types of compensation, such as commissions or salary.

In some companies, bonuses may be implemented as an incentive meant to help employees reach higher performance standards at their jobs. In such companies, employees usually receive bonuses when they live up to certain metrics (such as company OKRs or KPIs ).

How do I create an employee compensation plan?

In this section, we’ll talk about the steps you need to undertake in order to design a competitive compensation package properly.

The following steps will help your organization stay competitive in the market and attract the top-talent professionals you need.

Let’s go over each step in more detail.

Step #1: Define the company’s compensation philosophy

Competitive compensation is based on market pay rates. Therefore, when defining the compensation in your company, you can choose to:

- Lead,

- Lag, or

- Match the market .

While leading the market would entail offering higher compensation than the competitors, lagging would include offering lower compensation as compared to competitors. Finally, matching the market would mean giving the same compensation as the competitors.

Establishing the company’s compensation philosophy is completely up to you, but bear in mind that if you want to attract and retain top talent, you should at least match the numbers on the market.

You can always offer additional, non-monetary compensation such as more days off or other employee benefits that may sound more appealing to a job candidate than the actual monetary compensation.

Step #2: Define the type of employees you will hire

When outlining your compensation strategy, it’s also important to decide which employees you tend to hire. Remember that, as an employer, you must be aware of the different legal regulations and obligations concerning each type of worker.

Therefore, when choosing which employees to hire, you ask yourself the following questions:

- Are your employees full-time or part-time employees?

- Will you tap into the gig economy and employ contractors and freelancers?

- What are the average hourly rates you’ll need to offer to your freelancers and contractors?

- Does your business need to hire seasonal workers during peak times such as summer or winter holidays?

In case you’re wondering how to pay contractors and freelancers, here’s a text that will help you:

- How to pay contractors and freelancers in 5 simple steps

Step #3: Research and analyze the job market

As said above, you need to scrutinize the market before defining your compensation package and benefits since it’s crucial for attracting top talent.

If you are operating in the US, you can obtain useful general compensation statistics from the US Bureau of Labor Statistics .

Still, the best way to do so is to analyze and research salary data and market surveys — this is also known as compensation benchmarking.

When looking for market surveys and salary data to buy and analyze, make sure you pay close attention to the following elements:

- Industries — look for surveys that cater to your company’s industry,

- Location — look for surveys that cater to the country, state, or city your company is operating in,

- Employee size — look for surveys that cater to the size of your company,

- Revenue size — look for surveys that show data from companies that have a similar business volume as you, or

- Job summaries — look for the job summaries closest to the positions you need.

Furthermore, if you want to find compensation statistics on salary-focused websites, bear in mind that this data is not the true representation of the market, as anyone can edit it.

Step #4: Define your compensation structure

Compensation structure refers to the compensation strategy you will use to define how employees will be paid. No matter how you choose to compensate for your employees’ work, you’ll need to think carefully about how best to define the hourly rates, salaries, and salary ranges you want to offer.

Also, make sure you take the following elements into consideration before you make your decision:

- The industry you are operating in,

- The size of your company,

- The revenue your company makes,

- The specific job positions you are looking for, and

- The importance and worth of these positions for the successful operation of your company.

Here’s how you can best define the salaries and hourly rates in your company .

Defining employee salaries

If you’ve decided to compensate your employees through salaries, you’ll need to think about the salary ranges you want to offer.

To best define employee salaries , make sure you:

- Carry out job analysis — determining more information about the job position you are opening,

- Group the jobs into job families — grouping the jobs by department and type (such as executive, administrative, technical) or location,

- Gauge employee experience and expertise for a certain job position — focusing on the skillfulness and the collection of experiences that an employee possesses for the successful operations of the company,

- Group jobs by job grades — the US federal government recognizes 15 job pay grades, each characterized by the General Schedule (GS) payscale . For instance, for an entry-level position with a bachelor’s degree, the average pay rate in 2023 was from $40,082 to $52,106 per year,

- Calculate the actual salary ranges — most companies will use +/- 15% or 20%, starting from the midpoint, and

- Decide how you want employees to progress within their salary range — for example, you can base this progression on the number and difficulty of skills, duties, and responsibilities, on a preplanned schedule, etc.

Defining employee hourly wages

If you decide to hire hourly workers, you must make sure you determine hourly wages carefully. To be able to do that (and make sure you are offering competitive hourly rates), you must also take in factors such as your industry, skills, and the experience you are looking for in a candidate.

