An official website of the United States government

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Publications

- Account settings

- Advanced Search

- Journal List

Sustainability of airlines in India with Covid-19: Challenges ahead and possible way-outs

Anshu agrawal.

- Author information

- Article notes

- Copyright and License information

Corresponding author.

Received 2020 Jul 2; Accepted 2020 Aug 11; Issue date 2021.

This article is made available via the PMC Open Access Subset for unrestricted research re-use and secondary analysis in any form or by any means with acknowledgement of the original source. These permissions are granted for the duration of the World Health Organization (WHO) declaration of COVID-19 as a global pandemic.

Coronavirus outbreak has been highly disruptive for aviation sector, threatening the survival and sustainability of airlines. Apart from massive losses attributed to suspended operations, industry foresee a grim recession ahead. Restrictive movements, weak tourism, curtailed income, compressed commercial activities and fear psychosis are expected to compress the passenger demand from 30 to 60%, endangering the commercial viability of airlines operation. Fragile to withstand the cyclic momentary shocks of oil price fluctuation, demand flux, declining currency, airlines in India warrants for robust structural changes in their operating strategies, business model, revenue and pricing strategies to survive the long-lasting consequences of Covid-19. Paper attempts to analyze impact of lockdown and covid crisis on airlines in India and possible challenges ahead. Study also suggests the possible way-out for mitigating the expected losses.

Keywords: Airlines, Liquidity, Covid-19 impact, Altman Z-score, Cash burn rate, Cargo-cum-passenger model

Introduction

The world, at present is combating with pandemic Covid-19. Emerged from Wuhan (China) in December 2019, within few months it has taken 215 countries across the globe into its clutches. With 580 reported cases on 22 January 2020, the infected cases have crossed 10. 62 million as on July 1. 1 India is no different; with 3 cases reported as on 22 February, the number has surpassed 587,092, 2 whilst three extended phases of lockdown. 3 The magnitude of virus contagion spread in the absence of any antidote developed so far has left the countries across the world with quarantine as the only remedy, despite of its drastic consequences on the economy.

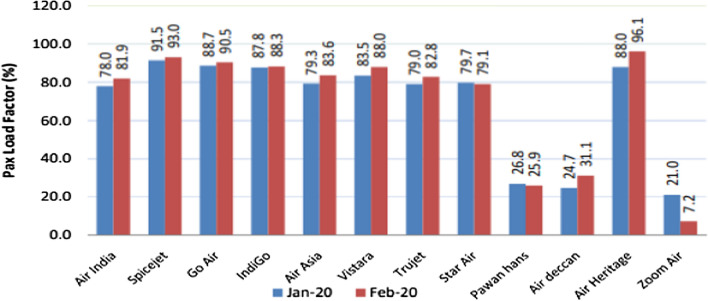

India is the third largest domestic civil aviation market in the world (IBEF, Report). 6 However, thin profit margins, high operating cost, inflated taxes and cut-throat price war make it one of the toughest aviation market (Saranga and Nagpal 2016 ). The cost structure of airlines in India is believed to be highly bloated with ATF taxes, landing and parking charges, which are perhaps highest in India. 7 The industry is exposed to high operating leverage. The airlines operating cost structure consists of nearly 30 to 40% of fuel cost, 15% lease rental, nearly 25% for other operating expenses (including general administrative, operating expenses such as flight equipment, maintenance, overhaul, user charges including landing, airport charges and air navigation charges (DGCA Report). Other than fuel cost, maintenance of aircraft, selling & distribution cost, and parking & landing charges, rest other expenses are fixed and are to be honored irrespective of flight operations. Burden of fixed charges- lease rental, interest charges, and crew salaries keep the airlines on their toes for managing cashflows. The high operating cost and cut-throat competition compel the airlines to struggle with low margins. The airlines demand in India is highly price elastic (Wang et al. 2018 ). Entry of low-frill competitors has changed the airlines price dynamics of pricing the services that were earlier based on additional frills (Saranga and Nagpal 2016 ). Any hike in the expenses, prima-facie, is a pinch on the airlines margin as ugly fare wars restrict to surpass the uncertain hike in costs on ticket prices. Commercials of airlines revolve around Available Seat Kilometers (ASK)-capacity, Revenue per kilometer (RPK)-income earned, Passenger load factor (PLF)-capacity utilized, Break-even load factor (BELF)-operating cost per ASK over operating revenue per RPK. Higher the distance flown, more is the opportunity for the airlines to spread the operating fixed cost over longer distance and thereby reducing their adjusted operating cost. In this backdrop, improving PLF by offering lucrative offers is prevalent trend in the industry. As provided, the airlines in India performed at decent capacity of nearly 85% in the month of January, 2020. In the month of February, irrespective of low demand, the SpiceJet, Go Air, Indigo, Air Asia, Vistara have managed high PLF by providing attractive offers (Fig. 1 ).

PLF of airlines in India during January and February 2020.

Source DGCA

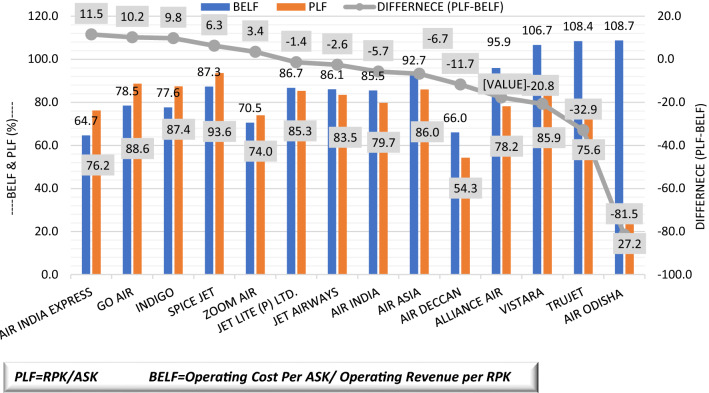

Higher PLF, however, does not implies profitability. It only represents the successful selling of available seats. Operating viability requires the PLF to exceed BELF. The irony is that despite of heavy demand, the airlines strive hard for making break-even due to tough competition. In the dilemma of managig operating cash flows, the cash stripped airlines with overmounted fixed operating costs emphasize on selling more seats, ignoring the break-even. As provided in the Fig. 2 , only five airlines operate above BELF during FY 2018–2019, with the safety margins from 3.4 to 11.5%, whilst rest all were in red.

