- Search Search Please fill out this field.

- Building Your Business

- Business Financing

How to Present a Business Loan Proposal

BURGER / PHANIE / Getty Images

It's been said that you never have a second chance to make a good first impression. Nowhere is that more important than when you present a business loan proposal to a potential lender. You can increase your chances of getting a startup loan by following these tips for presenting the loan.

Business loans are the riskiest loans because business is a risky enterprise. Startup loans are even riskier; the Small Business Administration (SBA) says 50% of small businesses fail in the first five years. A small business can still increase the odds of success by remembering these factors:

- The information you provide to the lender.

- How you present that information.

Included in this article is a discussion about presenting a business loan proposal to a lender. The information you provide should be in the form of a formal business plan . These tips assume that you already have prepared that business plan and that it's perfect, accurate, and complete.

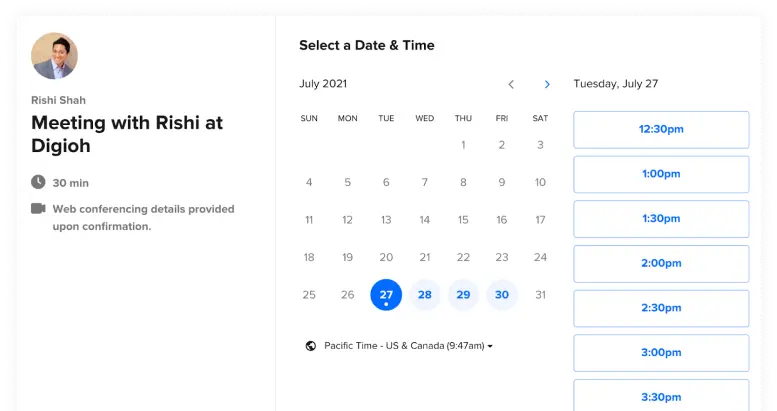

Make an Appointment

Lenders, like all of us, are busy people. If you want to impress a lender, call ahead and make an appointment for a specific time. Ask if the company is lending now, and give a brief one or two-sentence description of your business and why you want money, sometimes referred to as an " elevator pitch ."

Talking by phone will save you time if the lender is truly not interested, but remember this is how banks, credit unions, and other commercial lenders make their money.

In a situation where you aren't sure how to dress, it's always better to be overdressed than underdressed. If you want your loan proposal to be taken seriously, dress like you are serious.

Understand What a Lender Is Looking For

It's been said that lenders lend money to people who don't need it. In tough financial times, it's even truer. A lender wants to know only two things:

- How much do you want?

- How will you be able to pay it back?

The answers to the first question are shown in the business plan and financial spreadsheets you will be presenting. You will need a balance sheet, a proposed income statement (P&L), a break-even analysis, and possible sources and uses of funds statement to show where the money will come from and where it will be spent. Larger businesses may use a business requirements document to show how the funds will be used in a big project.

The answers to the second question can be developed as you talk to the lender. Have an understanding of the " 4 C's of credit " and what kinds of credit a lender is looking for. For example, you most likely will be required to provide a personal guarantee for that business loan, which is very common for startups. If you have the personal guarantee documents prepared, it will increase your credibility and the likelihood of getting that loan.

Be Prepared With Information

Bring all the information needed for the lender to make a decision. This includes personal information on yourself and any possible co-signers, in addition to a business plan and financial documents. You should bring your personal financial statement.

If you think there may be issues with your credit, check your credit score and get a detailed credit report. If you have assets you want to use as collateral, bring information on those assets. You want to be able to answer the lender's two questions above as completely as possible.

Remember the two things a lender wants to know. Talking about all the wonderful features of your business and how you found the idea for the business takes time and doesn't answer the questions.

The best way to be brief and complete is to have an executive summary of your business plan available for the lender to read. Include some meaningful graphs or charts to illustrate the financial projections you have prepared.

Plan What You Will Say

You may or may not get an opportunity to talk much, so work on the inverted pyramid method that newspapers use: Start with the most important information, to answer the lender's primary questions. Then, if you have time and the lender appears interested, talk more about your business and what you hope to achieve.

