🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a Financial Plan for a Business Plan

Noah Parsons

4 min. read

Updated July 11, 2024

Creating a financial plan for a business plan is often the most intimidating part for small business owners.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan in business plans

A sound financial plan for a business plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, you’ll need to include a few additional pieces of information as part of your business plan’s financial plan example.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your financial plan for a business plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan’s financial plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

How to Set and Use Milestones in Your Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Free Financial Planning Templates

By Andy Marker | September 21, 2017

- Share on Facebook

- Share on LinkedIn

Link copied

Whether you’re starting a business or looking for ways to grow an existing company, creating and following a financial plan can help ensure success. An effective plan can inform business decisions, provide documentation for investors and other stakeholders, and serve as a guide to help you reach objectives. Some businesses may choose to work with financial consultants or use software to manage financials, but for some teams, templates offer an easy method to begin strategic planning. Below, you’ll find multiple free financial planning templates for both business and personal use.

These free templates are designed for users with a wide range of experience levels, and offer professional quality along with simplicity. You’ll find templates for goal planning, financial projections, budget planning, retirement calculations, and more.

Business Financial Planning Templates

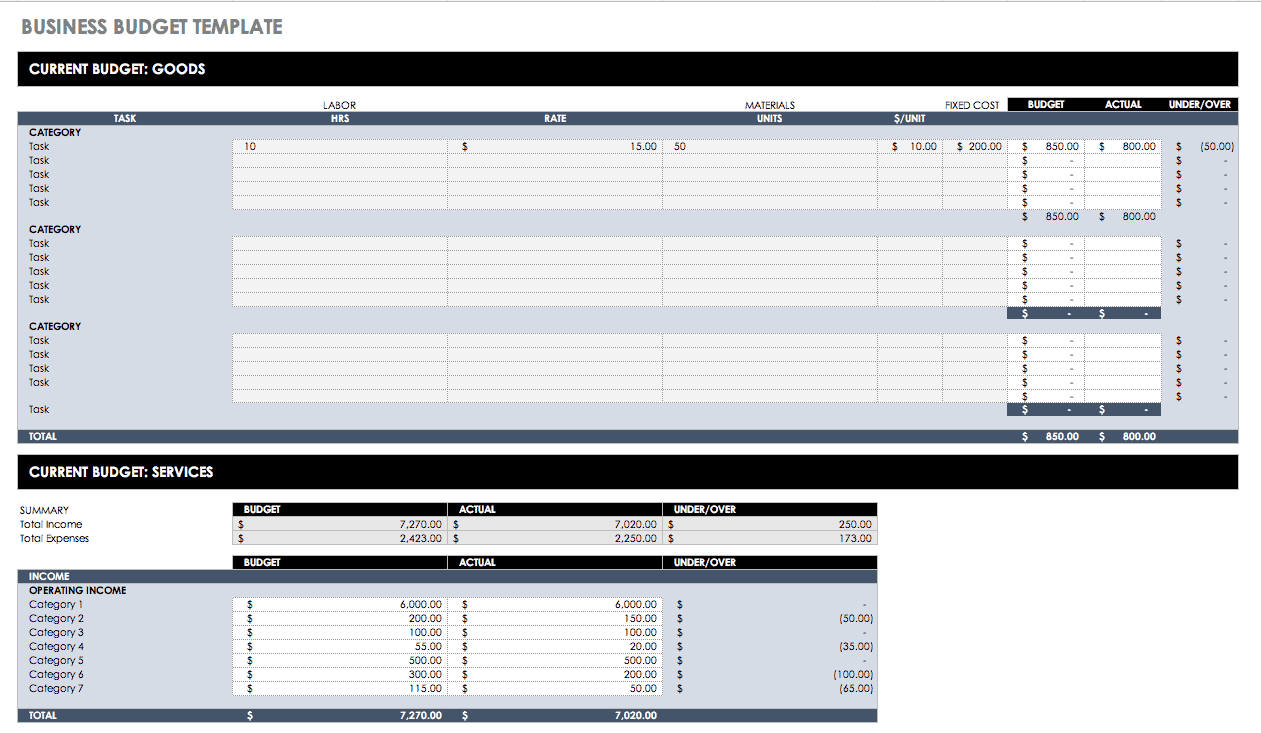

Business budget template - excel.

Download Business Budget Template

Excel | Smartsheet

This business budget template provides a mix of detailed spreadsheets and graphical data reports. You can estimate expenses, track actual expenditures, and view variances, all of which are summarized by month and visually represented in charts. This information allows you to create a comprehensive business financial plan template.

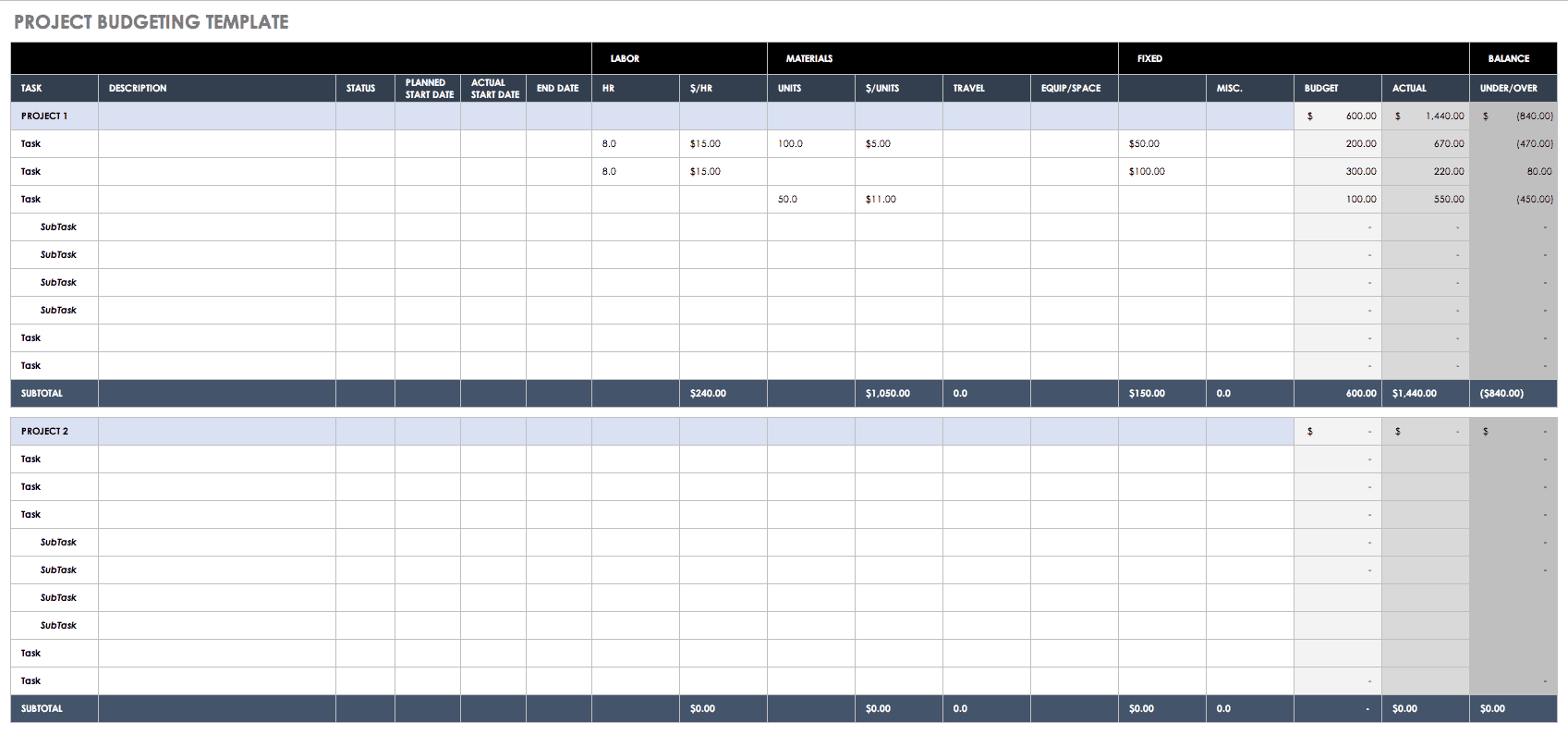

Project Budget Template - Excel

Download Project Budget Template

Designed for projects, this template allows you to list costs for each task. Depending on the type of project, you may include hourly services that contract employees provide, equipment costs, or other expenses. Create an estimated budget and then compare actual expenses to help with financial planning on future projects.