PLF and BELF of Airlines in India during FY 2018–2019.

The covid outbreak has added financial woes of the sector. With the dwindling demand anticipations, capacity utilization certainly will be a major challenge ahead for airlines sustainability. Hitherto combating for break-even, low passenger traffic possibly restrain the airlines from recovering their variable expenses, thereby obstructing the commercially viability of their operations. Present study attempts to analyze the financial impact of covid outbreak on airlines and challenges ahead. Possible suggestion for sustainable operations of airlines are suggested. Findings are expected to contribute in the restructuring of the airlines for operating viability and sustainability.

Literature review

Airline industry has been one of the fastest growing industry globally in terms of demand as well as capacity (Lee 2019 ). Over the past century, commercial aviation has been observed as integral part of economic prosperity, stimulating trade, cultivating tourism development. Its relative affordability in recent years has inculcated it in people’s lifestyles (O’Connell 2018 ). Aviation sectors economic contribution (direct, indirect, induced and tourism concomitant) in Global GDP is estimated as USD 2.7 trillion (ATAG 2018). 8 Notwithstanding the growth in demand as well as capacity, the sectors has always been financially challenging struggling with thin margins (O’Connell 2018 ), vulnerable to fuel prices, foreign exchange, interest rates and high competition (Merkert and Swidan 2019 ; Stamolampros and Korfiatis 2019 ). The industry has been exposed to dynamic external environment, regulations, technology, customers preference, intense competition, labor cost, fuel prices and security measures and so forth (Riwo-Abudho et al. 2013 ). Airline industry performance is contingent to macro-predictability, micro-uncertainty and macro environmental factors (Mhlanga 2019 ). Airlines industry has always been exposed to exogenous events. Terrorist attack of 9/11 has put the industry into depression making number of airlines bankrupt. Those who rescued from the effect have been grabbed with the oil crisis of 2002 (Yang 2007 ). The entry of low cost carriers (LCC) in 2006 triggered turnaround changes in the industry in terms of pricing strategies and well as competition level (Belobaba 2011 ). The LCCs pricing and revenue management strategies threaten the commercial viability of traditional model, compelling the changes in conventional airline revenue management practices (Michaels and Fletcher 2009 ). The paper examines how they differ in their approach, how airlines are responding and what constitutes an effective response in the changed airline business world. This includes consideration of all the marketing levers (product, price, promotion and distribution) in an integrated way, as well as developments needed in the core revenue management systems themselves (Michaels and Fletcher 2009 ). Online bookings, access to airline tickets on internet has made price competitiveness as an important parameter of airline's success (Ratliff and Vinod 2005 ).

India Airlines market despite of being the fastest growing market (Mahtani and Garg 2018 ), has been one of the toughest aviation markets in the world, due to high fuel prices, overcapacity and intense price competition (Saranga and Nagpal 2016 ). Notwithstanding the extensive infrastructural development supported by government, airlines in India often combat financial distress with the changing dynamics of internal and external environment (Mahtani and Garg 2018 ). Indian aviation industry in India has undergone rapid transformation with the liberalization of Indian aviation sector (Singh 2016 ). India began to relax controls on its airline industry in 1986, allowing willing entrants to add system’s capacity. However, financial performance of the airlines remains challenging owing to inappropriate policies, restricted capacity allocation on profitability basis (Hooper 1997 ). Liberalization of air travel services and the advent of low-frill airlines have changed the panorama of Indian Civil Aviation in terms of demand as well as supply (Ohri 2012 ; Srinidhi 2010 ). Reformation of regulatory policies resulted in three-fold increase in the number of scheduled airlines and a five-fold increase in the number of aircraft operated (O’Connell and Williams 2006 ). The increased interconnectivity within the global airline markets has altered the dynamics of external environment and internal operations (Riwo-Abudho et al. 2013 ; Singh 2016 ). Success and survival in this milieu warrants for coherent strategies adapting with market flavor (Pathak 2015 ).

Entry of the LCCs in India in 2003, with first 'no-frills' airlines- Air Deccan has changed the dynamics of Indian domestic aviation market (Sakariya et al. 2009 ). Low-cost carrier (LCC) by enhancing affordability of air travel has stimulated the demand for air travel in India (Krämer et al. 2018 ; Wang et al. 2018 ). Undoubtedly, low-frill operation has proved to be a successful business model in the industry (Alamdari and Fagan 2005 ). Budget airlines and small chartered airlines witnessed more efficient in the system (Dhanda and Sharma 2018 ; Jain and Natarajan 2015 ; Saranga and Nagpal 2016 ) and dominated the Indian airline market (Deeppa and Ganapathi 2018 ; Wang et al. 2018 ). The LCC in India have managed to achieve significant operational efficiencies with the rigid cost structure, heavy taxes, high landing and parking charges, undesirable regulatory factors (Saranga and Nagpal 2016 ). India’s low cost carriers show better scale efficiency vis-à-vis their full service competitors (Sakthidharan and Sivaraman 2018 ). Low Cost Airlines have been witnessed advantageous in utilizing their capacity compare to the full service airlines which strives hard to attain break-even capacity (Thirunavukkarasu 2015 ). However, the inexorable rise of LCC has made the industry more volatile (Doganis 2005 ). Intense competition and enhanced capacity have made cost effectiveness as the daring need for survival and sustainability.

Financial performance of airlines is vulnerable to both internal conditions of the company and as well the external environment. Operating factors, namely, operating revenue per air kilometers, capacity, cost structure, load factor dictate the operational output of the airlines and their commercial stability. From the external environment, ATF prices largely affect airlines profitability in India. Also, annual inflation and GDP growth rate in the country has a major influence on the sustainability of the airlines in India (Mahtani and Garg 2018 ). With uncontrollable cost behavior, tight margins and cut-throat market, survival and subsistence of airlines largely depends on its ability to maximize their customer base (Singh 2016 ). Fierce competition compel the airlines to optimizes their revenues (Josephi 2005 ; Krämer et al. 2018 ). In the backdrop of covid pandemic outbreak, the globally airline industry has been adversely affected. Airlines in India which have been observed vulnerable to withstand the cyclic economic disruption (of fuel prices, inflation, devaluation of currency and demand shock), certainly be entering into a tough time with extremely low demand and ever mounting losses. Present study attempts to analyze the financial impact of covid pandemic on airlines in India and possible impact of their financial strengths and weakness. Further study suggests possible way-outs of sustaining operating viability.