Use One Loan Presentation To Make the Next One Better

If you get a "no" answer, ask this question: " Under what circumstances would you consider giving a loan to this business?" If the answer is something like, "When hell freezes over," move on. It may be you are asking for too much, you have omitted some key piece of information, or you may need more collateral from your personal funds or a co-signer. Each meeting can be a learning experience and a step to better the experience the next time around.

Present to Several Lenders at Once

It may take you several banks or credit unions to fine-tune your presentation. Putting together a list of possible lenders helps you see the possibilities. As mentioned above, think out of the box, including credit unions on your list.

Have a Backup Plan

Know what you can do if you get rejected by lenders. Having a backup keeps your stress level lower, makes you less likely to show desperation and keeps you thinking ahead.

Consider Other Alternatives

If you have run through your list of possible lenders and you still don't have a loan, don't give up. Look at other sources of funding, such as trade credit, family and friends, or crowdsourcing . Also, you may want to consider scaling down your request.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1048250070-c250f3189b4042688d0840f08fbae22d.jpg)

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Newly Launched - AI Presentation Maker

Researched by Consultants from Top-Tier Management Companies

AI PPT Maker

Powerpoint Templates

PPT Bundles

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

How to Write a Compelling Business Loan Proposal: A Step-by-Step Guide [Templates Included]

![business loan presentation sample How to Write a Compelling Business Loan Proposal: A Step-by-Step Guide [Templates Included]](https://www.slideteam.net/wp/wp-content/uploads/2023/04/Business-Loan-Proposal.jpg)

Mohammed Sameer

Billionaire Entrepreneur Mark Cuban once said, "The number one thing that small businesses need is capital.

Entrepreneurs, business owners, and startups are no strangers to this truth. Money is the lifeblood of any business, and, without it, even the most innovative idea can wither and die. Getting a business a loan is crucial for any business owner looking to expand their operations, increase production, or enter new markets. However, the harsh reality is that only 20-30% of small business loan applications are approved. In other words, you need to be in the top tier to get your hands on the funding you need to make your dreams a reality.

But don't worry; we've got you covered. In this blog, we'll walk you through the step-by-step process of creating a compelling business loan proposal that will catch the eyes of lenders and give your business the boost it needs. And to make things even better, we're also providing you with Business Loan Proposal Templates to help you create a visually stunning and professional presentation to support your proposal.

Let's get started!

Steps to Write a Compelling Business Loan Proposal to Secure Funding

Step 1: research and planning.

Research your industry, target audience, and competition to create a plan that sets your business apart. It should cover the following areas:

- Industry Trends: What are the current trends in your industry? What are the future prospects? How does your business fit into these trends?

- Target Audience: Who is your target audience? What are their needs and pain points? How can your business meet its needs?

- Competition: Who are your competitors? What are their strengths and weaknesses? How can you differentiate your business from them?

Once you've completed your research, it's time to create a plan that incorporates your findings.

Step 2: Executive Summary

It is the most critical part of your Business Loan Proposal. It's a summary of your proposal and should provide the stakeholders with a clear understanding of your business, financial needs, and future plans. Your executive summary should include the following:

- A brief introduction to your business

- A summary of your financial needs

- An overview of your future plans

- A description of how the loan will be used

Keep your executive summary concise, clear, and to the point. Remember, the reader should be able to understand your proposal within a few minutes of reading it.

Step 3: Financial Projections

The financial projections section is where you provide the reader with an overview of your company's financial performance. You'll need to provide financial projections for the next three to five years, including your income statement, balance sheet, and cash flow statement. Your financial projections should include the following:

- Revenue projections

- Expenses projections

- Profit and loss projections

- Cash flow projections

Be realistic with your projections and back them up with facts and figures.

Step 4: Marketing and Sales Strategy

The marketing and sales strategy section is where you explain how you plan to market and sell your product or service. Your marketing and sales strategy should include the following:

- Target market

- Product positioning

- Marketing channels

- Sales channels

- Sales forecasting

Be specific and provide details on how you plan to execute your marketing and sales strategy.