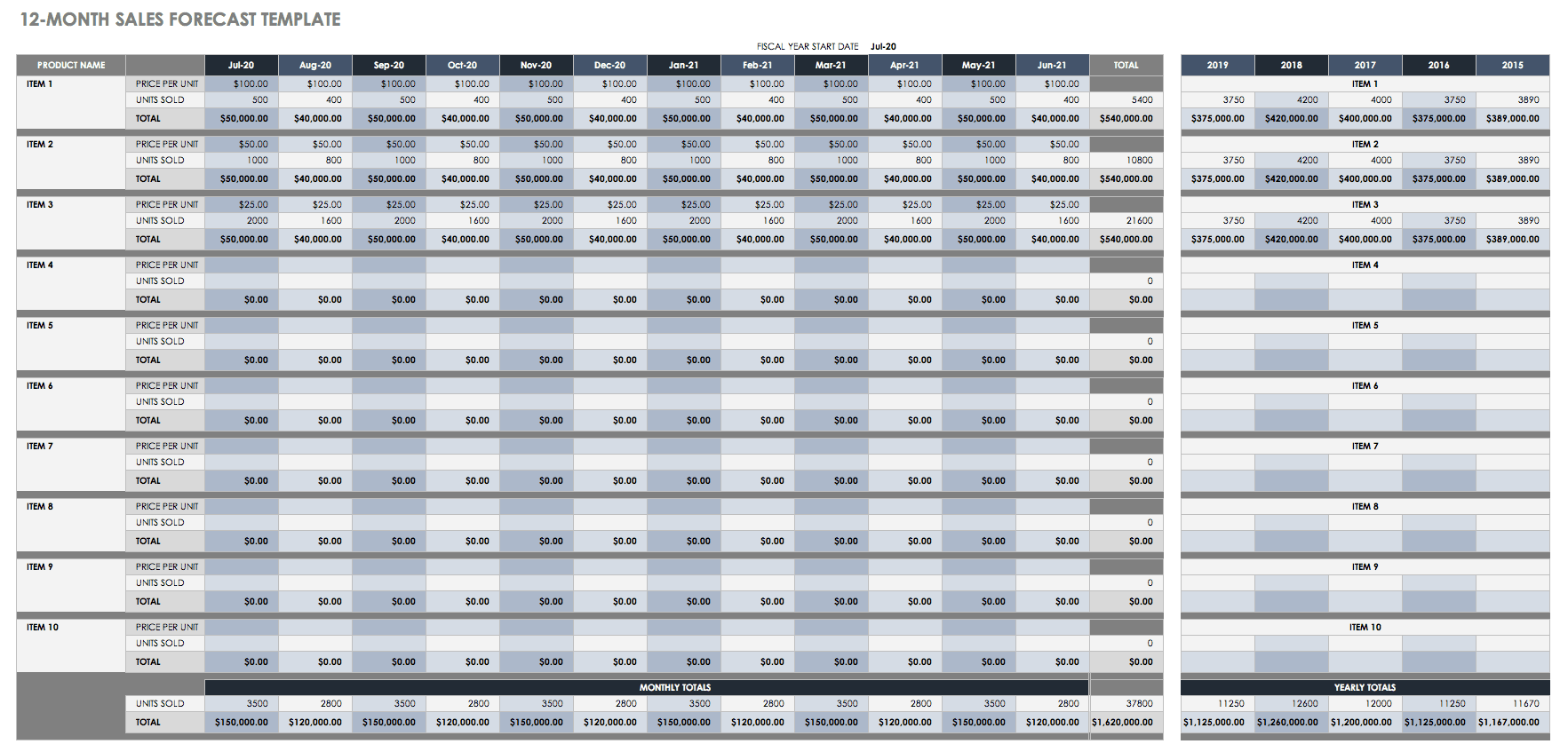

12-Month Sales Forecast Template - Excel

Download 12-Month Sales Forecast Template

Use this sales forecast template to create financial projections for individual products on a monthly and annual basis. You can also track sales performance over time and compare figures from previous years. Color-coded cells make it easy to view data for each month, and the template calculates monthly and annual totals.

Event Budget Template - Excel

Download Event Budget Template

Whether you’re planning a conference, company party, fundraiser, or wedding, any tool that helps organize your event planning process can reduce stress and aid in creating a successful event. This budget template lists the many expenses involved in an event, from venue rentals to programming and advertising. It also compiles the data you enter into visual charts so that you can quickly get an idea of your event budget allocation.

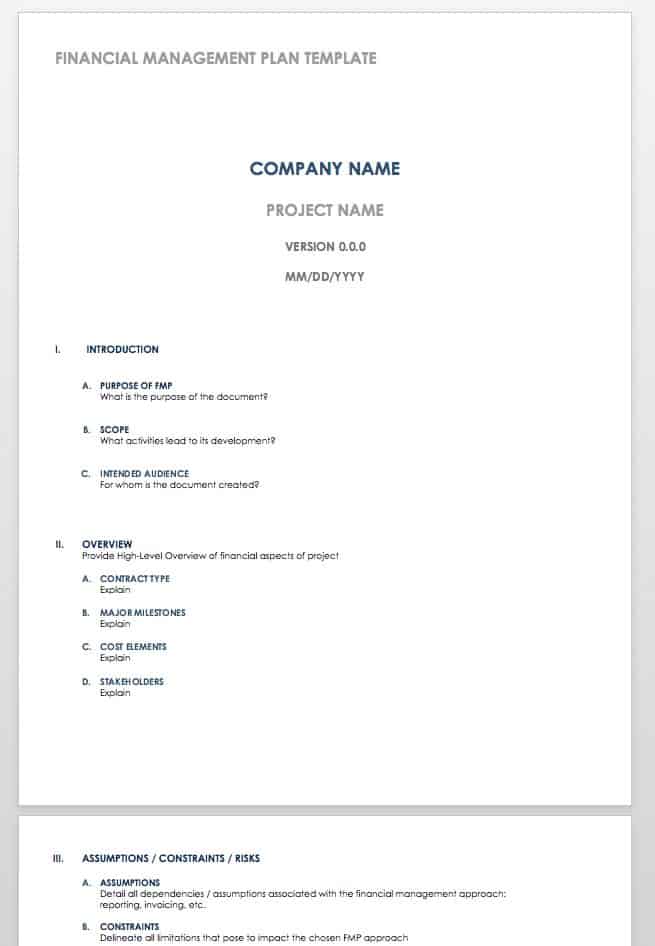

Financial Management Plan - Word

Download Financial Management Plan

Word | Smartsheet

Create a financial strategic action plan with this Word template. You’ll find a basic outline to follow, including sections for an overview of your business or project, assumptions, risks, financial management methods, and more. Once you have created a comprehensive financial plan, use it as a living document, just like you would a business plan. You should review and update financial templates regularly in order to assess progress, provide accountability and accuracy, and ensure that it continues to meet your needs.

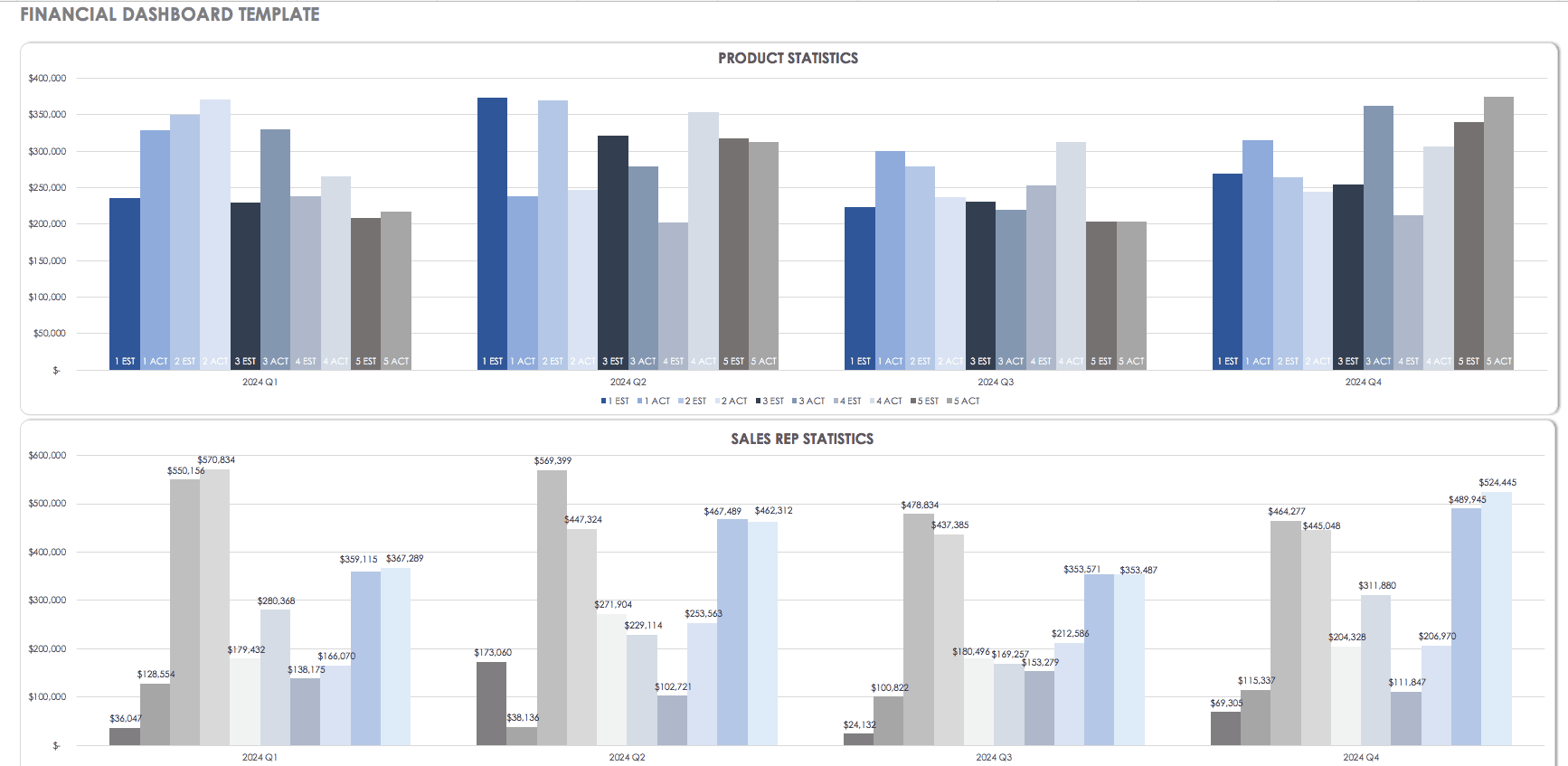

Financial Dashboard Template - Excel

Download Financial Dashboard Template - Excel

This template provides a summary report of financial data with a dashboard view, which makes it easy to compile and quickly review information. You’ll get a combination of bar charts, a pie chart, and a graph to compare statistics over time. Use the template to measure product performance, view sales data, and chart annual revenues or other financial information.