Impact of Covid pandemic

Impact of suspended operation amid lockdown.

Fixed charges of Airlines in India during the FY 2017 to 2019

Drying cash reserves

Cash burn rate in days

Deteriorating solvency

In the backdrop of tight liquidity, thin margins and high burn rate, the airlines have always been fragile to withstand the normal demand shocks, oil price fluctuation, depreciating currency, etc. Industry has vouched the devastating impact of these events ranging deep losses to airlines bankruptcy. Table 3 exhibits 2015 onwards financial performance of airlines in India in terms of profits margins, rate of returns, assets turnover ratio and interest coverage ratios. As provided, the profit margins of the airlines are highly thin and unsatisfactory to insulate the firms from sudden shocks. Median net profit margin − 0.73, prima-face, corroborate that net profits of all the airlines in India are occasionally positive. There appears only three airlines, Interglobe, Go Air, and Blue Dart (Cargo airline) with positive net profit margin in all the five years. In terms of magnitude, the net profit margin 0.5 to 9% and EBIT margin of 1 to 15% does not seems satisfactory to justify the corpus invested and the risk involved there in. Oil price hike of 2018 has plunged the sector into deep losses. Interglobe Aviation that appears to be best performer of the industry has experienced deep shrinkage in its net profit margin of 2019 from 9 to 0.5% (Table 3 ). Unable to take the hit, loss running Jet Airways blown out of the race with its operations meeting grinding halt in April 2019. 11 Previously also, Industry has a history of several starts and may failures; East West Airlines and Damania Airways in 90 s, Kingfisher Airlines in 2012 are classic instances of airlines financial failure.

Financials of Airlines in India during the years 2010 to 2019

Table 4 exhibit the Altman Z-score of select four airlines. Altman Z-score model (Altman 1968 ) was developed by Edward Altman in 1968. It gauges the likelihood of bankruptcy of business concern within two years, using multiple corporate income and balance sheet values. Z-scores are used to predict corporate defaults and an easy-to-calculate control measure for the financial distress status of companies. The Z-score is calculated using liquidity, profitability, leverage and turnover parameters. (Altman 1968 ).

here X 1 working capital/total asset, X 2 retained earnings/total asset, X 3 EBIT/total X 4 Market capitalization/ book value of debt, X 5 total sales/total assets.

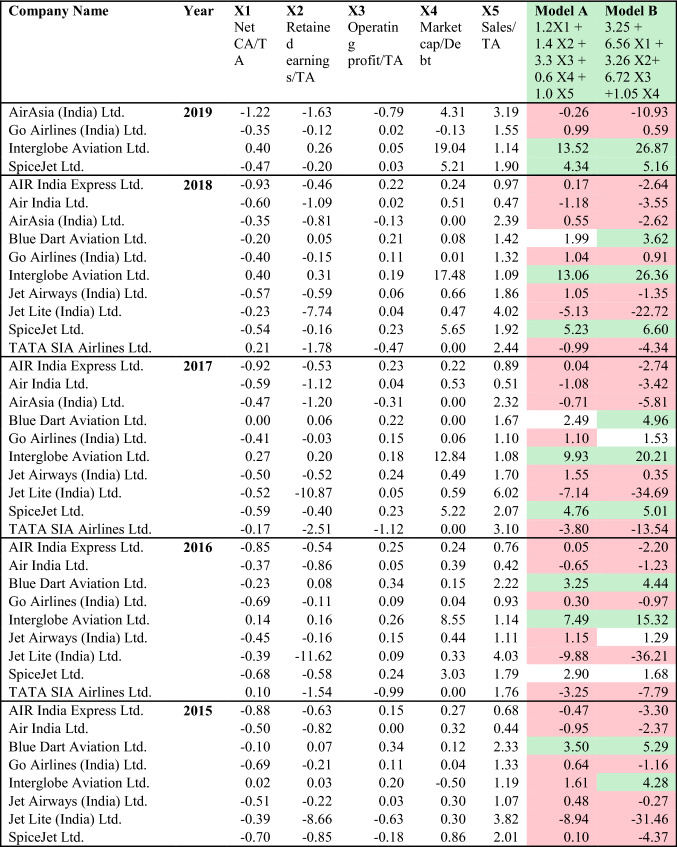

Altman Z-score of airlines in India for the years 2015 to 2019

Pink cells portray risky zone and green cells represent safe zone as per Altman Z-score

Score below 1.81 signifies high probability of bankruptcy; 1.81 to 2.99 is considered as grey zone and score of above 2.99 is considered as safe zone.

This model was applicable for manufacturing sector. For predicting the bankruptcy of service sector firms in emerging market modified Atman score was proposed (Altman 2013 ). As per the model,

here X 1 Working capital/total assets, X 2 retained earnings/total assets, X 3 EBIT/total assets, X 4 Market capitalization/book value of debt.

Score above 2.6 is considered safe zone, 1.1 to 2.6 as moderate risk and score below 1.1 indicates high risk of bankruptcy.

Table 3 exhibits the Altman Z-score of Airlines in India computed using traditional Altman model and modified Altman model for emerging market. In the backdrop of unavailability of market capitalization information of all the airlines, the enterprise value minus book value of debt is considered as value of equity. The findings of both the models lend credence to the sustainability of Indigo Aviation and SpiceJet. Nevertheless, the decline in the scores is very likely, due to deteriorated finances amid lockdown and grim prospect of passenger demand ahead.

Post-lockdown challenges

Grim passenger traffic.