Here are some hourly rates effective for 2024 based on federal pay grades that you can use as a reference when defining your own compensation packages:

- Entry-level positions (an associate’s or bachelor’s degree) — hourly rates range from $18.10 to $23.52,

- Mid-level positions (a bachelor’s or master’s degree) — hourly rates range from $24.60 to $31.97, and

- Top-level positions (a master’s degree or Ph.D.) — hourly rates range from $42.41 to $55.14.

Step #5: Add in employee benefits

Apart from direct compensation, in order to attract top talent, you’ll also need to offer competitive benefits packages when crafting your compensation strategy.

Therefore, make sure you include the most common employee benefits in your employee compensation package. Such benefits include (but are not limited to):

- COBRA health insurance — additional 18 months of health coverage to eligible employees after job termination, either voluntary or involuntary (applicable to companies with 20 employees or more),

- Workers’ compensation insurance — medical insurance and compensation to employees who suffered an injury or illness in the workplace,

- Disability insurance — compensation benefits provided to employees due to ‘temporary disability’ that occurred in the workplace,

- Paid holidays — in order to stay competitive, employers may provide employees with paid holidays as a way to boost employee morale,

- Family and medical leave — includes maternal, paternal, and adoption leave (not required to be paid leave, by law),

- Flexible schedules — employers may choose to offer flexible work arrangements such as a 4-day workweek or a 9/80 work schedule that contribute to a better work/life balance,

- Hazard pay — provided to employees whose job duties require them to work in unsafe conditions (such as security and military professions),

- Regular work breaks — times off during work time provided for lunch breaks, short breaks, and others.

If you are not sure about the holidays (paid or unpaid) you are entitled to while living and working in the US, head on to the following blog post to learn more about it:

- What are paid holidays and how do they work?

Bonus tip #1: Calculating commissions

If you’ve decided to include commissions in your compensation planning (either as the only form of compensation or a supplementary form of compensation), there are several factors you should consider when defining commissions for your employees:

- The commission rate — this is the percentage (e.g., 5%) of fixed compensation (e.g.,$25) employees will get for each sale they make.

- The total number of sales,

- The gross margin of the product being sold,

- The total net profit of the product being sold (when you want to inspire your sales team to focus on selling more profitable products in your offer),

- The cash received from sales (when you want to inspire the sales team to collect all overdue receivables), and

- The inventory (when you’re looking to eliminate a product from stock).

- The overrides — one percentage (e.g., 5%) of fixed compensation (e.g., $25) may apply before the employees reach a certain goal, after which they can count on a higher percentage (e.g., 8%) or fixed compensation (e.g., $30).

- The splits — in the case when two or more employees are responsible for the sale they split the commission.

- The payment delay — commissions are usually calculated subsequently at the end of the month.

Bonus tip #2: Calculating bonuses

Sometimes, you’ll want to include bonuses in your employee compensation packages as additional incentives for high-quality performance.

Here are some of the bonuses you can consider offering:

- Signing bonuses — bonuses offered to job candidate executives as incentives to inspire them to accept positions,

- Salary-based bonuses — based on the amount of hourly wages or annual salaries the employees are making (the higher the wages or salaries, the higher the bonuses),

- Bonuses based on department goals — once a team or department meets the predefined goal, all members of the team receive bonuses,

- Referral bonuses — the higher the number of customers referred, the higher the bonuses for the employees who referred them,

- Performance bonuses — bonuses based on the employee’s overall performance or achieved specific goals at work,

- Holiday bonuses — non-performance-based bonuses typically paid around a beloved national holiday, such as Christmas,

- Quarterly or annual bonuses — if the company reaches a certain net profit goal, the employees receive a flat rate bonus or percentage,

- Retention bonuses — bonuses paid to top performers in order to keep them, and others.

Benefits of a fair compensation system

A fair compensation strategy must be developed and implemented without any prejudice or favor to anyone or anything, showing equity in the workplace.

As such, a compensation system has a handful of benefits for both the organization and the employees:

- It helps you attract top talent through competitive compensation packages,

- It helps employees understand exactly how valued they are within the organization,

- It motivates employees to perform better at work ,

- It raises the morale and cooperation level among the people,

- It elevates employee satisfaction for a job well done, and

- It promotes workplace equity.