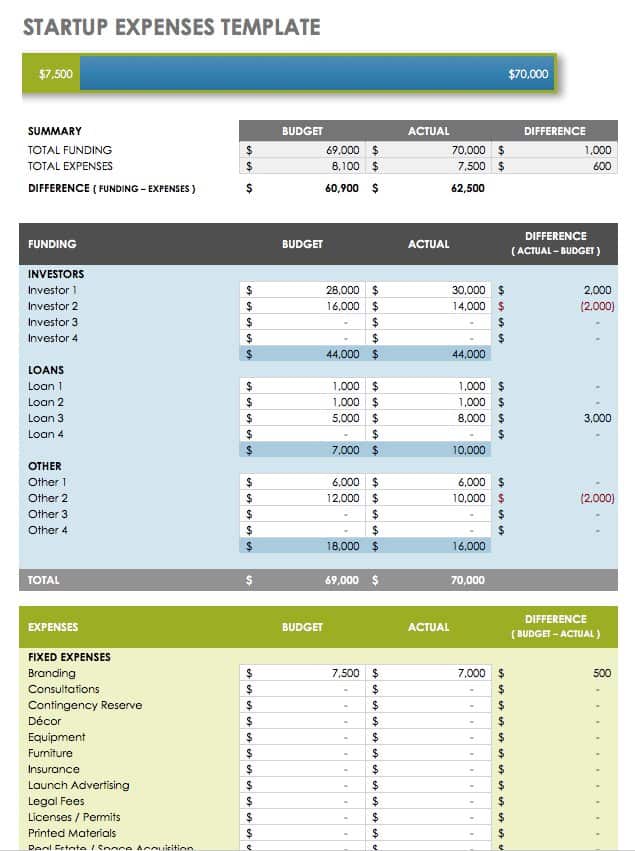

Startup Expenses Template - Excel

Download Startup Expenses Template - Excel

If you’re starting a business, this template can help you identify potential funding sources as well as necessary expenses to get your venture up and running. Similar to a budget template, you can track both estimated and actual costs, and make adjustments as needed. Identifying startup expenses can support your business planning process and help ensure that you have adequate financial resources to reach your goals.

Break-Even Analysis Template - Excel

Download Break-Even Analysis Template

A break-even analysis shows when a business will meet all of its expenses and begin to reach financial profitability. To do this analysis, enter your fixed and variable expenses into the template and the pre-set formulas will calculate how much revenue a business needs to break even.

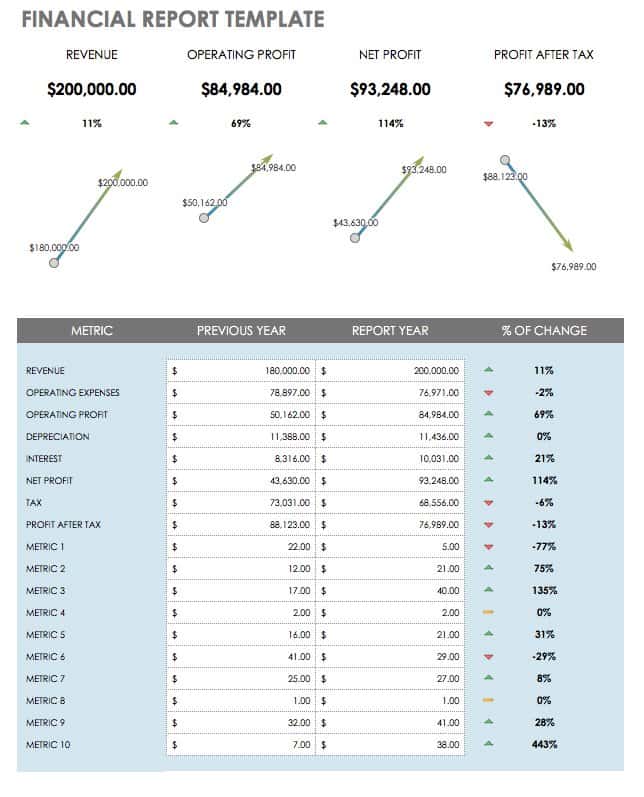

Financial Report Template - Excel

Download Financial Report Template

Create an annual financial report for your business that shows key metrics in an easy-to-read format. Getting a financial overview allows you to track performance over a given time period, and a summary report simplifies communication with stakeholders. You can easily print and share this Excel template as a PDF document.

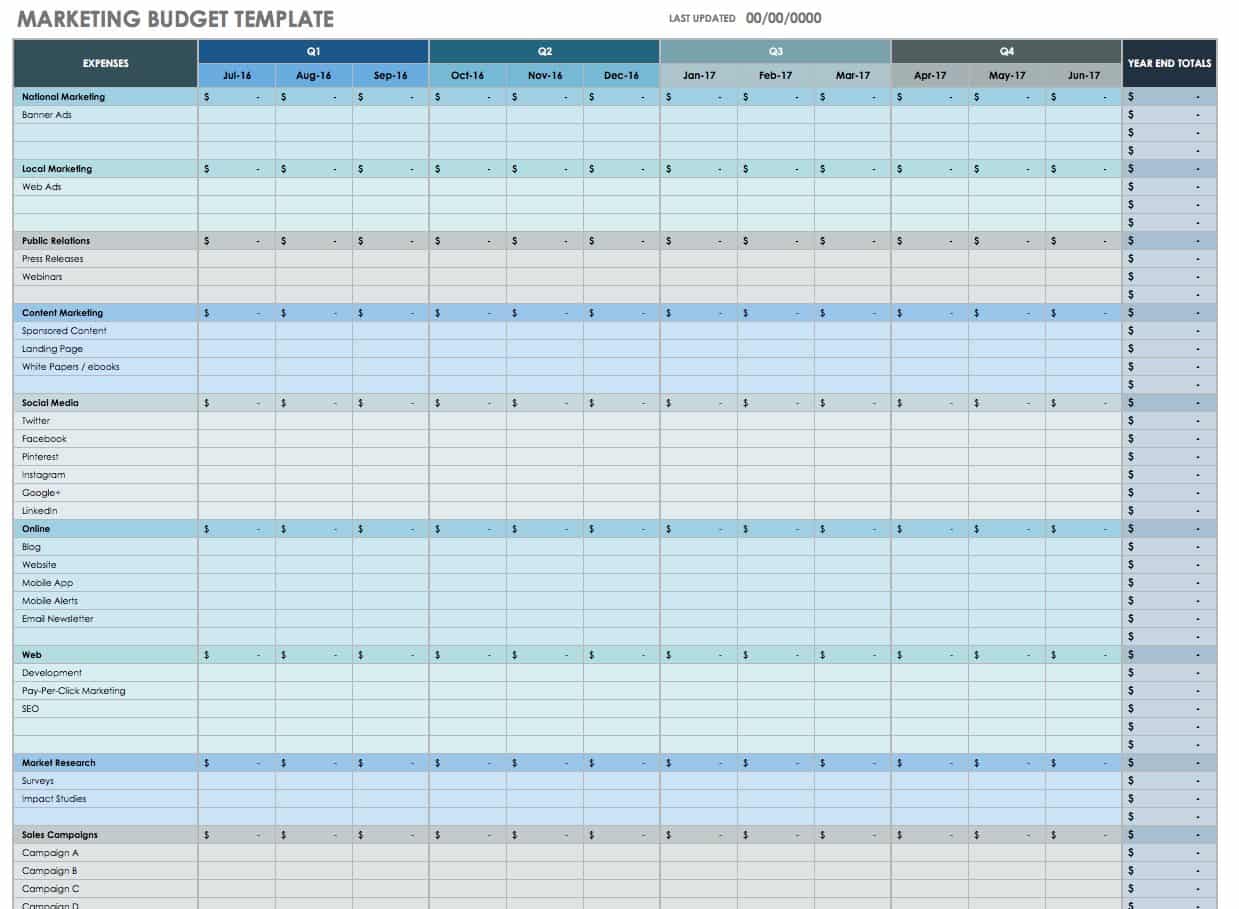

Marketing Budget Template - Excel

Download Marketing Budget Template - Excel

Create a comprehensive marketing budget plan with monthly, quarterly, and annual views on one template. In the first column, you’ll find a list of marketing expenses that include public relations, social media, advertising, online content, and more. There is also a section for listing specific marketing campaigns so that you can estimate and compare costs for each.

Personal Financial Planning Templates

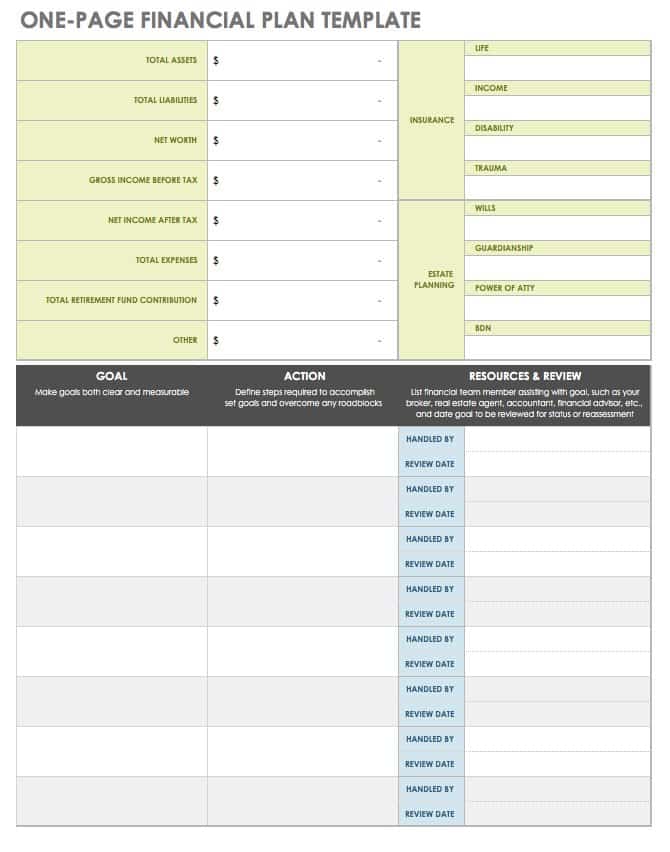

One-page financial plan template.