Step 5: Appendix

The appendix is where you include supporting documents that provide additional information about your business. Your appendix should include the following:

- Resumes of key team members

- Business licenses and permits

- Articles of incorporation

- Legal agreements

- Marketing materials

Make sure you label each document and include a table of contents for easy reference.

Step 6: Using Business Loan Proposal Templates

To make your task even easier, SlideTeam offers professionally designed Business Loan Proposal Templates that you can use as a starting point for creating your own compelling proposal.

The 100% customizable nature of the templates provides you with the desired flexibility to edit your presentations. The content-ready slides give you the much-needed structure.

Business Loan Proposal Templates We Bet On

Template 1: small business loan proposal ppt set.

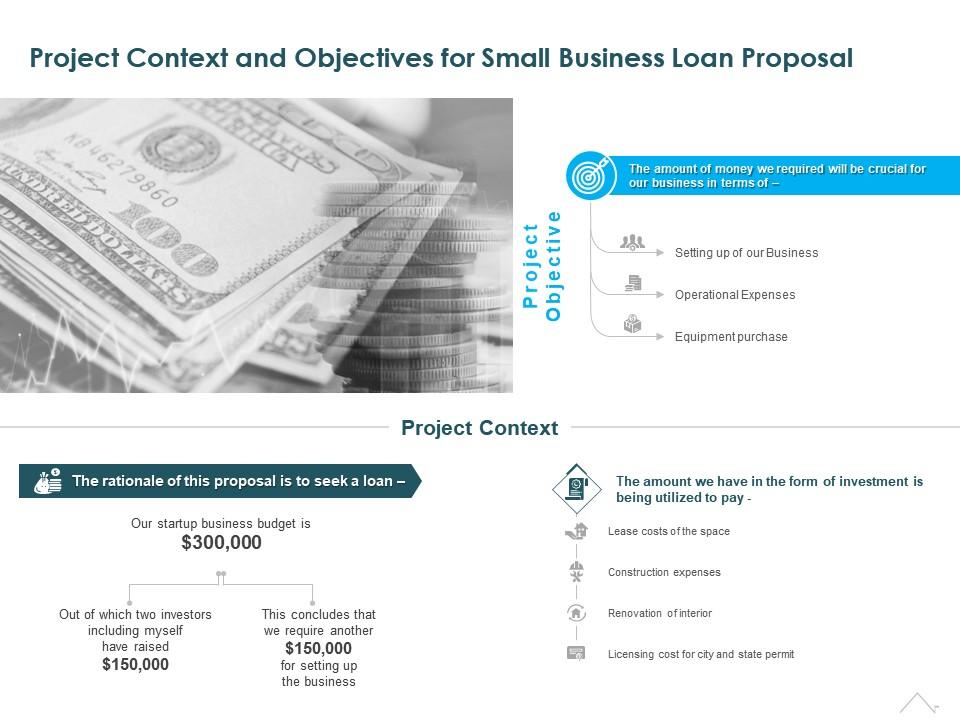

This PPT Bundle is your ticket to securing funding for your venture. With 30 sleek and modern slides, it covers the essentials of a loan proposal, including a cover letter, context and objectives, company profile, repayment plan, and operational and financial information. It also includes graphs and charts that make it easy to visualize and present complex data. Get it now.

Download this template

Template 2: Business Loan Proposal PPT Bundle

Whether you're a fledgling startup or a well-established enterprise, securing financial stability during lean times is crucial. Our PPT Set is indispensable in securing funding. It showcases your project objectives and context, highlighting challenges and solutions. With detailed budget allocation and repayment timelines, you'll impress lenders with your attention to detail. Plus, our PPT Layout covers everything from operational information to historical financial data, ensuring your proposal is comprehensive and convincing. Download now.

Template 3: Loan Proposal PPT Template

Pitch your startup business to investors and entrepreneurs with confidence using our PowerPoint Presentation. Impress your audience with a detailed company overview, showcasing your brand and current market statistics. Highlight your vision, mission, and achievements to prove your product's value. With our customizable PPT Graphic, you can present accurate cash flow data, salaries, business capacities, and outstanding debts. Back up your claims of genuineness and credibility by including a list of references. Download our PPT Set to map out your sources and uses of finance and provide a timeline for achieving your goals.