If you want to learn more about calculating work hours and streamlining your payroll processes, head to the following link:

- How to calculate work hours: A step-by-step guide to calculating payroll and hours worked

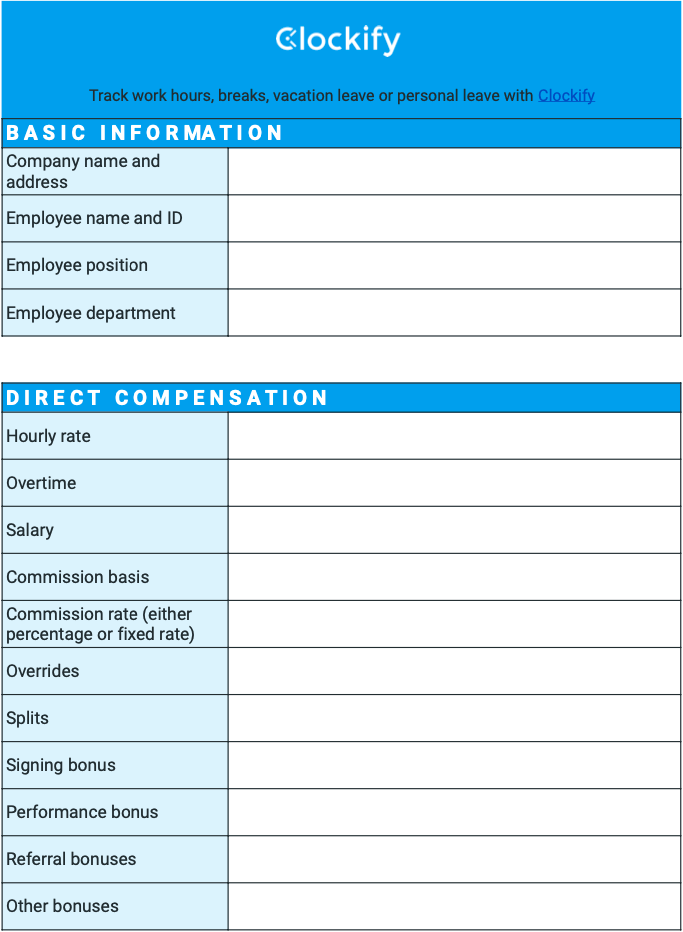

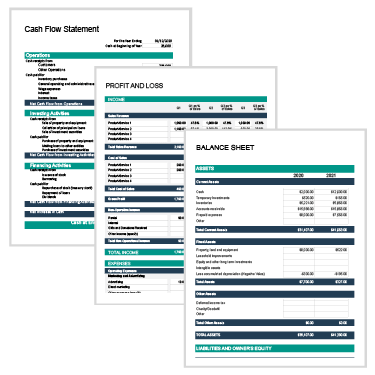

Compensation plan template

Now that you know what you need to include in your compensation plan, here is an example of a compensation plan template that you can follow when defining your compensation packages.

You can download the template and choose the form that suits you best, whether that’s Google Sheets, Google Docs, PDF, Excel, or Word.

⏬ Download an Employee Compensation Plan in Google Sheets

⏬ Download an Employee Compensation Plan in Google Docs

⏬ Download an Employee Compensation Plan in PDF

⏬ Download an Employee Compensation Plan in Excel

⏬ Download an Employee Compensation Plan in Word

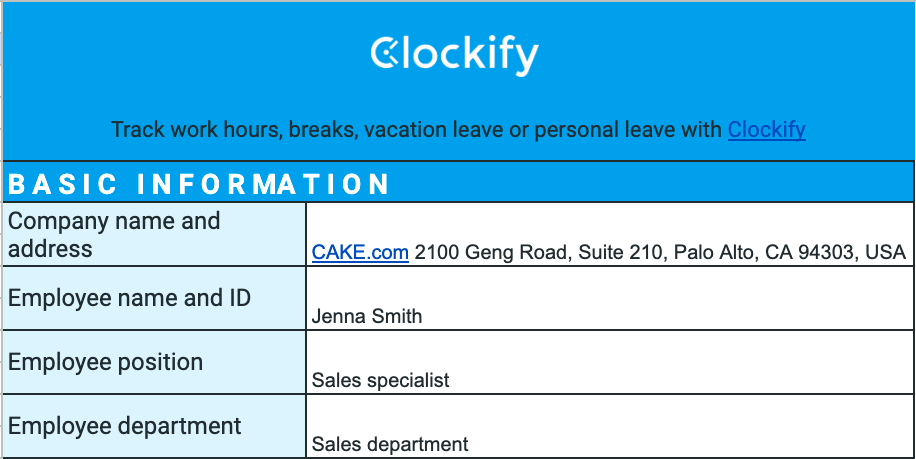

What is an example of a compensation plan?