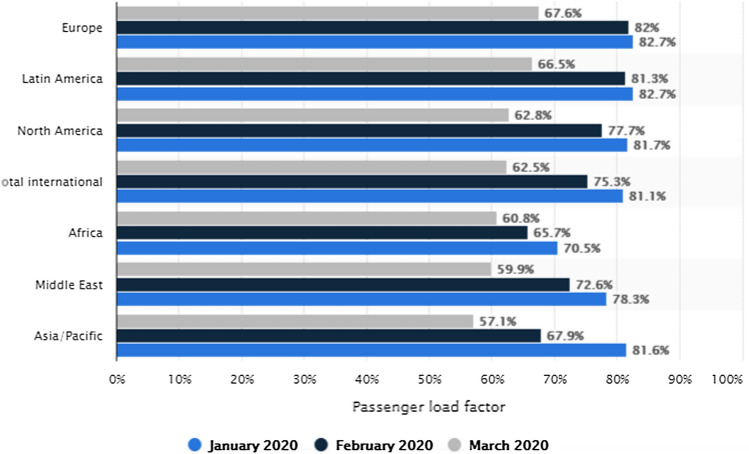

Covid-19 pandemic has proven highly disruptive. It has wreaked havoc with the global economy, economically, socially and financially (Laing 2020 ; Wren-Lewis 2020 ). The aftermath of the disasters is perhaps more threatening, endangering the survival and sustainability of various businesses. Airline industry is worst hit sector, which is expected to lose USD 84.3 billion in 2020, the highest loss the sector has ever witnessed (IATA). 12 Owing to the restricted movements and destinations, the industry expects severe decline in its passenger load (Thams et al. 2020 ), perhaps, a significant parameter of airlines profitability (Baltagi et al. 1995 ; Clark and Vincent 2012 ; Sibdari et al. 2018 ). As provided in Fig. 3 , month of March has witnessed sharp decline in PLF of airlines all across the globe.

PLF of Airlines across world during January to March 2020.

Source Statista 2020

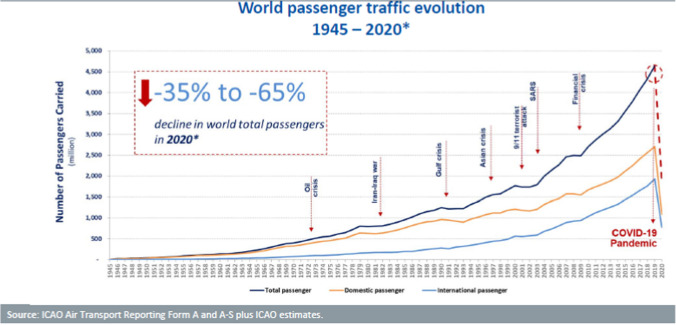

Other than the loss amid suspended operation, the future prospect of the industry seems more dreadful for sustainable operations of airlines. In the backdrop of aggressive multiplication in covid cases, the likelihood of normal passenger traffic seems distant. Restricted movements, fear psychosis, declined tourism, reduced commercial activities, curbed disposable income is expected to have significant impact on passenger airlines demand. Tourism sector is considered as significant driver/ stimulator of airlines business (Bieger and Wittmer 2006 ). An important aspect of international traffic to and from India pertains to trend in foreign tourist arrivals in India. The months from April to July are generally observed as peak season for the airlines, with the maximum Passenger load factor (PLF). In the FY 2018–2019, YoY growth in PLF is positive only in the month of April & July. 13 As per the DGCA report, 33% of international passenger traffic during FY 2019 was attributed to tourism sector. In view of expected decline in tourism amid covid pandemic, the airline business foresees a major disruption ahead. According to ICAO united Aviation study, depending upon the duration and intensity of outbreak, control measures and economic and psychological impact, the global airlines industry may witness decline of 33 to 60% seats offered, reduced passenger traffic from 1878 to 3227 million and gross operating revenue loss of approximately USD 244 to 420 million for the year 2020. 14 As per the report, the estimated decline is the worst ever observed before during any of the crisis, economic or otherwise (Fig. 4 ).

Global aviation passenger traffic trend amid different crisis (during 1945 to 2020)

Projected operating loss of Airlines amid Covid impact

Cost of social distancing

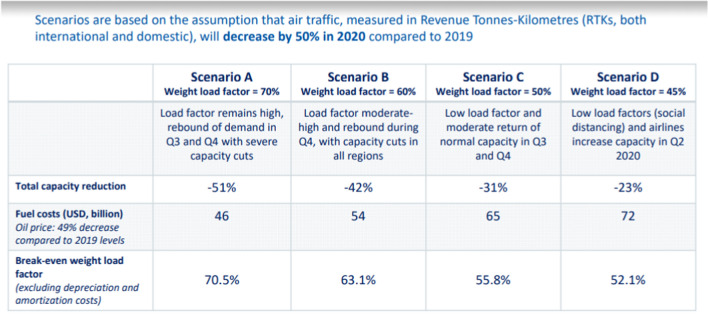

Social distancing practices initiated by regulatory authorities and airlines to prevent infection outbreak will be financial hit on airlines pocket (IATA Economics 2020 ). Declined PLF coupled with cost of social distancing is expected to threaten the commercial viability of airlines operations. Measures such as leave empty seats between passengers in the aircraft will reduce the seating capacity by 30 to 50%. In India, DGCA laid down social distancing norms and sanitization norms for airlines to be followed during passengers handling, sanitizing aircrafts, check-points and baggage, PPE kits, medical team, etc. This cost will further dig the profitability of the airlines. The DGCA advisory of blocking middle seat, will compressed the seat offering capacity of airlines 60 to 70%. PLF is an important driver of airline financial performance. Based on a sample of 122 airlines, on average, airlines break even at a load factor of 77%. Notwithstanding the high PLF of 70 to 75%, airlines are witnessed struggling for break-even. As per IATA analysis, out of the sample of 122 airlines across globe, only 4 airlines will manage break-even below 62%. In the present scenario, where airlines PLF is expected to decline by 30 to 50%, the financially feasibility of airlines operations seems scary. Additionally, the cost of implementing other social distancing and sanitization norms will further enhance the airlines’ costing. Airlines perhaps find it difficult to cover the variable cost of their operations.

The road ahead

Post-lockdown world will be not be the business as usual. The airline industry combat with Covid-19 and its after effects seems taxing and perhaps long drawn-out. The sustainability and survival of airlines warrants for turnaround changes in their strategies and business model to strengthen their financial stamina. Overcapacity, intense competition and high operating cost are the major factors affecting airlines performance. To overcome the present challenge of covid crisis, optimal utilization of resources, cooperation rather than competition, and cost optimization seem to be the possible way-outs for sustaining with commercially viable take-off on rough terrain.