Download One-Page Financial Plan Template

Excel | PDF

Individuals can also benefit from strategic financial plans. This one-page template allows you to create a personal financial plan that is concise yet comprehensive. Determine your current financial situation, create an action plan for reaching goals, and use the plan to track implementation and progress. If needed, you can include numbers for life insurance or estate planning.

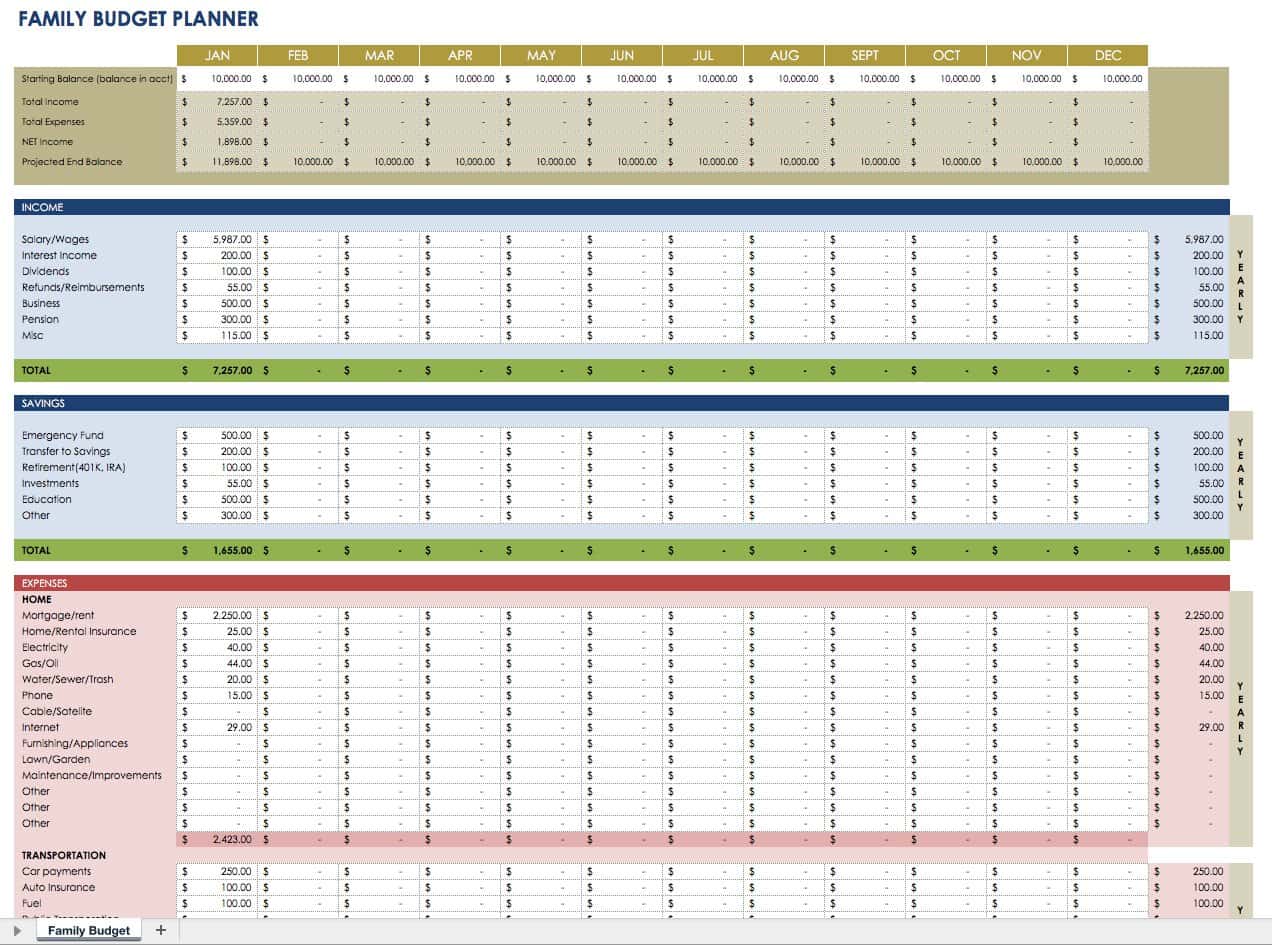

Family Budget Planner Template - Excel

Download Family Budget Planner Template - Excel

Families can use this planner to track household expenses and create a monthly balanced budget. You’ll find a list of common expenses including housing, transportation, healthcare, and entertainment, but you can also edit these categories to align with your specific monthly costs. The template also includes a section for savings to help you plan for retirement, create an emergency fund, and track investments.

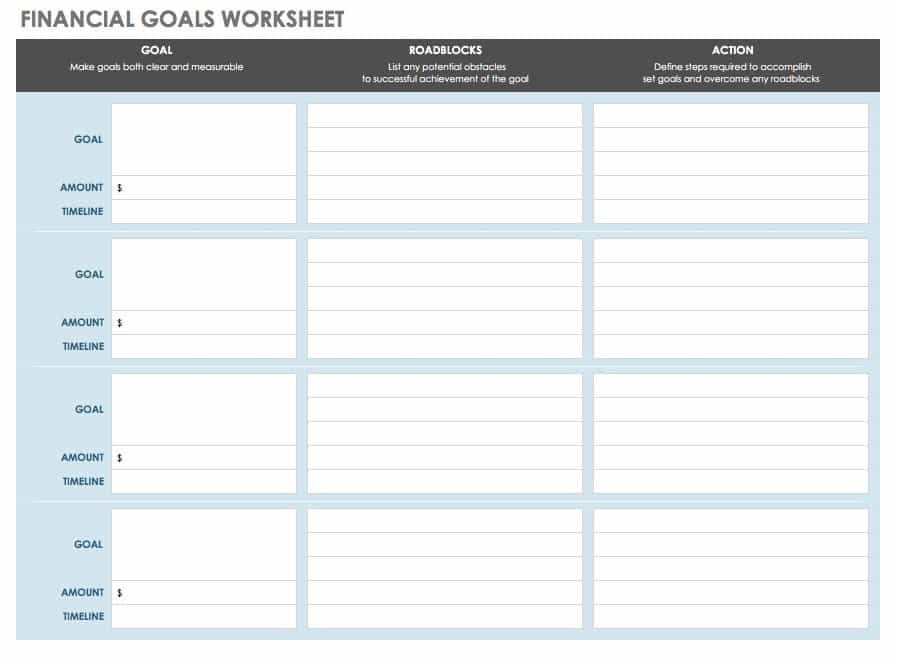

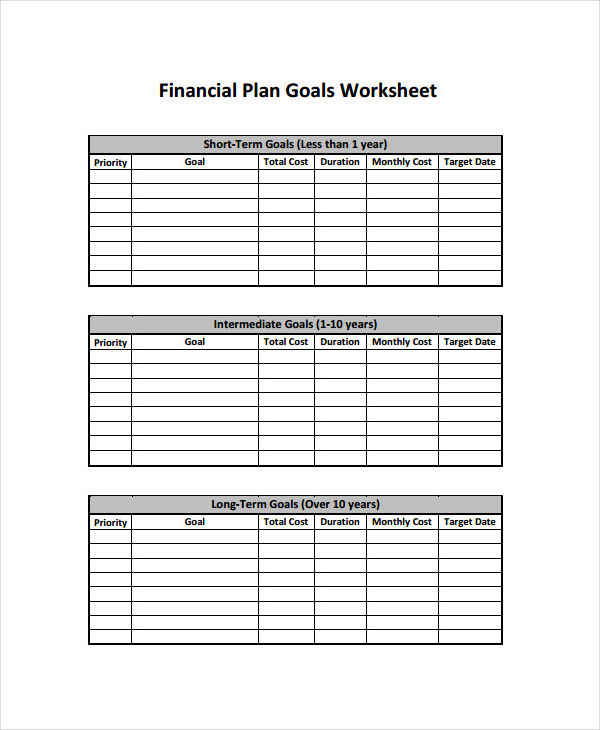

Financial Goals Worksheet

Download Financial Goals Worksheet

Excel | Word | PDF

Goals are only dreams unless you take steps to achieve them. Use this worksheet to clarify your top goals, identify potential roadblocks, and list actions you can take to overcome obstacles and reach your desired outcome. Goal planning can help prioritize objectives, create a realistic timeline, and provide accountability.