The following is an example of a filled out compensation package template. The example plan below contains some of the most important information when preparing a compensation package for your employees, including:

- Basic information,

- Direct compensation information,

- Benefits,

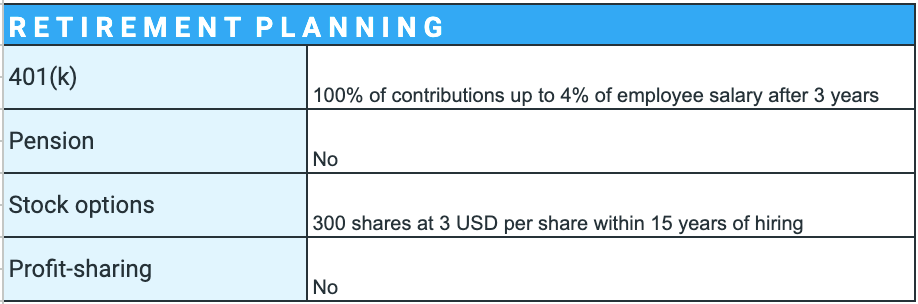

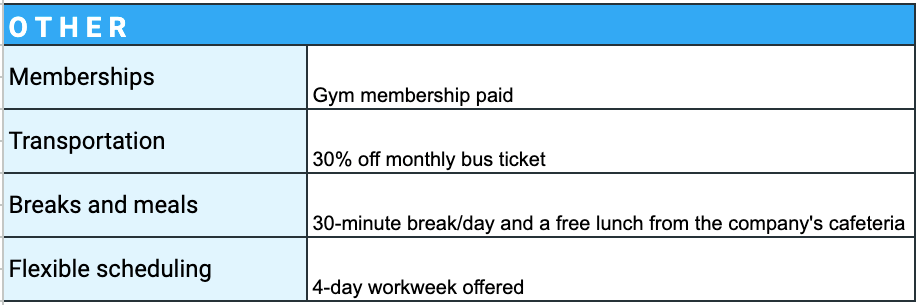

- Retirement planning, and

- Other relevant information.

Most of the information in the compensation plan example we already discussed in the above text, and we hope this example helps you craft your compensation package successfully and make sure you offer equity to your employees at the same time.

As for the direct compensation section in the template, you can see that the employee is an hourly worker hence there’s no salary information. Since she is a sales specialist, you can see all the details about her commission-based compensation, too.

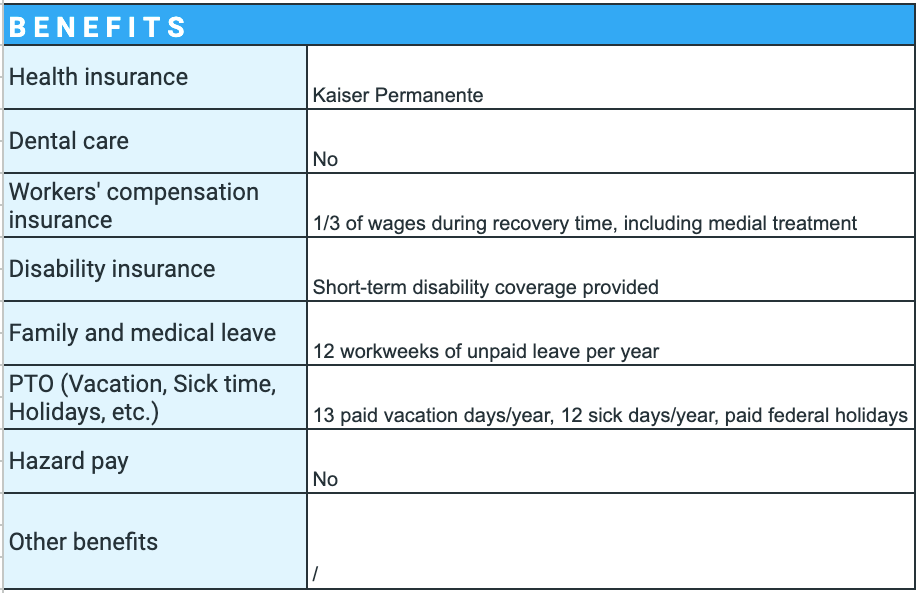

The next section in the template is about the employee’s benefits — whether the employee in question is given dental care, information about medical insurance, time off, and others.

As for the retirement planning section, the template provides information about the employer-paid retirement savings plan, eligibility to buy shares of the companies and under which conditions, or whether the employee may obtain a percentage of the company’s total earnings or not.

Finally, the template allows you to write any additional information about certain benefits, break and meal periods, reimbursement of transportation, and others.