Cargo-cum-passenger traffic

Air cargo business despite of being a least preferred choice of airlines compared to passenger business, has an important role to play in the airline’s profitability. Threatening subsistence with the growing challenges of the industry warrants for major structural changes in the present business model. Accommodating the cargo business in the existing business model perhaps be an effective steps towards the improved performance (Reis and Silva 2016 ). The globalization of the supply chain has resulted in competitive pressure on the air cargo industry. With independent and improved supply chain strategies, airlines can positioned themselves in the global supply chain market (Hong et al. 2018 ). High degree of cargo business is evident to improve the operational efficiency of combination as well as cargo airline (Hong et al., 2018 ). Airlines with a high share of cargo business in their overall operations are significantly more efficient than airlines ( Hong and Zhang 2010 ). However, challenges for handling cargo makes it less attractive to airlines compared to passenger business. Combination airlines use the belly space of passenger aircrafts to substantiate the cargo. These airlines often experience the problem of freight orders exceeding the airline's fixed capacity, particularly for hot selling routes (Feng et al. 2015 ).

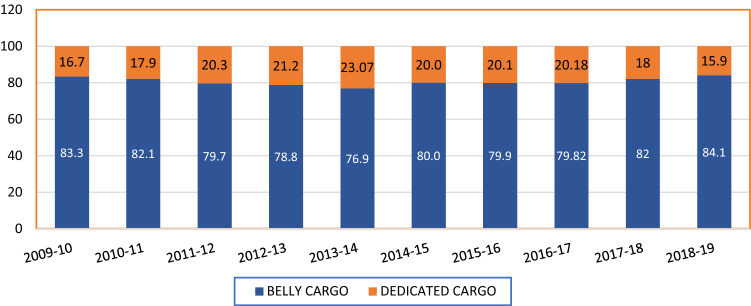

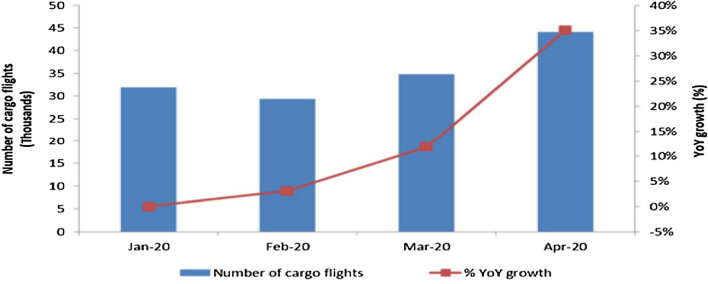

In present scenario, where a severe decline in passenger traffic as well as restricted destinations is expected amid infection paranoia, cargo business perhaps can be used a rescue boat to safeguard the airlines from expected the crash landing. It is a saying in management accounting, that in short-term if profits can’t be maximized, focus should be on minimizing the losses. For optimum capacity utilization, cargo-cum-passenger model can be an effective way-out. At present nearly 8% of freight business in India is done through belly cargo. 15 Only Blue Dart is fully dedicated airlines for freight cargo business (Fig. 5 ). In view of restricted passenger movements, from January onwards airlines across the globe have started engaging passenger aircrafts entirely for cargo (Fig. 6 ). Indigo followed by SpiceJet have also joined the race.

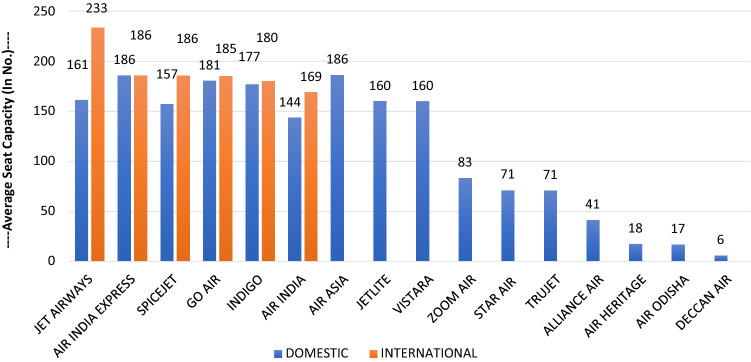

Average seat capacity of scheduled operating Indian fleet (2018–2019).

Cargo carried through dedicated cargo planes and belly cargo.

Figure 7 portray the average seat capacity of scheduled airlines in Indian during FY 2018–2019. As provided, most of the airlines have the average capacity of 160 to 180. With the expected 30–35 decline in passenger traffic in current fiscal, 16 accommodating cargo load for unutilized seats can mitigate the revenue losses of the airlines. Amid low passenger traffic, dedicating small aircrafts (with less seating capacity) for passenger business relatively will be more financially viable for the airlines. Big aircrafts can be temporarily converted in cargo planes for carrying supplies. Depending upon the cargo load, large capacity planes can be fully dedicated or utilized as passenger cum cargo planes. In view of DGCA advisory to leave middle seat vacant, some temporary arrangements for accommodating cargo in provided space can be worked out. For instance, vacant seat can be used for carrying passenger’s luggage and the side carriers can be utilized for lesser weights parcels. Also, the space used for accommodating passengers’ check-in luggage can be utilized for cargo business. The passenger cabin can be restructured in such a manner that its front and back seats can be used for passenger traffic and middle space can be utilized for cargo services.

Cargo business using passenger flights during January to April 2020.

Source ICAO

Alliance for resource sharing

Airline industry is known for ugly competition and fare wars that perhaps has been the prime reason for their meagre profit margin (Eng and Vichitsarawong 2019 ). In the backdrop of trimmed passenger traffic expected for upcoming months, pooling of resources perhaps can be useful step in this direction. Airlines industry needs to adapt cooperation model instead of competition. Alliance in the airline industry is a widely used strategy to stimulate competition (Cobeña et al. 2019 ). Alliances are useful rescue for the firms with vulnerable strategic positions either because of competition or when they are attempting pioneering technical strategies (Eisenhardt and Schoonhoven 1996 ). They enhance value by facilitating optimal utilization of pooled resources (Das and Teng 2000 ). The alliance, perhaps, can be better way-out for balancing these demand and supply fluctuations. Alliance for aircraft sharing can possibly assist the airlines in optimizing their aircraft capacities and mitigating their operating losses.