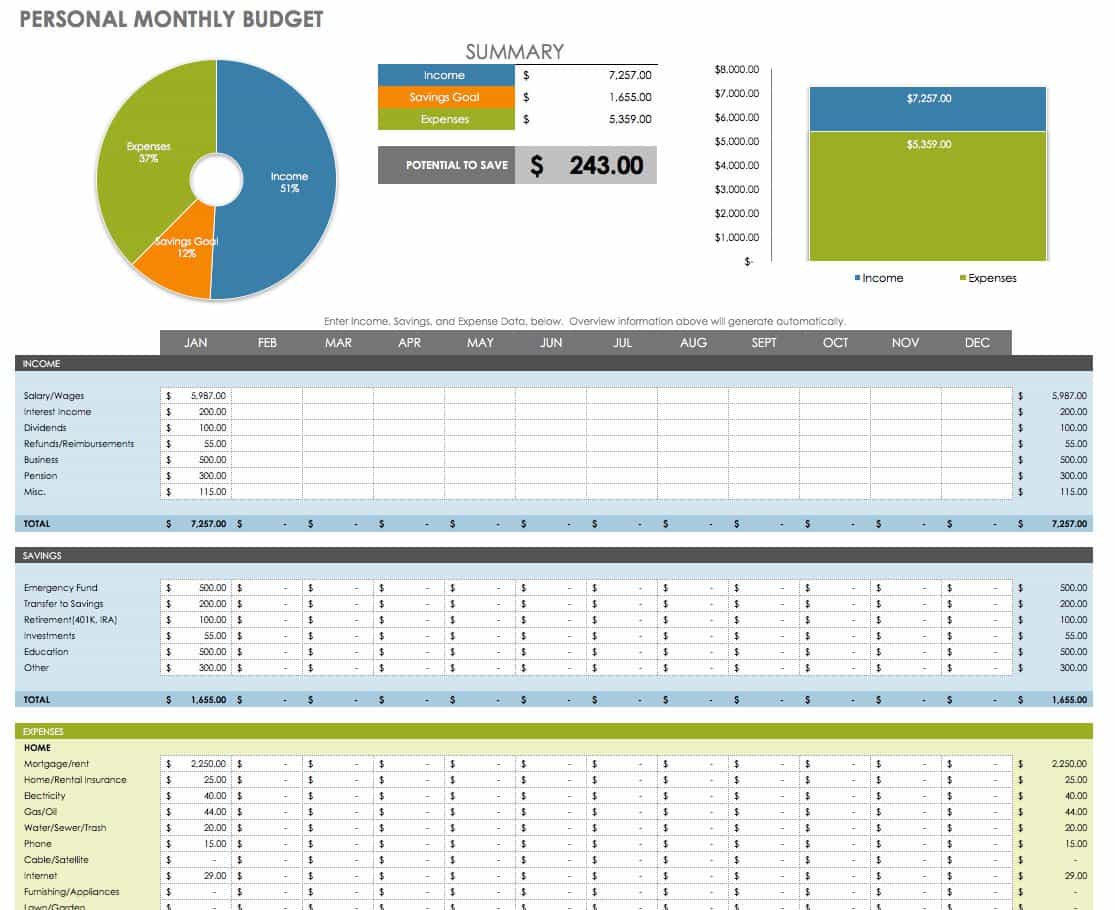

Personal Monthly Budget - Excel

Download Personal Monthly Budget - Excel

This monthly financial planner template provides a detailed budget along with a visual summary of your data. It includes sections for listing all sources of income, different savings accounts, and all of the expenses required to meet basic needs and support your lifestyle. You can use this template to plan for each month as well as to track earnings and expenditures over time.

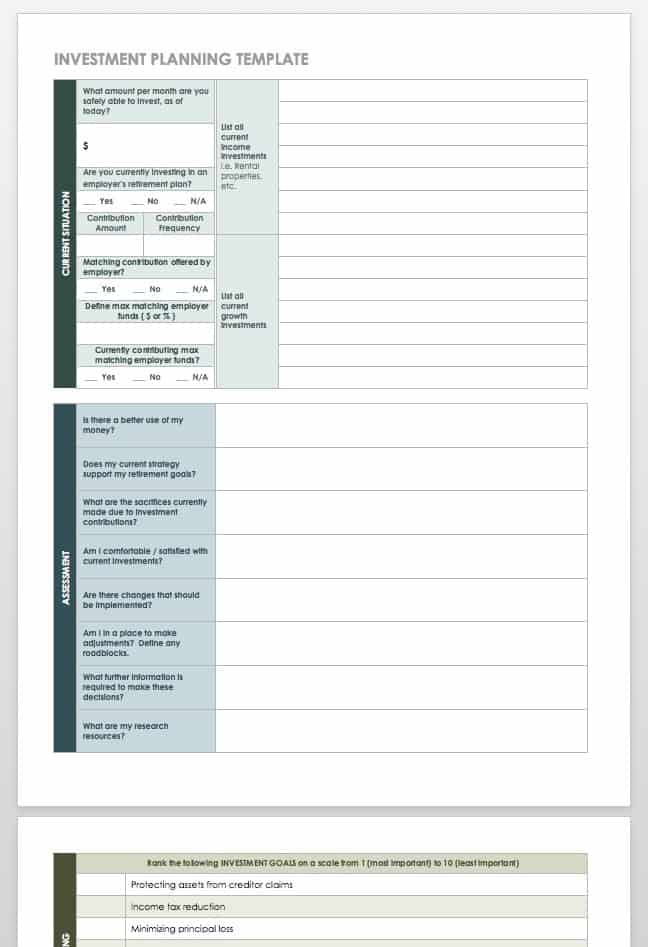

Investment Planning Template

Download Investment Planning Template

Word | PDF

Use this template to analyze your financial situation, assess your investment strategies, and determine investment goals. This worksheet can help clarify where to make changes in your current strategies and identify your comfort level with different approaches to investing. Even if you don’t have any investments, this template can provide a starting point for thinking about and planning your goals.

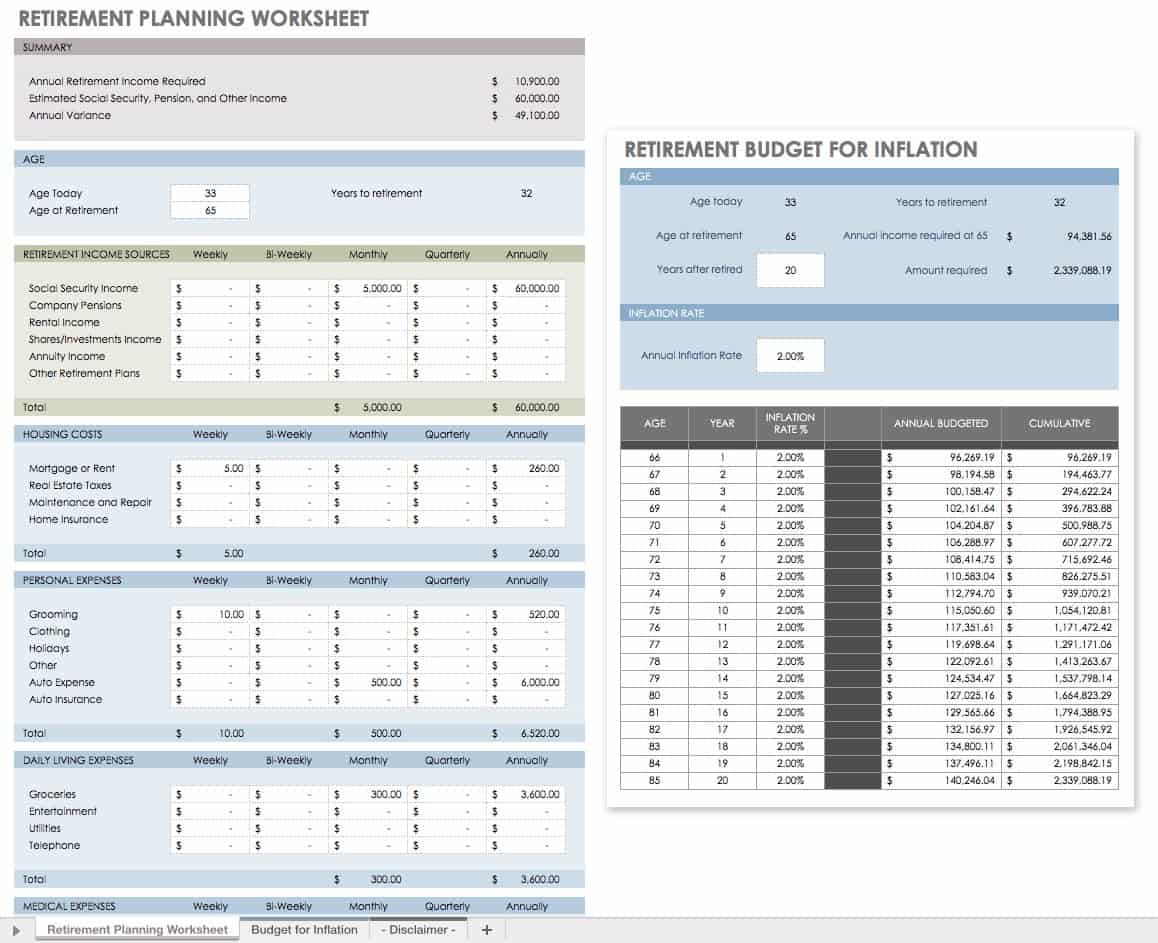

Retirement Planning Worksheet - Excel

Download Retirement Planning Worksheet - Excel

This template serves as a retirement calculator and budget worksheet that you can use to plan for retirement while accounting for inflation. If you are already retired, use the template to create a weekly, monthly, or annual budget based on your current income and expenses. You may want to consult with a financial planner to ensure that you are maximizing your income and saving sufficiently for retirement, but this template provides a basic financial planning and management tool that can help kickstart the conversation.

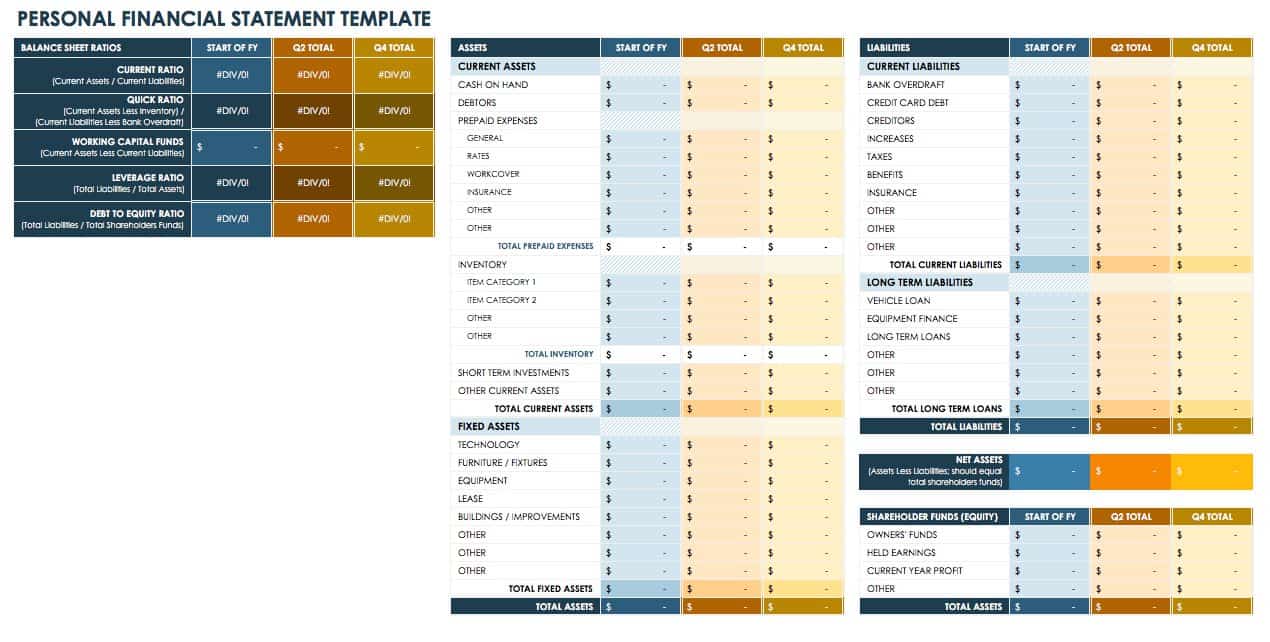

Personal Financial Statement - Excel

Download Personal Financial Statement - Excel

Determine your personal net worth with this simple yet detailed template. Enter your assets and liabilities - from cash and retirement savings to credit card debt and mortgages - and the template will automatically calculate your net worth. These details provide a quick look at your current financial standing. If you’re starting a business and seeking funding from lenders or investors, you may need to provide the information you collect in this template.