Tracking work hours vigilantly is the cornerstone of fair employee compensation

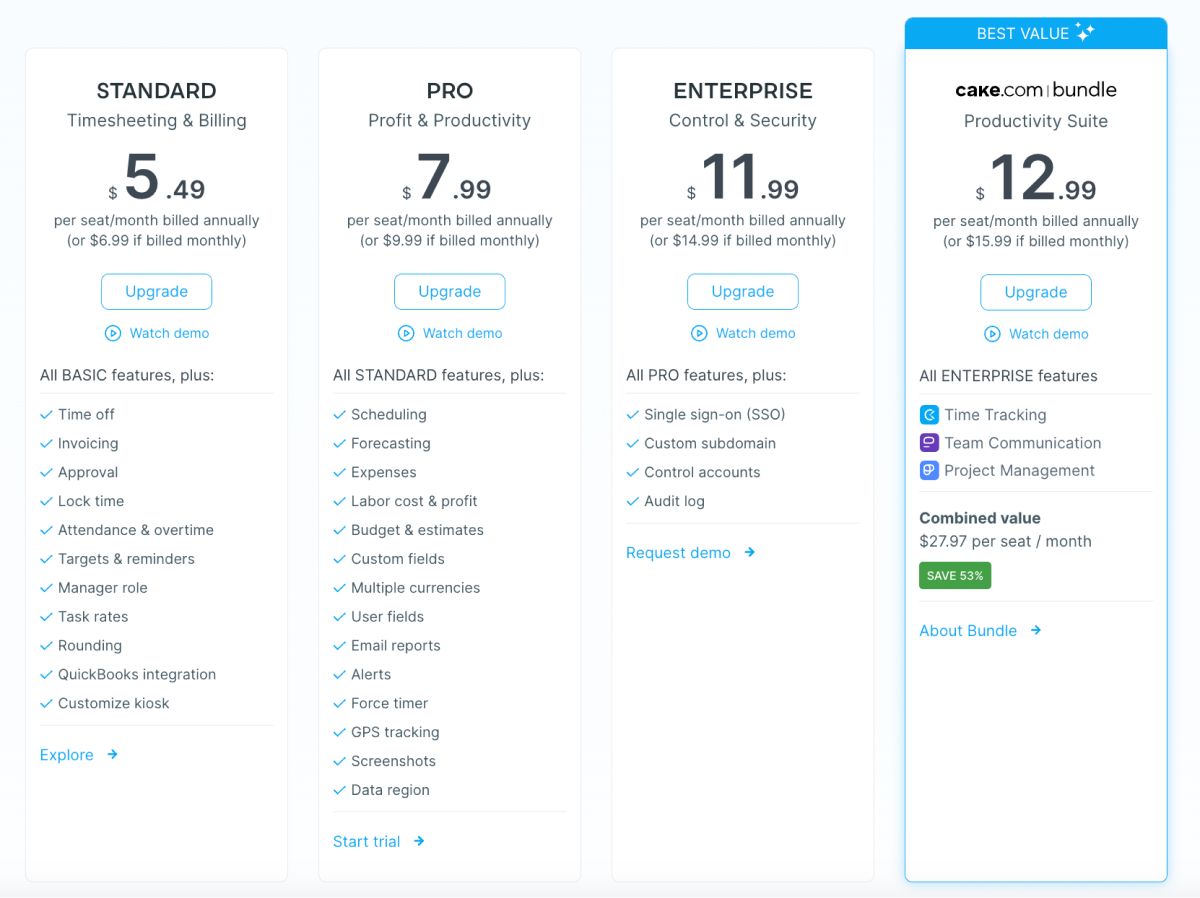

Whether you need to fill in employee timesheets, track overtime, PTO, or billable hours, having a reliable tool is critical. Clockify is an efficient business solution that can help you with that and so much more, as it abounds with features designed to work in a variety of business cases.

With Clockify, you’ll also be able to define hourly rates for all people within your company and have their pay calculated automatically based on the number of hours they worked in a given time period.

What’s more, no matter if you hire salaried or hourly workers, exempt or non-exempt, Clockify’s employee hours tracker will also help you stay on top of compensatory time (provided that your employees are eligible for comp time, of course).

Clockify can be your ally in making sure your employees are compensated accurately and timely, no matter which employees you hire.

Marija Kojic is a productivity writer who's always researching about various productivity techniques and time management tips in order to find the best ones to write about. She can often be found testing and writing about apps meant to enhance the workflow of freelancers, remote workers, and regular employees. Appeared in G2 Crowd Learning Hub, The Good Men Project, and Pick the Brain, among other places.

Where does the time go?

START TRACKING TIME

with Clockify

Recurring Billing: Definition, Types, and Best Alternative

Though convenient for subscription businesses, recurring billing comes at a cost. Learn how to optimize recurring payments.

Avoid the Dreaded Cost Overrun With This Simple Strategy

A project cost overrun happens when the project costs exceed the budget estimate. Here’s how to avoid it.