Dues waiver

The covid economic impact on aviation is extreme and perhaps uncertain. Higher the reduction in PLF, more difficult will be the attainment of break-even for the airlines. The lockdown of two months with zero revenue and spiraled fixed charges, particularly, loan instalments and lease rental, perhaps has drained out the liquidity of airlines. With the trimmed air traffic estimated in the coming months, there seems meagre probability of recovering the past losses. With the reduced PLF the recovery of variable cost of operating a flight will be challenging, threating the operation viability of airlines. Figure 8 portray projection done by ICAO regarding commercials of aviation sector. As provided, in all the situations the operating losses are confirmed, with the only difference in the magnitude of losses from high to low. In the given situation, bailout package, particularly, waivers of interest charges pertaining to lockdown period, reduced landing and parking charges, ATF taxes, seems essential for the stability of the sector. The cost waivers by reducing operating cost of airlines will enhance the airlines probability of attaining break-even. In fact, in view of dipped consumable income, the reduced cost possibly be a relief for passengers in terms of affordable flying. Air travelers rate assurance (Singh, 2016 ) and financial conditions of airlines significantly affect the quality of air travel. Product quality decreases when airlines are in financial distress (Phillips and Sertsios 2013 ). Given the deteriorating finances and demand crunch ahead, airlines service quality and safe operations may be compromised. Further, the reasonable ticket cap as a safeguard to airlines as well as passengers’ interest may be implemented.

Possible scenarios of Covid impact on airlines commercials.

Concluding observations

Present paper attempts to analyze the vulnerability of airlines in India to withstand Covid-19 after effects. Lockdown of two months has been drastic for the fragile airlines business distressed with thin margins, liquidity crisis, over mounting fixed cost and debt. Zero revenue, albeit spiraling fixed expenses has been a drain on the cash reserves of airlines dragging them towards insolvency. Above all, the sector is viewing grim recession ahead. In this backdrop, the operation viability of airlines seems conditional on the recovery of variable expenses. Sustainability of airlines warrants of turnaround changes in their revenue strategies and operating models. Focus on minimizing losses rather than profit maximization possibly can help the airlines to combat current situation.

Dr. Anshu Agrawal

is a faculty in the area of accounting and finance at Indian Institute of Management Sirmaur, Himachal Pradesh. She has completed M. Com, M.A (Economics). She has done PhD in the area of Mergers and Acquisitions from Department of Management Studies, Indian Institute of Technology Delhi in 2014. She is into teaching for six years. She has research papers in national and international journals to her credit. She has presented papers in national and international conferences.

https://www.worldometers.info/coronavirus/ as on 10th June 2020.

https://www.worldometers.info/coronavirus/country/india/ as on 1st July 2020.

Lockdown phase 1 begin in India from 22 March 2020- 14th April, Phase 2 begin from 15th April to 30th April and Phase 3 from 1st May to 31st May.

https://www.business-standard.com/article/companies/india-suspends-flights-till-may-17-as-losses-for-airlines-mount-in-lockdown-120050200618_1.html

https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/indian-aviation-sector-may-incur-3-3-3-6-billion-loss-in-june-quarter-capa-india/articleshow/74813509.cms?from=mdr#:~:text=India%20has%20suspended%20operation%20of,be%20USD%201.50%2D1.75%20billion

https://www.ibef.org/industry/indian-aviation.aspx#:~:text=India's%20aviation%20industry%20is%20expected,aviation%20navigation%20services%20by%202026

https://www.dnaindia.com/business/report-the-cost-of-flying-high-2732879

https://www.icao.int/sustainability/Pages/Economic-Impacts-of-COVID-19.aspx

https://www.newindianexpress.com/business/2020/apr/16/lockdown-airlines-to-see-rs-75-90-cr-loss-per-day-2130758.html

https://www.businesstoday.in/current/corporate/indigo-q3-profit-zooms-over-2-fold-to-rs-496-crore-revenue-spikes-25/story/394735.html

https://www.bbc.com/news/business-47963536#:~:text=Taking%20the%20last%20flight%20of%20India's%20stricken%20Jet%20Airways&text=Troubled%20Indian%20airline%20Jet%20Airways,fuel%20and%20other%20critical%20services

https://www.ndtv.com/business/coronavirus-crisis-airlines-expected-to-lose-84-3-billion-due-to-covid-19-says-industry-body-iata-2243659

DGCA Handbook 2018–19.

https://www.icao.int/sustainability/Documents/COVID-19/ICAO_Coronavirus_Econ_Impact.pdf

Using passenger planes for carrying cargo in belly space

https://www.hindustantimes.com/business-news/india-s-domestic-air-traffic-to-fall-to-90-mn-this-fiscal-report/story-YnObZButtdz95G7D4Sn4fM.html

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

- Alamdari F, Fagan S. Impact of the adherence to the original low-cost model on the profitability of low-cost airlines. Transport Reviews. 2005;25(3):377–392. doi: 10.1080/01441640500038748. [ DOI ] [ Google Scholar ]

- Altman, E. I. (2013). Predicting financial distress of companies: Revisiting the Z-Score and ZETA® models. In Handbook of Research Methods and Applications in Empirical Finance (pp. 428–456). Edward Elgar Publishing. 10.4337/9780857936097.00027

- Altman, I. (1968). Altman Z-Score. FCS Commercial Finance Group .

- Baltagi BH, Griffin JM, Rich DP. The measurement of firm-specific indexes of technical change. The Review of Economics and Statistics. 1995;77(4):654. doi: 10.2307/2109813. [ DOI ] [ Google Scholar ]

- Belobaba PP. Did LCCs save airline revenue management? Journal of Revenue and Pricing Management. 2011;10(1):19–22. doi: 10.1057/rpm.2010.45. [ DOI ] [ Google Scholar ]

- Bieger T, Wittmer A. Air transport and tourism: Perspectives and challenges for destinations, airlines and governments. Journal of Air Transport Management. 2006;12(1):40–46. doi: 10.1016/j.jairtraman.2005.09.007. [ DOI ] [ Google Scholar ]

- Chen Z, Harford J, Kamara A. Operating leverage, profitability, and capital structure. Journal of Financial and Quantitative Analysis. 2019;54(1):369–392. doi: 10.1017/S0022109018000595. [ DOI ] [ Google Scholar ]

- Clark R, Vincent N. Capacity-contingent pricing and competition in the airline industry. Journal of Air Transport Management. 2012;24:7–11. doi: 10.1016/j.jairtraman.2012.04.005. [ DOI ] [ Google Scholar ]

- Cobeña M, Gallego Á, Casanueva C. Diversity in airline alliance portfolio configuration. Journal of Air Transport Management. 2019;75:16–26. doi: 10.1016/j.jairtraman.2018.11.004. [ DOI ] [ Google Scholar ]