Grab this template

Template 4: Commercial Loan Proposal PPT Set

First impressions matter, especially when you're pitching a business loan proposal to a lender. Our PPT Bundle helps you streamline the process, highlighting your experience, plans, and budget allocation. You can reassure investors that their money will pay off by presenting a detailed project context and objectives. With operational information like management, marketing, and distribution, you can showcase your company's potential for growth. And by demonstrating your financial history and reputation, you can build trust and increase your chances of securing that all-important loan. Get it now.

Get this template

Template 5: Project Context and Objectives for Small Business Loan Proposal PPT Design

This exclusive PPT Slide offers valuable insights and strategic planning to secure the funding you need to fuel your growth. With a clear and concise layout, our PPT Design provides a well-structured proposal that divides your budget into two essential sections: the amount you have raised and the amount you need as a loan. It guides you in defining your plan to utilize this loan amount to further your business objectives, ensuring a compelling case for lenders or investors. Download now.

Craft a Winning Business Loan Proposal

Writing a compelling business loan proposal takes time and effort, but with the right approach, you can increase your chances of success. Use our step-by-step guide to create a professional and visually appealing proposal that showcases your business's strengths and potential. Remember, a business loan is a significant investment, and lenders want to be sure that they're making the right decision. By following our guide and using our business loan proposal PPT templates, you can create a proposal that stands out from the rest and demonstrates why your business is a good investment opportunity.

FAQs on Business Loan Proposal

What is a business loan proposal .

A business loan proposal is a document that outlines a company's financial needs, its repayment plan, and the intended use of the loan funds. The proposal provides a detailed description of the business, its market, and its operations, along with the requested amount of funding and the expected timeline for repayment. A well-written business loan proposal can help a company secure financing from investors, banks, or other lending institutions.

How do you write a business proposal request?

To write a business proposal request:

- Start by researching and identifying potential lenders or investors who may be interested in your business.

- Develop a detailed plan outlining your company's financial needs, the intended use of the funds, and your repayment plan. Your proposal should also provide information on your company's operations, target market, competition, and growth potential.

- Customize your proposal to the specific lender or investor you are targeting and provide any additional information or documentation they may require.

What are the five steps of writing a business proposal?

The five steps of writing a business proposal are as follows:

- Research: Conduct thorough research on the lender or investor you are targeting and their requirements for loan proposals.

- Outline: Develop an outline that includes key sections such as an executive summary, company overview, market analysis, funding request, and repayment plan.

- Draft: Use the outline to write the proposal, ensuring that it is well-organized, easy to read, and communicates the company's financial needs, potential, and repayment plan.

- Edit: Review the proposal for spelling and grammatical errors, clarity, and coherence.

- Submit: Submit the proposal to the targeted lender or investor, along with any additional documents they may require, and follow up promptly to answer any questions they may have.

Related posts:

- Top 10 Business Loan Proposal Templates to Ensure Funding (Free PDF Attached)

- Top 10 Conference Proposal Templates With Samples and Examples [Free PDF Attached]

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

Liked this blog? Please recommend us

Top 15 Business Proposal Cover Letter Templates With Samples and Examples

Top 10 Executive Summary Business Plan Templates with Samples and Examples

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Free Business Loan Proposal Template

This business loan proposal template managed to secure funds to over 16,000 clients! If you're unsure of how your business loan requests should look, simply use this completely customizable template and get ready to close the deal! You can change the text, images, colors, your logo - it's all 100% editable.

EVERYTHING INCLUDED IN THIS TEMPLATE

Visually attractive cover

No matter which industry you're writing a business loan request for, the first impression always matters. In this business loan proposal template, the first thing your creditor sees is a nicely designed cover, fit for a world-class company like yours. From the text, logo, and background image, you can change everything to make it a better fit for your needs.

The best way to start your bank loan application is with a direct and straightforward cover letter or executive summary. Use this page to clearly and briefly describe who you are, your business background, the nature of your business or start-up, and how the loan will be used to help your company succeed.

Like everything else in this proposal, it's completely editable - the colors, the text, images, layout - everything.