Smart Ways for Monthly Expense Tracking

Learn about some easy-to-apply ways for monthly expense tracking, with methods.

4 Essential Tips for Building Stronger Client Relationships

Learn how to effectively manage client relationships and turn every client into a return customer.

Keep Your Business Afloat With These Budgeting Methods

Learn how to use popular budgeting methods to your advantage and get your budget management in order.

Ace the Test: Steps to Pricing Services for Company Heads

Pricing services feels like a high-stakes gamble for every business owner. Here’s a simple guide to setting prices confidently.

FREE FOREVER • UNLIMITED USERS

Free time tracker

Time tracking software used by millions. Clockify is a time tracker and timesheet app that lets you track work hours across projects.

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Forums Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- Happiness Hub

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

- Managing Your Money

- Personal Income

How to Write a Compensation Proposal

Last Updated: March 24, 2023 References

This article was co-authored by Jill Newman, CPA . Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting. This article has been viewed 174,540 times.

A compensation proposal is a letter addressed to an employer seeking a new or improved rate of pay. It can serve as the first step in negotiating a higher salary. Letters often work better than asking your boss in person because it gives him or her time to process the request without being put on the spot. Though writing a letter may seem less stressful than having a meeting, you will still have to conduct research and present it in a formal way to improve your chances of having a successful negotiation.

Gathering Information

- If you're unaware of what your exact compensation is, collect your past pay stubs. If you don't have these, ask at the company payroll department for your financial history at the job.

- Not all companies do regular performance reviews. In this case, there are a few things you could do to gather information to help your case. For example, if you have team or planning meetings for your area or department, then these could be good opportunities to check in with your boss and assess your performance on a regular basis.

- You could periodically schedule a meeting with your boss and ask how you're doing at your job. Make note of the feedback you receive. If your boss says you're doing a great job, use this as your positive feedback. If your boss tells you a few things you could improve upon, take that feedback seriously and work on those areas. Then when you write your letter, you can say how you've taken your boss's advice and improved.

- If you have a direct supervisor who's not your boss, see if he or she will give you some feedback. If you get good feedback, you can ask your supervisor to write a letter to your boss about your good performance.

- You may also consider looking for a mentor at work. If your company has a mentorship program, then indicate your interest to your supervisor. Or, if there is not mentorship program, then try talking with a more experienced, successful employee and see if they would be willing to be your mentor.

- Take all feedback you receive without getting defensive. If you get some negative feedback, don't argue. Instead, take the advice and use it when you write your letter. You can demonstrate that you've taken feedback to heart and improved your performance. [3] X Trustworthy Source Harvard Business Review Online and print journal covering topics related to business management practices Go to source Keep in mind that businesses are results-driven, so it is important to put your emotions aside during this process.

- Use sites like PayScale or Glassdoor to research salaries within your industry.

- For example, you might find that the average worker in your field earns between $45,000 and $50,000. If you're earning $44,000, you're below the average, and it would certainly be reasonable to ask for more money. You can use this as leverage when you write your proposal.

- If, however, you're making $52,000, you might have trouble getting an increase. You boss could counter your request by saying that you make an above-average salary.

- If you're earning above the industry average, you could still ask for a raise, but you'll need a lot of evidence that you're a true asset to the company. Financial figures would help most, because it would show your boss that he or she is making money with you around.

- Also consider the company's budget. If things have been tough for a while, your boss may not be able to give you a raise even if he wanted to. If earnings have been high, however, you can take advantage of both the availability of money and your boss' good mood by asking then.

Writing Your Letter

- Place your name, title, and address on the top left of the paper.

- Place the date below this.

- Put your boss' name, title, and address below this.

- Address your boss appropriately. Start with "Dear Mr." or "Dear Mrs."

- Have 1-inch margins around the paper and use single spacing. Don't indent, just use a double space in between paragraphs.

- End with "Sincerely," then leave 4 lines so you can manually sign your name. Below this, type your name and title.

- For example: Dear Mr. Smith, Please allow me to once again express my pride in working for this company. I appreciate all the opportunities this job has granted me.

- You will need to provide concrete evidence of your performance in the letter. Be sure to include specific details, percentages, and figures about your contributions to the company. Avoid general statements such as, “I work hard” and “I do a great job.”

- Mention how sales have increased in your department, or how customer satisfaction has gone up.

- If you have any good performance reviews, cite them here. Also be sure to include copies of them with the letter.

- Include exact figures here. State exactly what you're making, and then state what the industry average is. Point out what the discrepancy is.

- If you're making above average, point out exactly why you're such an asset to the company that you deserve more.

- Write, "In line with my performance for this company, I request a compensation increase of 3% annually, which will bring my yearly salary to $50,000."