- Das TK, Teng B-S. A resource-based theory of strategic alliances. Journal of Management. 2000;26(1):31–61. doi: 10.1177/014920630002600105. [ DOI ] [ Google Scholar ]

- Deeppa K, Ganapathi R. Customers’ loyalty towards low cost airlines in India. SCMS Journal of Indian Management. 2018;15:42–48. [ Google Scholar ]

- Dhanda N, Sharma M. A study on analysis of operating efficiency of Air India and Indigo airlines. Journal of Advances and Scholarly Researches in Allied Education. 2018;15(3):6–10. doi: 10.29070/15/56746. [ DOI ] [ Google Scholar ]

- Doganis R. The Airline Business. The Airline Business: Routledge; 2005. [ Google Scholar ]

- Eisenhardt KM, Schoonhoven CB. Resource-based view of strategic alliance formation: Strategic and social effects in entrepreneurial firms. Organization Science. 1996;7(2):136–150. doi: 10.1287/orsc.7.2.136. [ DOI ] [ Google Scholar ]

- Eng LL, Vichitsarawong T. Competition and profits in the airline industry: The case of AirAsia and Malaysia Airlines. International Journal of Revenue Management. 2019;11(1/2):126. doi: 10.1504/IJRM.2019.103049. [ DOI ] [ Google Scholar ]

- Feng B, Li Y, Shen H. Tying mechanism for airlines’ air cargo capacity allocation. European Journal of Operational Research. 2015;244(1):322–330. doi: 10.1016/j.ejor.2015.01.014. [ DOI ] [ Google Scholar ]

- Gahlon JM. Operating leverage as a determinant of systematic risk. Journal of Business Research. 1981;9(3):297–308. doi: 10.1016/0148-2963(81)90023-0. [ DOI ] [ Google Scholar ]

- García-Feijóo L, Jorgensen RD. Can operating leverage be the cause of the value premium? Financial Management. 2010;39(3):1127–1154. doi: 10.1111/j.1755-053X.2010.01106.x. [ DOI ] [ Google Scholar ]

- González VM. Leverage and corporate performance: International evidence. International Review of Economics & Finance. 2013;25:169–184. doi: 10.1016/j.iref.2012.07.005. [ DOI ] [ Google Scholar ]

- Hong S-J, Randall W, Han K, Malhan AS. Estimation viability of dedicated freighter aircraft of combination carriers: A data envelopment and principal component analysis. International Journal of Production Economics. 2018;202:12–20. doi: 10.1016/j.ijpe.2018.05.012. [ DOI ] [ Google Scholar ]

- Hong S, Zhang A. An efficiency study of airlines and air cargo/passenger divisions: A DEA approach. World Review of Intermodal Transportation Research. 2010;3(1/2):137. doi: 10.1504/WRITR.2010.031584. [ DOI ] [ Google Scholar ]

- Hooper P. Liberalisation of the airline industry in India. Journal of Air Transport Management. 1997;3(3):115–123. doi: 10.1016/S0969-6997(97)00019-7. [ DOI ] [ Google Scholar ]

- IATA Economics. (2020). IATA Economics Chart of the Week-Social distancing would make most airlines financially unviable. IATA Economics .

- Jain RK, Natarajan R. A DEA study of airlines in India. Asia Pacific Management Review. 2015;20(4):285–292. doi: 10.1016/j.apmrv.2015.03.004. [ DOI ] [ Google Scholar ]

- Josephi, S. (2005). Revenue Management. In Key Concepts in Hospitality Management (pp. 140–144). 1 Oliver’s Yard, 55 City Road London EC1Y 1SP: SAGE Publications, Inc. 10.4135/9781526435606.n32

- Krämer A, Friesen M, Shelton T. Are airline passengers ready for personalized dynamic pricing? A study of German consumers. Journal of Revenue and Pricing Management. 2018;17(2):115–120. doi: 10.1057/s41272-017-0122-0. [ DOI ] [ Google Scholar ]

- Laing T. The economic impact of the Coronavirus 2019 (Covid-2019): Implications for the mining industry. The Extractive Industries and Society. 2020;7(2):580–582. doi: 10.1016/j.exis.2020.04.003. [ DOI ] [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Lee J. Effects of operational performance on financial performance. Management Science Letters. 2019 doi: 10.5267/j.msl.2018.11.003. [ DOI ] [ Google Scholar ]

- Mahtani US, Garg CP. An analysis of key factors of financial distress in airline companies in India using fuzzy AHP framework. Transportation Research Part A. 2018;117:87–102. doi: 10.1016/j.tra.2018.08.016. [ DOI ] [ Google Scholar ]

- Mandelker GN, Rhee SG. The impact of the degrees of operating and financial leverage on systematic risk of common stock. The Journal of Financial and Quantitative Analysis. 1984 doi: 10.2307/2331000. [ DOI ] [ Google Scholar ]

- McDaniel WR. Operating leverage and operating risk. Journal of Business Finance & Accounting. 1984;11(1):113–125. doi: 10.1111/j.1468-5957.1984.tb00062.x. [ DOI ] [ Google Scholar ]

- Merkert R, Swidan H. Flying with(out) a safety net: Financial hedging in the airline industry. Transportation Research Part E. 2019;127:206–219. doi: 10.1016/j.tre.2019.05.012. [ DOI ] [ Google Scholar ]

- Mhlanga O. Impacts of the macro environment on airline performances in southern Africa: Management perspectives. Tourism and Hospitality Research. 2019;19(4):439–451. doi: 10.1177/1467358418771442. [ DOI ] [ Google Scholar ]

- Michaels L, Fletcher S. Competing in an LCC world. Journal of Revenue and Pricing Management. 2009;8(5):410–423. doi: 10.1057/rpm.2009.7. [ DOI ] [ Google Scholar ]

- O’Connell, J. F. (2018). The Routledge Companion to Air Transport Management . (N. Halpern & A. Graham, Eds.), The Routledge Companion to Air Transport Management . 1 Edition. | New York : Routledge, 2018. | Series: Routledge companions in business, management and accounting: Routledge. 10.4324/9781315630540

- O’Connell JF, Williams G. Transformation of India’s domestic airlines: A case study of Indian Airlines, Jet Airways, Air Sahara and Air Deccan. Journal of Air Transport Management. 2006;12(6):358–374. doi: 10.1016/j.jairtraman.2006.09.001. [ DOI ] [ Google Scholar ]