Business profile

Explaining what your business does and the process of using and repaying the loan may sound a bit overwhelming to small business owners. That's why we created a business profile - a page dedicated to the history of your business, along with current activity and results.

It is a perfect place to highlight your business plan, leave some links to your brochures or any other documents that will help soft sell your business.

Management experience

The best way to show potential creditors how serious you are about your business is through management experience. Describing the experience, qualifications, and skills of key members of your management team gives you the perfect opportunity to show you understand exactly what your business needs to succeed.

In this business loan proposal template, we've created a whole section for management experience. All you need to do is fill it in!

Loan request and payment

This section in the business loan proposal template is all about the numbers. Show precisely why you need business financing, the amount you are requesting, the interest rate, as well as what you will use it for.

Whether you're looking for a small business loan or a large sum of money, this is the place to write it down. Like the rest of this template, every part is editable, from the text and logo to the background image.

Financial statements

This is the section the creditor will spend the most time looking at! It is also the perfect place to include your personal financial statements, balance sheets, credit history and reports, tax returns, and any other financial document you see fit for the cause.

Next steps and supporting documents

Once the hard part of writing the loan proposal is done, use this section to attach the proof behind the story you have told. If you're feeling optimistic, you can even add a digital signature box that will allow your creditors to approve your business loan right away!

Get paid straight from the proposal

No more messing around with invoices, no more waiting for checks to clear. This proposal template lets you take payments directly from the proposal, using the integrations with PayPal, Stripe, and GoCardless.

SEE HOW IT WORKS

Your docs, your branding

Set up your logo, brand colors, and fonts once to have them automatically embedded in all your documents.

1. Let's begin

Reuse what works

Save your best work into the Content Library and use pre-built blocks to speed up your doc creation.

Become flawless

Leave embarrassing mistakes in the past. Use merge tags to automatically populate docs with the right information.

- {{company_name}}

- {{first_name}}

- {{last_name}}

- {{email_address}}

- {{brand_company_name}}

- {{owner_first_name}}

- {{owner_last_name}}

- {{owner_email_address}}

Create VIP experiences

Give clients an onboarding experience they won’t forget. Collect extra info with forms, let them book calls, get paid, or redirect them to your website.

Documents for all your project stages

Financial Planning Quote Template

One of the best ways to convince a client about your financial planning skills is to present them with an amazing business quote first. This quote template is based on hundreds of thousands of proposals that got amazing results for our customers.

View Template

General Statement of Work Template

Get the scope of work decided and agreed with the client before starting work

Simple Loan Agreement Template

Getting things in writing is smart thinking even when giving out the simplest loan out there. Protect yourself with this agreement and make sure everything runs smoothly.

Bathroom Remodel Proposal Template

The best bathroom remodelling proposal for remodelling companies. Easily present the price of removal, design, tiling, and installation. Whether you’re remodelling a small bathroom or a master bathroom, this proposal has you covered.

All categories

Your questions, answered.

Common questions about plans, designs and security

Try Better Proposals Free Today

Start sending world-class, professional looking proposals, with no errors, in way less time. Blow your clients' minds and your competition out the water.

IMAGES

VIDEO

COMMENTS

Unleash Your Inner Proposal Pro with Our Top 10 Business Investment Proposal Templates! Money can't buy happiness, but a successful business loan proposal can buy everything else! In the cut-throat competitive landscape, securing a loan can be the difference between success and failure.

This business loan presentation template allows you to use visual storytelling to present your business history, ideas and future plans. This template can be added to other documentation you need to present for a bank loan or you can use the design to find investors and supporters for your cause.

To be successful at getting a business loan, review these tips for talking to lenders, including what to do before, during, and after a presentation.

Help your clients acquire financial support with our Business Loan Proposal PowerPoint Presentation Slide. With the PPT template showcase the project context and objectives in the client’s proposal highlighting the challenges and solutions.

In this blog, we'll walk you through the step-by-step process of creating a compelling business loan proposal that will catch the eyes of lenders and give your business the boost it needs.

This business loan proposal template managed to secure funds to over 16,000 clients! If you're unsure of how your business loan requests should look, simply use this completely customizable template and get ready to close the deal!