- It is often good to ask for slightly more than you actually want so if your boss negotiates with you, you'll end up closer to what you actually want. Don't go overboard, however, or you'll seem unreasonable. For example, if you want a 2% raise, ask for 2.5 or 3%, not 10%. [11] X Research source

Expert Q&A

- If you are in a position where you think you deserve greater compensation but an employer has already firmly stated what they are offering in terms of salary or benefits, think of other ways in which you can be reimbursed: relocation allowances, extra time off, greater retirement benefits, financial help with educational costs, etc. Thanks Helpful 0 Not Helpful 0

- Writing a compensation proposal is an alternative to in-person salary negotiations and should only be done when an employer indicates that he or she is open to such a proposal. Do not send a compensation or salary proposal out of the blue or without having been previously requested to do so. Thanks Helpful 0 Not Helpful 0

You Might Also Like

- ↑ https://hbr.org/2015/03/how-to-ask-for-a-raise

- ↑ https://hbr.org/2014/12/how-to-ask-for-feedback-that-will-actually-help-you

- ↑ http://www.businessinsider.com/how-to-ask-for-a-raise-and-get-it-2014-6

- ↑ http://businessletterformat.org/

- ↑ http://www.forbes.com/sites/learnvest/2014/05/07/how-to-ask-for-a-raise-and-get-it/3/

- ↑ http://www.salary.com/9-things-never-say-ask-for-raise/slide/10/

About This Article

To write an effective letter of compensation, start the body of the letter by reassuring your boss that you like your job and want to stay, so they don’t feel threatened. Then, mention what you have accomplished for the company, and compare your income to others in the industry so your boss knows what you and the job are worth. After that, include the exact amount you want to be paid, but ask about 1% more than you'll accept so you have room for negotiation. For tips from our Accountant reviewer on how to gather information for the letter, keep reading! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Cooper Sydon

Apr 1, 2017

Did this article help you?

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

wikiHow Tech Help Pro:

Level up your tech skills and stay ahead of the curve

Salary Increment Proposal to Management Sample: Free & Effective

In this article, I’ll share a comprehensive guide on crafting a compelling salary increment proposal, complete with a proven template and tips from my personal experience.

Salary Increment Proposal Generator

Disclaimer: This tool is for generating a basic salary increment proposal template. Ensure you personalize it and verify accuracy before sending it to management.

Key Takeaways

- Understand Your Worth: Research your role’s market value and how your contributions align.

- Be Specific: Quantify your achievements and how they’ve benefited the company.

- Professional Tone: Maintain a respectful and professional tone throughout the proposal.

- Follow a Structure: Use a clear, concise structure to present your case effectively.

- Timing Matters: Choose the right moment to submit your proposal for the best impact.

- Prepare for Discussion: Be ready to discuss your proposal in more detail if required.

Step-by-Step Guide to Crafting Your Proposal

Step 1: do your homework.

Before drafting your proposal, research the typical salary range for your position in your industry and region. Understand where you stand in comparison and how your experience and achievements position you within that range.

Step 2: Reflect on Your Achievements

List out your significant contributions to the company. Quantify these achievements in terms of revenue generated, costs saved, projects led, or any other relevant metrics.

Step 3: Draft Your Proposal

Trending now: find out why.

Start with a formal salutation, then move on to express your appreciation for your current role and the opportunities you’ve had.

Transition into discussing your contributions and the value you’ve added to the company. Next, present your salary research and state your request clearly.

Step 4: Review and Edit

Ensure your proposal is clear, concise, and free of errors. A well-written proposal reflects your professionalism and attention to detail.

Step 5: Submit Your Proposal

Choose the right time to submit your proposal, ideally after a successful project completion or during performance reviews. Follow up if you haven’t received a response within a specified timeframe.

Template for Salary Increment Proposal

Subject: Request for Salary Review – [Your Name]

Dear [Manager’s Name],

I hope this message finds you well. I am writing to express my gratitude for the opportunity to work as [Your Position] with [Company Name]. Over the past [Duration], I have thoroughly enjoyed contributing to our team’s success and growth.

During my time here, I have taken pride in [Briefly describe your key achievements and how they’ve benefited the company]. These accomplishments reflect my commitment to our collective goals and my continuous effort to contribute meaningfully to our team.

Based on my research and understanding of the industry standards, I’ve observed that the typical salary range for someone in my position, with similar responsibilities and in our region, is [Provide data].

Given my contributions and achievements, I kindly request a review of my current compensation to align with the industry standards at [Specific Requested Amount] annually.

I am eager to discuss this proposal further and am open to feedback or any additional information you might require.