- Ohri M. Discussion paper: Airport privatization in India. Networks and Spatial Economics. 2012 doi: 10.1007/s11067-009-9117-8. [ DOI ] [ Google Scholar ]

- Pathak AA. Survival lessons from a dying Kingfisher. Strategic Direction. 2015;31(8):13–16. doi: 10.1108/SD-06-2015-0086. [ DOI ] [ Google Scholar ]

- Phillips G, Sertsios G. How do firm financial conditions affect product quality and pricing? Management Science. 2013;59(8):1764–1782. doi: 10.1287/mnsc.1120.1693. [ DOI ] [ Google Scholar ]

- Ratliff R, Vinod B. Future of revenue management: Airline pricing and revenue management: A future outlook. Journal of Revenue and Pricing Management. 2005;4(3):302–307. doi: 10.1057/palgrave.rpm.5170149. [ DOI ] [ Google Scholar ]

- Reis V, Silva J. Assessing the air cargo business models of combination airlines. Journal of Air Transport Management. 2016;57:250–259. doi: 10.1016/j.jairtraman.2016.08.011. [ DOI ] [ Google Scholar ]

- Riwo-Abudho M, Njanja LW, Ochieng I. Key success factors in airlines: Overcoming the challenges. European Journal of Business and Management. 2013;5(3):84–88. [ Google Scholar ]

- Sakariya, S., Parmar, D., Thandamalla, J. S., & Suresh, K. (2009). Kingfisher’s acquisition of air deccan: Altering India’s LCC scenario? The Case Centre .

- Sakthidharan V, Sivaraman S. Impact of operating cost components on airline efficiency in India: A DEA approach. Asia Pacific Management Review. 2018;23(4):258–267. doi: 10.1016/j.apmrv.2017.12.001. [ DOI ] [ Google Scholar ]

- Saranga H, Nagpal R. Drivers of operational efficiency and its impact on market performance in the Indian Airline industry. Journal of Air Transport Management. 2016;53:165–176. doi: 10.1016/j.jairtraman.2016.03.001. [ DOI ] [ Google Scholar ]

- Sibdari S, Mohammadian I, Pyke DF. On the impact of jet fuel cost on airlines’ capacity choice: Evidence from the U.S. domestic markets. Transportation Research Part E. 2018;111:1–17. doi: 10.1016/j.tre.2017.12.009. [ DOI ] [ Google Scholar ]

- Singh AK. Competitive service quality benchmarking in airline industry using AHP. Benchmarking. 2016;23(4):768–791. doi: 10.1108/BIJ-05-2013-0061. [ DOI ] [ Google Scholar ]

- Srinidhi S. Demand model for air passenger traffic on international sectors. South Asian Journal of Management. 2010;17:23–56. [ Google Scholar ]

- Stamolampros P, Korfiatis N. Airline service quality and economic factors: An ARDL approach on US airlines. Journal of Air Transport Management. 2019;77:24–31. doi: 10.1016/j.jairtraman.2019.03.002. [ DOI ] [ Google Scholar ]

- Thams, A., Zech, N., Rempel, D., Ayia-koi, A., & Management, H. (2020). Tourism & Hospitality: An initial assessment of economic impacts and operational challenges for the tourism & hospitality industry due to COVID-19. IUBH Discussion Papers .

- Thirunavukkarasu A. An analysis on domestic airlines capacity performance in India. International Journal of Management (IJM). 2015;6:12. [ Google Scholar ]

- Wang K, Zhang A, Zhang Y. Key determinants of airline pricing and air travel demand in China and India: Policy, ownership, and LCC competition. Transport Policy. 2018;63:80–89. doi: 10.1016/j.tranpol.2017.12.018. [ DOI ] [ Google Scholar ]

- Wren-Lewis, S. (2020). The economic effects of a pandemic . Economics in the Time of COVID-19 .

- Yang H. Airlines’ futures. Journal of Revenue and Pricing Management. 2007;6(4):309–311. doi: 10.1057/palgrave.rpm.5160105. [ DOI ] [ Google Scholar ]

- View on publisher site

- PDF (1.6 MB)

- Collections

Similar articles

Cited by other articles, links to ncbi databases.

- Download .nbib .nbib

- Format: AMA APA MLA NLM

Add to Collections

IMAGES

VIDEO

COMMENTS

With the increased demand in air travel, India’s aviation industry by 2038 might need 2,380 new commercial airliners. In this paper, the aviation industry in India with special emphasis...

With the increased demand in air travel, India’s aviation industry by 2038 might need 2,380 new commercial airliners. In this paper, the aviation industry in India with special emphasis on the privatization process is discussed and analyzed.

With the increased demand in air travel, India’s aviation industry by 2038 might need 2,380 new commercial airliners. In this paper, the aviation industry in India with special emphasis...

In this study, we analyse the effect of a prospective carbon tax on the Indian aviation industry from the perspective of aviation network strategies, namely, the P2P strategy followed by the LCCs and the hubbed network strategy followed by the FSAs.

The present research scrutinizes how the prominent airlines in India have chosen eco-friendly efforts to mitigate greenhouse gas emissions and executing their responsibility towards the environment. The research explores how the seven airlines being operated in India executed several climate change actions.

Allowing FDI by foreign air carrier service providers into India‘s civil aviation sector would create the possibility of code-shares, optimal utilization of a carrier‘s fleet, and an expansion of consumer choice.

In India’s 75 years of independence, the country’s aviation sector has reached several key milestones and has recently become one of the largest civil aviation markets in the world in terms of domestic traffic. Due to its growing significance in the world economy and the presence of varied resources, India’s civil aviation sector is

PDF | On Jul 4, 2014, Akhil Mohan Pillai published A secondary research study on Indian Airline Industry 2013-14 | Find, read and cite all the research you need on ResearchGate

India’s civil aviation sector has shown solid growth during the past years. The growth in domestic flights for ASK (available seat Kilometre) and RPK (Revenue passenger Kilom. tre) stood at 111,455 million km and 81,778 million km respectively in FY 22. During the year ASK grew at a CAGR rate of 3.

Present paper attempts to analyze the vulnerability of airlines in India to withstand Covid-19 after effects. Lockdown of two months has been drastic for the fragile airlines business distressed with thin margins, liquidity crisis, over mounting fixed cost and debt.