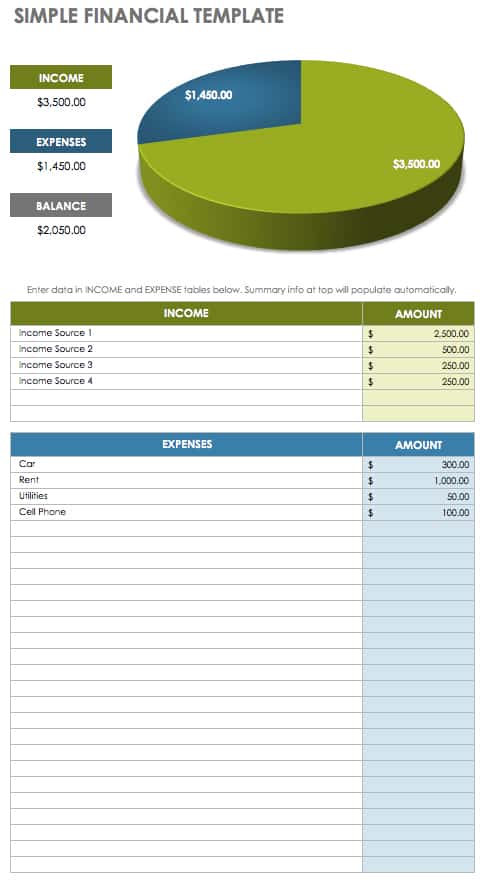

Simple Financial Template - Excel

Download Simple Financial Template - Excel

If you want to create a streamlined budget, use this simple financial template to see the difference between your income and expenses. Sections are provided for an itemized list of each, and a pie chart displays the balance between the two. This template may be helpful for individuals who are building a budget for the first time, or for those without complicated finances who just want to see how much they spend each month.

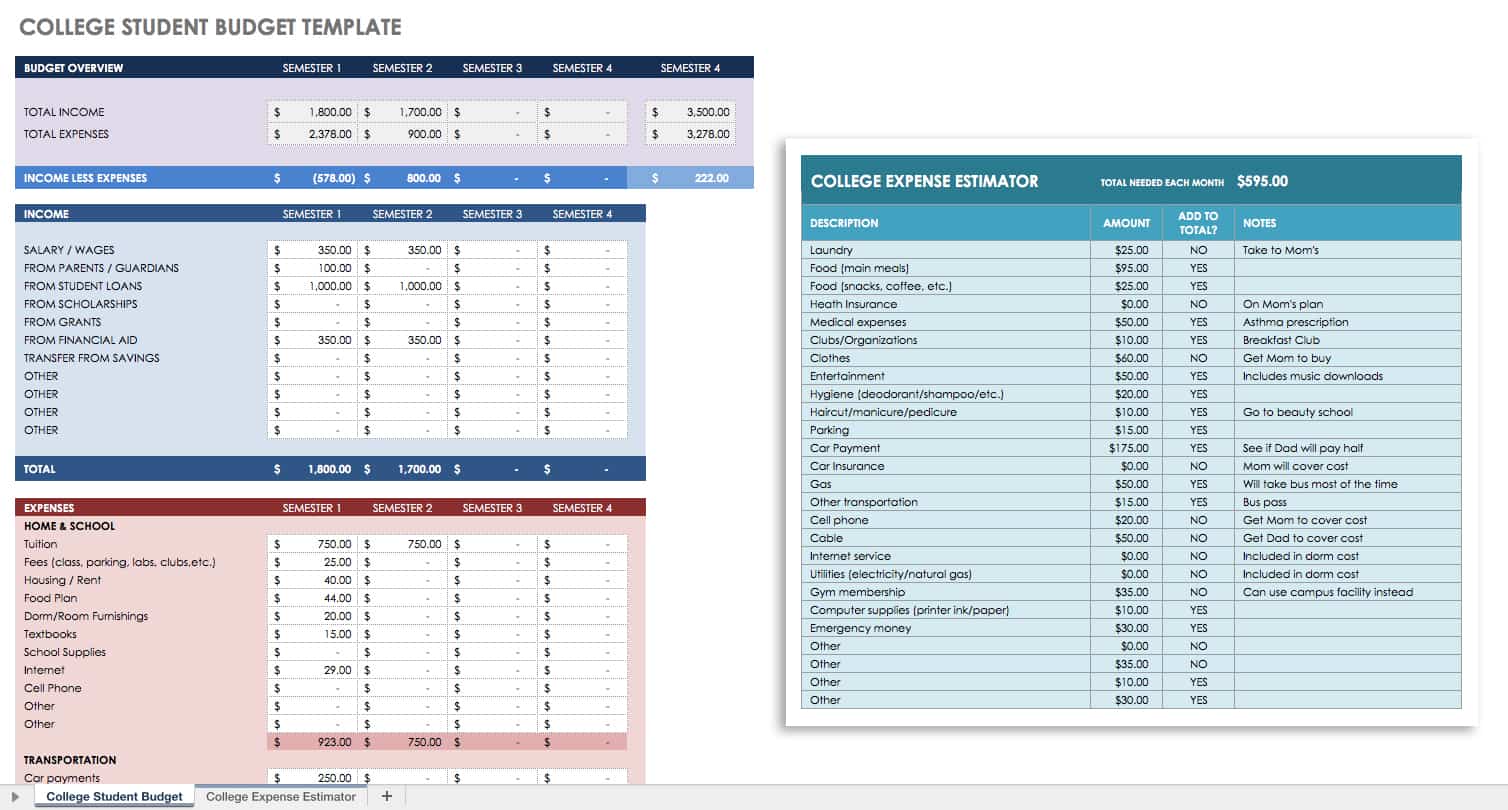

College Student Budget Template - Excel

Download College Student Budget Template - Excel

This template includes a list of potential expenses for college students. Use the details it reveals to determine how to pay for each item or where to cut costs. It also allows you to create a budget for each semester, weighing income against expenses to ensure that you have adequate funds. By creating a balanced budget, college students can focus on school responsibilities rather than worrying about finances, and also ensure that spending money is available for entertainment and wellness needs.

Improve Financial Planning with Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Financial Plan

A financial plan is a necessary document that is created to assure that a company is guided in terms of factors such as monetary resources, financial condition, budget usage, and development plans. Unlike a business marketing plan whose aim is to propose events, branding activities, and new market penetration; a financial plan instead focuses on factors such as fund allocation and operational sustainability.

Financial Plan Template

- Google Docs

Size: A4, US

If you want to stay up-to-date with the financial status or position of your company, you can check out and download this comprehensive “Financial Plan” template. Using this template, you will be able to determine factors such as cash flows , asset values, and much more. This plan template has ready-made effective content that you can personalize to suit your requirements.

Business Financial Plan Example Template

Financial Budget Plan Example Template

If you have no idea on how to create this document, we can provide you with different kinds of financial plan samples and templates. The downloadable examples available in this post can be used as references when making the specified document to assure that you are well-aware of the items that you need to present within a financial plan.

Printable Financial Plan Template

Business Financial Plan

Size: 154 KB

Personal Financial Plan Example

Size: 255 KB

Financial Services Action Plan

Size: 205 KB

One Page Financial Plan

Size: 329 KB

What Is a Financial Plan?

Some of the basic definitions of a financial plan include the following:

- It is a document that describes the current financial state of an entity which is necessary to plot future activities where funding is needed.

- A financial plan can be considered as one of the budget plan examples as it is a tool used by a business to identify variables that can help them layout cash flows and other asset values that they need for future operations.

How Is Financial Planning Important?

Creating a financial plan in business is important for the following reasons:

- A financial plan allows the assessment of free business plan examples especially whether the operational plans of the business are aligned with the money that it can shell out for particular activities.

- Unlike non-profit plan examples , financial plans are centered on assuring that the business can achieve sales quotas and financial stability.

- A financial plan helps businesses to make sure that they are well aware of financial trends and other external factors present in the industry. This can minimize the impacts of risks and threats in the finance department of a company.

Strategic Financial Plan Example

Comprehensive Financial Plan Sample

Financial Budget Plan

Project Financial Plan

What Is the Difference between a Budget Plan and a Financial Plan?

In a business plan example in PDF , a budget plan more or less cones under a financial plan. However, here are some differences that can be identified to know how these terms are used within a business environment:

- A financial plan focuses on identifying finance efforts which are essential for the growth of the small business and its readiness on future operations, especially concerning budget and finances. On the other hand, a budget plan is created to estimate the company’s revenues and expenses within a particular time period.

- A financial plan is created to have a list of the activities and programs that can be helpful for the development of the way a business gathers and uses its monetary resources. Meanwhile, a budget plan represents the financial position of the business and how a financial plan can be applied in actual money allocations.