Thank you very much for considering my request. I look forward to continuing to contribute to our team’s success.

Sincerely,

[Your Name]

Personal Tips from Experience

- Be Prepared for a Discussion: Your proposal might initiate a dialogue. Be ready to discuss your points confidently and calmly.

- Timing is Key: Present your proposal at a strategic time, such as after a major success or during annual reviews.

- Stay Professional: Regardless of the outcome, maintain professionalism. This proposal is a negotiation, not a demand.

Final Thoughts

Writing a salary increment proposal is about demonstrating your value to the company and aligning your compensation with the market and your contributions.

Follow the steps outlined, use the template as a guide, and remember the tips based on personal experience to create a compelling proposal.

Salary Increment Impact Over Time Calculator

Frequently asked questions (faqs).

Q: How Do I Approach Writing a Salary Increase Proposal Letter?

Answer: In my experience, the key to writing an effective salary increase proposal letter is to be concise and clear. I start by addressing my manager directly and stating my purpose in the first paragraph.

Then, I highlight my achievements and contributions to the company, aligning them with specific goals or projects. I make sure to mention any new skills or responsibilities I’ve taken on since my last salary review.

In the final part, I propose a specific salary figure or range based on my research of industry standards. I close the letter respectfully, expressing my willingness to discuss the matter further.

Q: What Should I Avoid in My Salary Increase Proposal Letter?

Answer: From my experience, it’s crucial to avoid sounding demanding or entitled in the salary increase proposal letter. I steer clear of emotional language and focus on presenting a factual and professional case.

I don’t compare my salary to that of my colleagues, as it can come across as unprofessional. Instead, I base my request on my performance and market value.

I also avoid making ultimatums or implying that I might leave if my request isn’t met; this can backfire and damage my professional relationship with my employer.

Q: How Do I Justify My Request for a Salary Increase?

Answer: To justify my request, I compile a list of my accomplishments and how they’ve positively impacted the company. I include any quantifiable results, like an increase in sales, improvement in efficiency, or successful completion of major projects.

I also mention any additional responsibilities I’ve assumed and how they’ve contributed to my role’s evolution. If I’ve completed any relevant training or certifications, I include those too. By showing how my role and responsibilities have grown, I make a strong case for why a salary increase is justified.

Q: When Is the Best Time to Submit a Salary Increase Proposal Letter?

Answer: In my experience, timing is everything. I find it most effective to submit my salary increase proposal letter after a successful project completion or during a performance review cycle.

These moments often highlight my contributions and value to the company. I avoid times of financial strain for the company, like after a major loss or during economic downturns. I also keep in mind the company’s review schedules and try to align my request with these periods.

Q: How Can I Follow Up on My Salary Increase Proposal Letter?

Answer: After submitting my letter, I wait for about a week before following up. I usually send a brief email to my manager, expressing my willingness to discuss the proposal in more detail.

If I don’t hear back within another week, I request a meeting to talk about it in person. During the meeting, I stay calm and professional, ready to discuss and negotiate as needed.

I also prepare myself to listen to any feedback or counteroffers and remain open to a discussion that may lead to a mutually agreeable solution.

MORE FOR YOU

Writing a powerful request letter for air conditioner replacement (free sample).

In this article, I’ll share my personal guide to writing a compelling request letter for an air conditioner replacement, along with a proven template and…

Read More »

Goodbye Email To Coworkers After Resignation: The Simple Way

Craft a heartfelt farewell with our "Goodbye Email to Coworkers After Resignation" template. Easy, professional, and personal.

Urgent Alert: Absence Excuse Letter for Work Template

Secure your time off with our absence excuse letter template. Communicate professionally and maintain your work ethic effortlessly

Salary Negotiation Counter Offer Letter Sample: Free & Effective

As someone who has crafted numerous salary negotiation counter-offer letters, I’ve gained unique insights into the art of negotiation. Crafting a successful counter offer letter…

Formal Complaint Letter Sample Against A Person: Free & Effective

In this article, I’ll guide you through the steps to write an impactful formal complaint letter, share a template to get you started, and offer…

Medical Reimbursement Letter To Employer Sample: Free & Effective

As a seasoned professional in drafting medical reimbursement letters for various clients, I’ve seen firsthand how a well-crafted letter can make a significant difference in…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

AI Research Assist Your go-to AI-powered research assistant

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Plan Writing & Consulting We create a business plan for you

Business Plan Review Get constructive feedback on your plan

Financial Forecasting We create financial projections for you

SBA Lending Assistance We help secure SBA loans for your business

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Customer Success Stories Read our customer success stories

Help Center Help & guides to plan your business