Tips and Guidelines in Creating a Financial Plan

Some of the guidelines that you may incorporate in creating a financial plan include the following:

- You may check out existing financial plan templates so that it will act as a guide in making the format of your company’s own financial plan.

- You also need to assure that you will be aware of audit plan examples and accounting plan documents so you can align the content of your financial plan with the mentioned documents.

- Be precise and specific with the amount that you will place in a financial plan up to the last centavo.

These guidelines will allow you to create a comprehensive financial plan that can be used accordingly within a specific operational time frame.

Text prompt

- Instructive

- Professional

Create a study plan for final exams in high school

Develop a project timeline for a middle school science fair.

How To Write a Financial Plan for a Business Plan + Template

Written by Dave Lavinsky

What is a Financial Plan?

A business’ financial plan is the part of your business plan that details how your company will achieve its financial goals. It includes information on your company’s projected income, operating expenses, and cash flow in the form of a 5-Year Income Statement, Balance Sheet and Cash Flow Statement. The plan should also detail how much funding your company needs and the key uses of these funds.

The financial plan is an important part of the business plan, as it provides a framework for making financial decisions. It can be used to track progress and make adjustments as needed.

Download our Ultimate Business Plan Template here >

Why Your Financial Plan is Important

The financial section of your business plan details the financial implications of running your company. It is important for the following two reasons:

Making Informed Decisions

A financial plan provides a framework for making decisions about how to use your money. It can help you determine whether or not you can afford to make a major purchase, such as a new piece of equipment.

It can also help you decide how much money to reinvest in your business, and how much to save for paying taxes.

A financial plan is like a roadmap for your business. It can help you track your progress and make adjustments as needed. The plan can also help you identify potential problems before they arise.

For example, if your sales are below your projections, you may need to adjust your budget accordingly.

Your financial plan helps you understand how much outside funding is required, when your levels of cash might fall low, and what sales and other goals you need to hit to become financially viable.

Securing Funding

This section of your plan is absolutely critical if you are trying to secure funding. Your financial plan should include information on your revenue, anticipated expenses, and cash flow.

This information will help potential investors or lenders understand your business’s financial situation and decide whether or not to provide funding.

Include a detailed description of how you plan to use the funds you are requesting. For example, what are the key uses of the funds (e.g., purchasing equipment, paying staff, etc.) and what are the future timings of these financial outlays?

The financial information in your business plan should be realistic and accurate. Do not overstate your projected revenues or underestimate your expenses. This can lead to problems down the road.

Potential investors and lenders will be very interested in your future projections since they indicate whether you will be able to repay your loans and/or provide a nice return on investment (ROI) upon exit.

Making Appropriate Financial Projections and Realistic Assumptions

Your financial projections should be based on your current revenue model and market research. Conduct market research and speak with industry experts to get a better idea of the key trends affecting your business and realistic growth rates. The goal is to make as realistic and achievable projections as possible. You should also use historical financial data to help inform your projections. For example, if you are launching a new product, use past sales data to estimate how many units you might sell in Year 1, Year 2, etc.

Once you have this information, you can develop realistic financial assumptions around revenue growth, cost of goods sold, margins, expenses, and other key metrics.

Finish Your Business Plan Today!

If you’d like to quickly and easily complete your business plan, download Growthink’s Ultimate Business Plan Template and complete your plan and financial model in hours.

4 Key Elements to Include in Your Financial Plan

The financial plan of a business plan should have the following four sub-sections:

1. Revenue Model

Here you will detail how your company generates revenues. Oftentimes this is very straightforward, for instance, if you sell products. Other times, your answer might be more complex, such as if you’re selling subscriptions (particularly at different price/service levels) or if you are selling multiple products and services.

2. Financial Overview & Highlights

When creating a financial plan, you need to create full financial forecasts including the following financial statements.

5-Year Income Statement / Profit and Loss Statement

An income statement, also known as a profit and loss statement (P&L), shows how much revenue your business has generated over a specific period of time, and how much of that revenue has turned into profits. This financial statement includes your company’s revenues and expenses for a given time period, such as a month, quarter, or year. It can also show your company’s net income, which is the amount of money your company has made after all expenses have been paid.

5-Year Balance Sheet

A balance sheet shows a company’s financial position at a specific point in time. The balance sheet lists a company’s assets (what it owns), its liabilities (what it owes), and its equity (the difference between its assets and its liabilities).

The balance sheet is important because it shows a business’s financial health at a specific point in time. A strong balance sheet indicates that a company has the resources it needs to grow and expand. A weak balance sheet, on the other hand, may indicate that a company is struggling to pay its bills and may be at risk of bankruptcy.

5-Year Cash Flow Statement

A cash flow statement shows how much cash a company has on hand, as well as how much cash it is generating (or losing) over a specific period of time. The statement includes both operating and non-operating activities, such as revenue from sales, expenses, investing activities, and financing activities.

While your full financial projections will go in your Appendix, highlights of your financial projections will go in the Financial Plan section.

These highlights include your Total Revenue, Direct Expenses, Gross Profit, Other Expenses, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), and Net Income projections. Also include key assumptions used in creating these future projections such as revenue and cost growth rates.

3. Funding Requirements/Use of Funds

In this section, you will detail how much outside funding you require, if any, and the core uses of these funds.

For example, detail how much capital you need for:

- Product Development

- Product Manufacturing

- Rent or Office/Building Build-Out

4. Exit Strategy

If you are seeking equity capital, you need to explain your “exit strategy” here or how investors will “cash out” from their investment.

To add credibility to your exit strategy, conduct market research. Specifically, find other companies in your market that have exited in the past few years. Mention how they exited and the amounts of the exit (e.g., XYZ Corp. bought ABC Corp. for $Y).

Using a Financial Plan Template

A financial plan template is a pre-formatted spreadsheet that you can use to create your own financial plan. It includes formulas that will automatically calculate your revenue, expenses, and cash flow projection. Growthink’s Ultimate Business Plan Template includes a complete financial plan template and more to help you write a solid business plan in hours.

A well-crafted financial plan is the cornerstone of a successful business. It not only provides a roadmap for your company’s financial health but also serves as a powerful tool for securing funding from investors and lenders. By following the guidelines outlined in this article and utilizing a reliable financial plan template, you can create a persuasive financial plan for a comprehensive plan.

Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

Business Financial Plan Example: Strategies and Best Practices

Any successful endeavor begins with a robust plan – and running a prosperous business is no exception. Careful strategic planning acts as the bedrock on which companies build their future. One of the most critical aspects of this strategic planning is the creation of a detailed business financial plan. This plan serves as a guide, helping businesses navigate their way through the complex world of finance, including revenue projection, cost estimation, and capital expenditure, to name just a few elements. However, understanding what a business financial plan entails and how to implement it effectively can often be challenging. With multiple components to consider and various economic factors at play, the financial planning process may appear daunting to both new and established business owners.

This is where we come in. In this comprehensive article, we delve into the specifics of a business financial plan. We discuss its importance, the essential elements that make it up, and the steps to craft one successfully. Furthermore, we provide a practical example of a business financial plan in action, drawing upon real-world-like scenarios and strategies. By presenting the best practices and demonstrating how to employ them, we aim to equip business owners and entrepreneurs with the tools they need to create a robust, realistic, and efficient business financial plan. This in-depth guide will help you understand not only how to plan your business finances but also how to use this plan as a roadmap, leading your business towards growth, profitability, and overall financial success. Whether you're a seasoned business owner aiming to refine your financial strategies or an aspiring entrepreneur at the beginning of your journey, this article is designed to guide you through the intricacies of business financial planning and shed light on the strategies that can help your business thrive.

Understanding a Business Financial Plan

At its core, a business financial plan is a strategic blueprint that sets forth how a company will manage and navigate its financial operations, guiding the organization towards its defined fiscal objectives. It encompasses several critical aspects of a business's financial management, such as revenue projection, cost estimation, capital expenditure, cash flow management, and investment strategies.

Revenue projection is an estimate of the revenue a business expects to generate within a specific period. It's often based on market research, historical data, and educated assumptions about future market trends. Cost estimation, on the other hand, involves outlining the expenses a business anticipates incurring in its operations. Together, revenue projection and cost estimation can give a clear picture of a company's expected profitability. Capital expenditure refers to the funds a company allocates towards the purchase or maintenance of long-term assets like machinery, buildings, and equipment. Understanding capital expenditure is vital as it can significantly impact a business's operational capacity and future profitability. The cash flow management aspect of a business financial plan involves monitoring, analyzing, and optimizing the company's cash inflows and outflows. A healthy cash flow ensures that a business can meet its short-term obligations, invest in its growth, and provide a buffer for future uncertainties. Lastly, a company's investment strategies are crucial for its growth and sustainability. They might include strategies for raising capital, such as issuing shares or securing loans, or strategies for investing surplus cash, like purchasing assets or investing in market securities.

A well-developed business financial plan, therefore, doesn't just portray the company's current financial status; it also serves as a roadmap for the business's fiscal operations, enabling it to navigate towards its financial goals. The plan acts as a guide, providing insights that help business owners make informed decisions, whether they're about day-to-day operations or long-term strategic choices. In a nutshell, a business financial plan is a key tool in managing a company's financial resources effectively and strategically. It allows businesses to plan for growth, prepare for uncertainties, and strive for financial sustainability and success.

Essential Elements of a Business Financial Plan

A comprehensive financial plan contains several crucial elements, including:

- Sales Forecast : The sales forecast represents the business's projected sales revenues. It is often broken down into segments such as products, services, or regions.

- Expenses Budget : This portion of the plan outlines the anticipated costs of running the business. It includes fixed costs (rent, salaries) and variable costs (marketing, production).

- Cash Flow Statement : This statement records the cash that comes in and goes out of a business, effectively portraying its liquidity.

- Income Statements : Also known as profit and loss statements, income statements provide an overview of the business's profitability over a given period.

- Balance Sheet : This snapshot of a company's financial health shows its assets, liabilities, and equity.

Crafting a Business Financial Plan: The Steps

Developing a business financial plan requires careful analysis and planning. Here are the steps involved:

Step 1: Set Clear Financial Goals

The initial stage in crafting a robust business financial plan involves the establishment of clear, measurable financial goals. These objectives serve as your business's financial targets and compass, guiding your company's financial strategy. These goals can be short-term, such as improving quarterly sales or reducing monthly overhead costs, or they can be long-term, such as expanding the business to a new location within five years or doubling the annual revenue within three years. The goals might include specific targets such as increasing revenue by a particular percentage, reducing costs by a specific amount, or achieving a certain profit margin. Setting clear goals provides a target to aim for and allows you to measure your progress over time.

Step 2: Create a Sales Forecast

The cornerstone of any business financial plan is a robust sales forecast. This element of the plan involves predicting the sales your business will make over a given period. This estimate should be based on comprehensive market research, historical sales data, an understanding of industry trends, and the impact of any marketing or promotional activities. Consider the business's growth rate, the overall market size, and seasonal fluctuations in demand. Remember, your sales forecast directly influences the rest of your financial plan, particularly your budgets for expenses and cash flow, so it's critical to make it as accurate and realistic as possible.

Step 3: Prepare an Expense Budget

The next step involves preparing a comprehensive expense budget that covers all the costs your business is likely to incur. This includes fixed costs, such as rent or mortgage payments, salaries, insurance, and other overheads that remain relatively constant regardless of your business's level of output. It also includes variable costs, such as raw materials, inventory, marketing and advertising expenses, and other costs that fluctuate in direct proportion to the level of goods or services you produce. By understanding your expense budget, you can determine how much revenue your business needs to generate to cover costs and become profitable.

Step 4: Develop a Cash Flow Statement

One of the most crucial elements of your financial plan is the cash flow statement. This document records all the cash that enters and leaves your business, presenting a clear picture of your company's liquidity. Regularly updating your cash flow statement allows you to monitor the cash in hand and foresee any potential shortfalls. It helps you understand when cash comes into your business from sales and when cash goes out of your business due to expenses, giving you insights into your financial peaks and troughs and enabling you to manage your cash resources more effectively.

Step 5: Prepare Income Statements and Balance Sheets

Another vital part of your business financial plan includes the preparation of income statements and balance sheets. An income statement, also known as a Profit & Loss (P&L) statement, provides an overview of your business's profitability over a certain period. It subtracts the total expenses from total revenue to calculate net income, providing valuable insights into the profitability of your operations.

On the other hand, the balance sheet provides a snapshot of your company's financial health at a specific point in time. It lists your company's assets (what the company owns), liabilities (what the company owes), and equity (the owner's or shareholders' investment in the business). These documents help you understand where your business stands financially, whether it's making a profit, and how your assets, liabilities, and equity balance out.

Step 6: Revise Your Plan Regularly

It's important to remember that a financial plan is not a static document, but rather a living, evolving roadmap that should adapt to your business's changing circumstances and market conditions. As such, regular reviews and updates are crucial. By continually revisiting and revising your plan, you can ensure it remains accurate, relevant, and effective. You can adjust your forecasts as needed, respond to changes in the business environment, and stay on track towards achieving your financial goals. By doing so, you're not only keeping your business financially healthy but also setting the stage for sustained growth and success.

Business Financial Plan Example: Joe’s Coffee Shop

Now, let's look at a practical example of a financial plan for a hypothetical business, Joe’s Coffee Shop.

Sales Forecast

When constructing his sales forecast, Joe takes into account several significant factors. He reviews his historical sales data, identifies and understands current market trends, and evaluates the impact of any upcoming promotional events. With his coffee shop located in a bustling area, Joe expects to sell approximately 200 cups of coffee daily. Each cup is priced at $5, which gives him a daily sales prediction of $1000. Multiplying this figure by 365 (days in a year), his forecast for Year 1 is an annual revenue of $365,000. This projection provides Joe with a financial target to aim for and serves as a foundation for his further financial planning. It is worth noting that Joe's sales forecast may need adjustments throughout the year based on actual performance and changes in the market or business environment.

Expenses Budget

To run his coffee shop smoothly, Joe has identified several fixed and variable costs he'll need to budget for. His fixed costs, which are costs that will not change regardless of his coffee shop's sales volume, include rent, which is $2000 per month, salaries for his employees, which total $8000 per month, and utilities like electricity and water, which add up to about $500 per month.

In addition to these fixed costs, Joe also has variable costs to consider. These are costs that fluctuate depending on his sales volume and include the price of coffee beans, milk, sugar, and pastries, which he sells alongside his coffee. After a careful review of all these expenses, Joe estimates that his total annual expenses will be around $145,000. This comprehensive expense budget provides a clearer picture of how much Joe needs to earn in sales to cover his costs and achieve profitability.

Cash Flow Statement

With a clear understanding of his expected sales revenue and expenses, Joe can now proceed to develop a cash flow statement. This statement provides a comprehensive overview of all the cash inflows and outflows within his business. When Joe opened his coffee shop, he invested an initial capital of $50,000. He expects that the monthly cash inflows from sales will be about $30,417 (which is his annual revenue of $365,000 divided by 12), and his monthly cash outflows for expenses will amount to approximately $12,083 (his total annual expenses of $145,000 divided by 12). The cash flow statement gives Joe insights into his business's liquidity. It helps him track when and where his cash is coming from and where it is going. This understanding can assist him in managing his cash resources effectively and ensure he has sufficient cash to meet his business's operational needs and financial obligations.

Income Statement and Balance Sheet

With the figures from his sales forecast, expense budget, and cash flow statement, Joe can prepare his income statement and balance sheet. The income statement, or Profit & Loss (P&L) statement, reveals the profitability of Joe's coffee shop. It calculates the net profit by subtracting the total expenses from total sales revenue. In Joe's case, this means his net profit for Year 1 is expected to be $220,000 ($365,000 in revenue minus $145,000 in expenses).

The balance sheet, on the other hand, provides a snapshot of the coffee shop's financial position at a specific point in time. It includes Joe's initial capital investment of $50,000, his assets like coffee machines, furniture, and inventory, and his liabilities, which might include any loans he took to start the business and accounts payable.

The income statement and balance sheet not only reflect the financial health of Joe's coffee shop but also serve as essential tools for making informed business decisions and strategies. By continually monitoring and updating these statements, Joe can keep his finger on the pulse of his business's financial performance and make necessary adjustments to ensure sustained profitability and growth.

Best Practices in Business Financial Planning

While crafting a business financial plan, consider the following best practices:

- Realistic Projections : Ensure your forecasts are realistic, based on solid data and reasonable assumptions.

- Scenario Planning : Plan for best-case, worst-case, and most likely scenarios. This will help you prepare for different eventualities.

- Regular Reviews : Regularly review and update your plan to reflect changes in business conditions.

- Seek Professional Help : If you are unfamiliar with financial planning, consider seeking assistance from a financial consultant.

The importance of a meticulously prepared business financial plan cannot be overstated. It forms the backbone of any successful business, steering it towards a secure financial future. Creating a solid financial plan requires a blend of careful analysis, precise forecasting, clear and measurable goal setting, prudent budgeting, and efficient cash flow management. The process may seem overwhelming at first, especially for budding entrepreneurs. However, it's crucial to understand that financial planning is not an event, but rather an ongoing process. This process involves constant monitoring, evaluation, and continuous updating of the financial plan as the business grows and market conditions change.

The strategies and best practices outlined in this article offer an invaluable framework for any entrepreneur or business owner embarking on the journey of creating a financial plan. It provides insights into essential elements such as setting clear financial goals, creating a sales forecast, preparing an expense budget, developing a cash flow statement, and preparing income statements and balance sheets. Moreover, the example of Joe and his coffee shop gives a practical, real-world illustration of how these elements come together to form a coherent and effective financial plan. This example demonstrates how a robust financial plan can help manage resources more efficiently, make better-informed decisions, and ultimately lead to financial success.

Remember, every grand journey begins with a single step. In the realm of business, this step is creating a well-crafted, comprehensive, and realistic business financial plan. By following the guidelines and practices suggested in this article, you are laying the foundation for financial stability, profitability, and long-term success for your business. Start your journey today, and let the road to financial success unfold.

Related blogs

Stay up to date on the latest investment opportunities

.png)

IMAGES

VIDEO

COMMENTS

Jul 29, 2020 · In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats. Included on this page, you’ll find the essential financial statement templates, including income statement templates, cash flow statement templates, and balance sheet templates.

Jan 5, 2021 · Here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement. A business plan is all conceptual until you start filling in the numbers and terms.

Jul 11, 2024 · Learn how to improve your business financial projections by following these five basic guidelines. Download and use these free financial templates and calculators to easily create your own financial plan.

Apr 26, 2024 · Create a detailed business financial plan that can showcase your current and desired business financial condition. Use our downloadable examples of business financial plan templates for references.

Apr 29, 2022 · A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Explore our collection below of over 300 business plan examples across a variety of industries. With over two decades of experience, Growthink has assisted more than 1 million companies in developing effective business plans to launch and expand their businesses.

Sep 21, 2017 · Below, you’ll find multiple free financial planning templates for both business and personal use. These free templates are designed for users with a wide range of experience levels, and offer professional quality along with simplicity.

May 24, 2024 · If you want to stay up-to-date with the financial status or position of your company, you can check out and download this comprehensive “Financial Plan” template. Using this template, you will be able to determine factors such as cash flows, asset values, and much more.

What is a Financial Plan? A business’ financial plan is the part of your business plan that details how your company will achieve its financial goals. It includes information on your company’s projected income, operating expenses, and cash flow in the form of a 5-Year Income Statement, Balance Sheet and Cash Flow Statement.

Learn how to build a business financial plan with strategic insights, best practices, and an illustrative example.